I Bonds, or Series I Savings Bonds, have gained significant attention recently, especially in times of fluctuating interest rates and economic uncertainty. The allure is understandable: they are backed by the full faith and credit of the U.S. government, offering a virtually risk-free way to earn interest. But the question remains: are they truly "worth it" in the current investment landscape, or are there better alternatives for growing your wealth?

To answer this, we need to delve into the mechanics of I Bonds and evaluate them against other investment options. I Bonds earn a composite rate, which consists of two components: a fixed rate and an inflation rate. The fixed rate remains constant for the life of the bond, while the inflation rate is adjusted twice a year based on the non-seasonally adjusted Consumer Price Index for all Urban Consumers (CPI-U). This inflation-linked feature is what makes I Bonds particularly attractive during periods of high inflation, as the yield rises to match, preserving your purchasing power.

Currently, many alternative investments offer potentially higher returns, albeit often with correspondingly higher risks. Consider the stock market. While it can be volatile, historically, stocks have significantly outperformed bonds over the long term. Investing in a diversified portfolio of stocks through index funds or exchange-traded funds (ETFs) allows you to participate in the growth of the economy and potentially earn substantial returns. However, it's crucial to understand that the stock market can experience significant downturns, and you could lose a portion of your investment.

Real estate is another asset class that can offer competitive returns. Investing in rental properties can provide a stream of income and potential appreciation in value. However, real estate requires significant capital and ongoing management, including dealing with tenants, maintenance, and property taxes. There are also real estate investment trusts (REITs) that allow investors to participate in the real estate market without directly owning properties. REITs can be a good option for those seeking diversification and income, but they are also subject to market fluctuations and interest rate risk.

High-yield savings accounts and certificates of deposit (CDs) are other alternatives to I Bonds. These options offer fixed interest rates and are generally considered low-risk. While their yields may not be as high as I Bonds during periods of high inflation, they offer more liquidity. I Bonds have a restriction: you cannot redeem them within the first year, and if you redeem them within the first five years, you forfeit the last three months of interest. High-yield savings accounts and CDs, on the other hand, typically allow you to access your funds more easily, although some CDs may have penalties for early withdrawal.

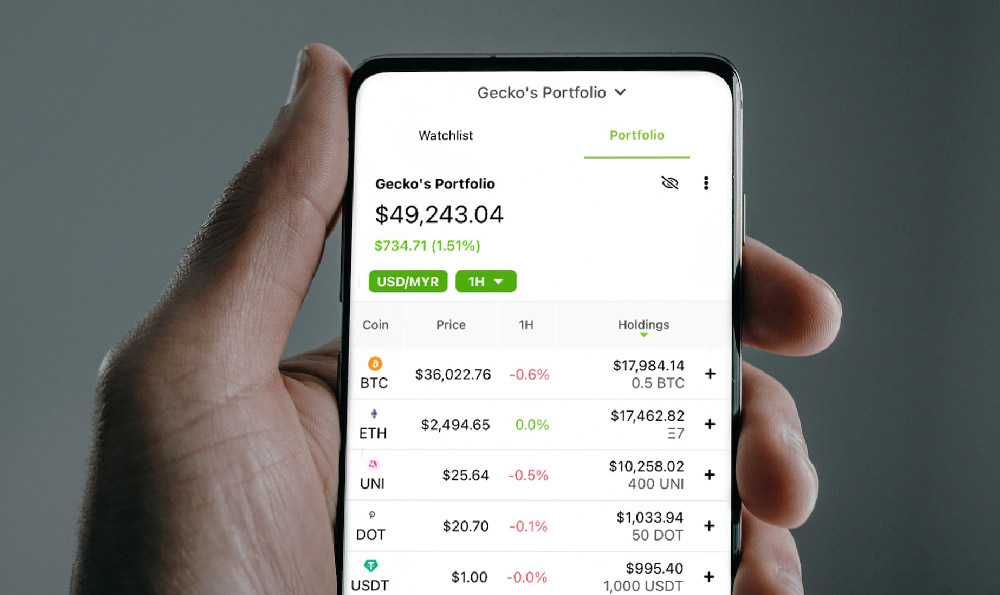

Cryptocurrencies have emerged as a new asset class with the potential for high returns, but they are also highly volatile and speculative. Investing in cryptocurrencies requires a strong understanding of the technology and market dynamics. It's essential to do thorough research and only invest what you can afford to lose. While cryptocurrencies may offer the potential for significant gains, they also carry a high risk of loss.

Now, let's consider the advantages and disadvantages of I Bonds more closely. One of the key advantages is their safety. As mentioned earlier, they are backed by the U.S. government, making them virtually risk-free. Another advantage is their tax benefits. The interest earned on I Bonds is exempt from state and local taxes, and federal taxes can be deferred until you redeem the bonds or they mature. Furthermore, I Bonds can be used for certain education expenses, in which case the interest may be entirely tax-free.

However, I Bonds also have some drawbacks. The most significant is their limited liquidity. As mentioned before, you cannot redeem them within the first year, and redeeming them within the first five years incurs a penalty. Another disadvantage is the purchase limit. You can only purchase up to $10,000 in electronic I Bonds per person per year. This limit may be a constraint for investors with larger amounts of capital. Finally, while the inflation-linked feature protects your purchasing power during periods of high inflation, the yield may be relatively low during periods of low inflation.

So, are I Bonds worth it? The answer depends on your individual circumstances, financial goals, and risk tolerance. If you are looking for a safe, low-risk investment that protects your purchasing power during periods of high inflation, and you don't need immediate access to your funds, I Bonds can be a good option. They are particularly suitable for conservative investors, those nearing retirement, or those saving for specific goals like education.

However, if you are seeking higher returns and are willing to take on more risk, other investment options like stocks, real estate, or even potentially cryptocurrencies may be more suitable. It's important to diversify your portfolio and allocate your assets based on your risk tolerance and time horizon.

Before making any investment decisions, it's always wise to consult with a qualified financial advisor who can assess your individual needs and recommend the best investment strategies for you. Remember that investing involves risk, and there is no guarantee of returns. A well-diversified portfolio, coupled with a long-term perspective and a disciplined approach, is the key to achieving your financial goals. Consider your investment timeline, your risk tolerance, and your financial goals before committing funds to any investment, including I Bonds. Analyze the current market conditions, compare the potential returns with other investment options, and make an informed decision that aligns with your overall financial plan.