American Funds, a brand name under Capital Group, is a colossal player in the investment management industry. With a history spanning over 90 years and trillions of dollars under management, it has undeniably carved out a significant presence. However, the question of whether it represents a “wise choice” or a “risky investment” is nuanced and requires a careful examination of its structure, investment philosophy, performance, fees, and suitability for individual investors.

Firstly, understanding American Funds' structure is crucial. Unlike many investment firms with star managers dominating the spotlight, American Funds employs a multi-manager system. Each fund is divided into portions managed independently by multiple portfolio managers. This approach aims to reduce risk by diversifying management styles and perspectives. The idea is that if one manager underperforms, the others can compensate, leading to more consistent long-term results. This can be a strength, particularly in volatile markets where different strategies might thrive at different times. It also mitigates the risk associated with relying solely on the judgment of a single individual. However, this multi-manager approach also brings its own challenges. The need for coordination and oversight across multiple managers can potentially lead to diluted decision-making or a lack of a clear, cohesive investment strategy.

Moving on to investment philosophy, American Funds generally adopts a long-term, value-oriented approach. This means they typically look for companies that are undervalued relative to their intrinsic worth, with a focus on long-term growth potential. They also tend to favor dividend-paying stocks. This approach can be appealing to investors seeking stability and consistent returns over the long haul. However, value investing can sometimes underperform during periods of rapid growth driven by momentum or speculative assets. During bull markets focused on high-growth technology stocks, for example, a value-oriented approach might lag behind. Therefore, understanding your own investment horizon and risk tolerance is critical when considering American Funds. If you're looking for quick gains or are comfortable with higher levels of volatility, other investment strategies may be more suitable.

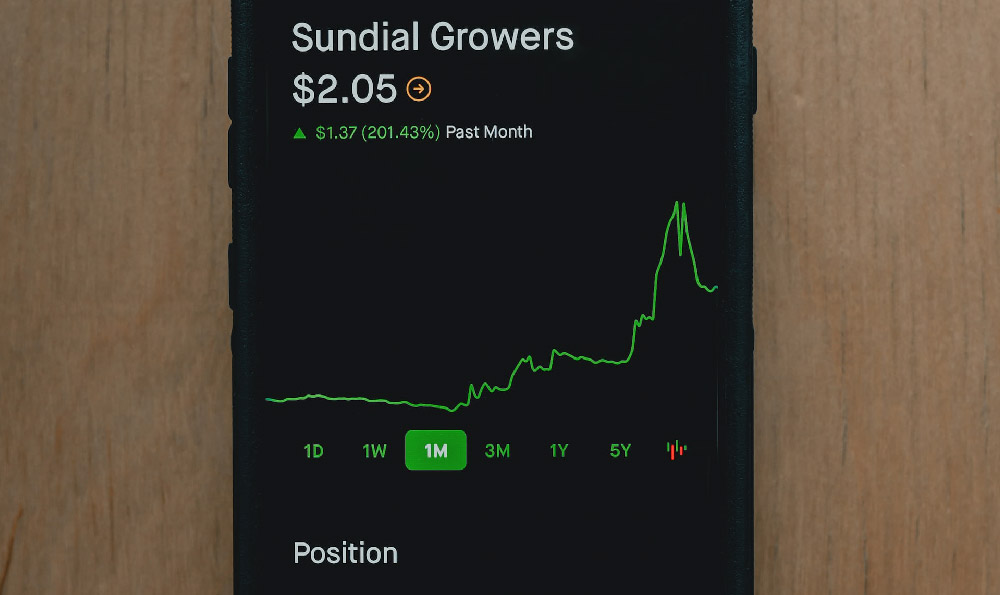

Evaluating the historical performance of American Funds is essential. While past performance is not indicative of future results, it provides valuable insights into how the funds have performed in different market conditions. American Funds boasts a track record of generally strong performance over long periods. Many of their funds have consistently outperformed their benchmarks, showcasing the effectiveness of their multi-manager approach and value-oriented philosophy. However, it's vital to delve deeper than headline numbers. Examine the performance of specific funds that align with your investment goals and compare them to their respective benchmarks and peer groups. Consider the fund's performance during different market cycles – bull markets, bear markets, and periods of economic uncertainty. A fund that performs well in all market conditions is often a better choice than one that only excels in specific environments. The consistency of outperformance, rather than just the magnitude of outperformance in a single year, is a key metric to consider.

Fees are a critical factor in evaluating any investment, and American Funds is no exception. American Funds generally charges higher expense ratios than some of its competitors, particularly in the index fund and exchange-traded fund (ETF) space. This is partly due to their active management style and the costs associated with maintaining a multi-manager system. While higher fees don't automatically disqualify a fund, it's crucial to justify those fees with superior performance. Investors need to assess whether the potential outperformance outweighs the cost of the higher expense ratios. It's important to understand all the fees associated with investing in American Funds, including expense ratios, sales charges (loads), and any other administrative fees. These fees can significantly impact your overall returns, especially over long periods. Consider the net return after fees, not just the gross return.

Finally, consider the suitability of American Funds for your individual circumstances. American Funds offers a wide range of funds, including equity funds, bond funds, and balanced funds. Determine your investment goals, risk tolerance, and time horizon. Are you saving for retirement, a down payment on a house, or another long-term goal? Are you comfortable with market volatility, or do you prefer a more conservative approach? Choose funds that align with your specific needs and risk profile. If you are a novice investor, or lack the time or expertise to manage your own investments, engaging with a financial advisor can be invaluable. They can assess your financial situation, help you choose the right American Funds, and create a personalized investment plan.

In conclusion, American Funds is not inherently a "wise choice" or a "risky investment." Its suitability depends entirely on individual circumstances, investment goals, risk tolerance, and a thorough understanding of its structure, philosophy, performance, and fees. While their multi-manager approach and value-oriented philosophy have historically delivered strong long-term performance, the higher fees need to be carefully considered. Investors should conduct their own due diligence, compare American Funds to other investment options, and seek professional advice if needed. A well-informed decision, based on a clear understanding of your own financial situation and the characteristics of American Funds, will ultimately determine whether it's the right choice for you.