Okay, I understand. Here's an article on the topic "CoinPro: Keepbit Cue Execution - How & Why?", focusing on providing valuable information and avoiding overly structured formats.

``` CoinPro: Keepbit Cue Execution - Decoding the Signals

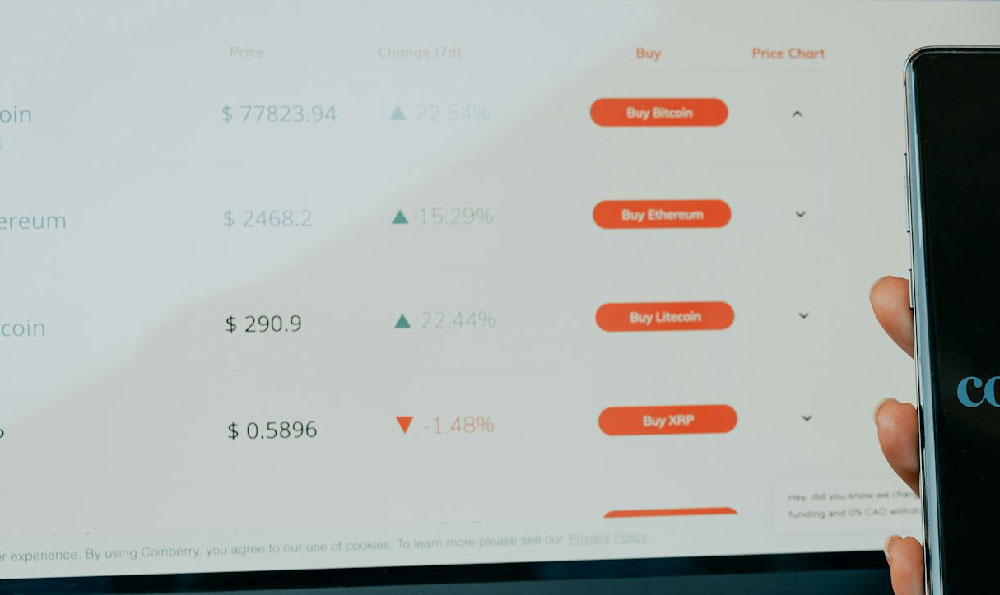

The world of cryptocurrency trading is rife with complexity, a landscape where split-second decisions can make or break an investor's portfolio. Within this dynamic environment, automated trading platforms and sophisticated signal providers have emerged as valuable tools. One such tool, which we'll refer to as "Keepbit Cue Execution" (KCE), aims to streamline the trading process by interpreting signals and automatically executing trades on behalf of the user. To fully grasp the utility of KCE, it's crucial to delve into the "how" and "why" behind its operation.

The fundamental principle driving KCE is the automation of trade execution based on pre-defined signals or "cues." These cues can originate from a variety of sources: technical analysis indicators, fundamental news events, proprietary algorithms developed by signal providers, or even social media sentiment analysis. The core purpose is to alleviate the trader from the constant monitoring and manual execution required in a volatile market. Imagine trying to track dozens of cryptocurrencies, each fluctuating wildly based on a constant stream of information. It's practically impossible for a human to react to every opportunity or threat in real-time. This is where KCE steps in, acting as an automated proxy executing trades as signals trigger it.

So, how does KCE actually work? The process typically involves these key steps:

-

Signal Acquisition: KCE needs a source of trading signals. This usually involves subscribing to a signal provider (like CoinPro, in this hypothetical scenario) or connecting the system to a user's own custom-built trading strategy. The method of delivery can vary, ranging from API integrations to simple email alerts or webhooks. The important factor is the signal has to be reliably delivered in a format KCE can understand.

-

Signal Interpretation: Once a signal is received, KCE parses it to determine the appropriate action. This involves extracting information like the target cryptocurrency, the desired trade direction (buy or sell), the trade size, and optional parameters like stop-loss and take-profit levels. The system needs to be capable of handling different signal formats and adapting to the specific conventions of the signal provider. A system that can only read a specific format is going to be very limited.

-

Order Placement: After interpreting the signal, KCE automatically places the corresponding order on the connected cryptocurrency exchange. This requires a secure and reliable connection to the exchange's API. The system must also handle potential errors, such as insufficient funds or order rejection, gracefully. Risk management is paramount at this stage. For example, a sudden spike in price might make an order unprofitable if filled at the updated market price. The system should be able to analyze the order book and either cancel the order or adjust the execution parameters.

-

Order Management: Once an order is placed, KCE monitors its status until it is filled. If the order includes stop-loss or take-profit levels, the system automatically manages these orders as well, ensuring that the position is closed out if the price reaches those thresholds. This automated order management is one of the main benefits. It allows users to 'set and forget' strategies to a certain extent.

-

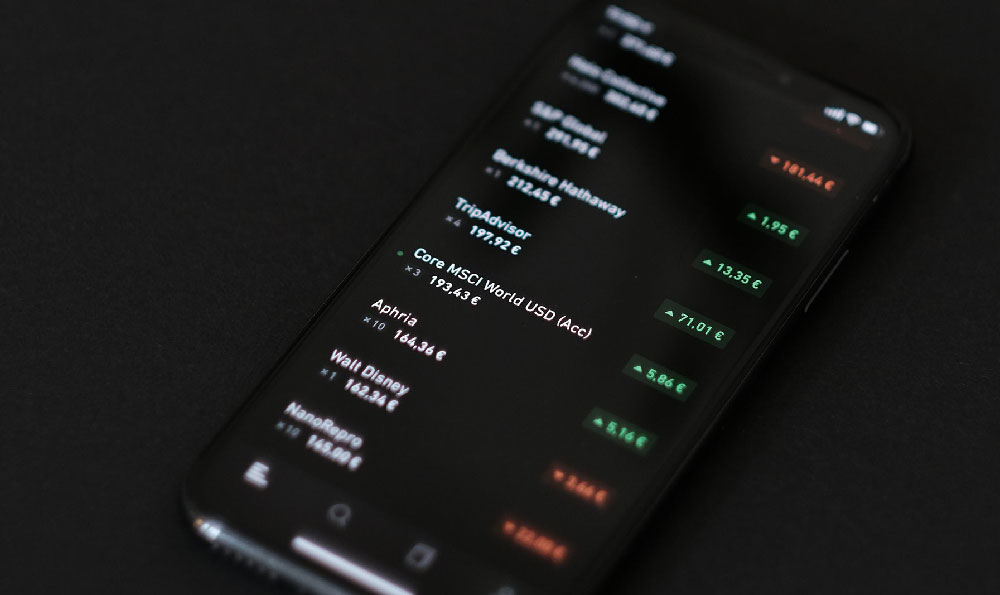

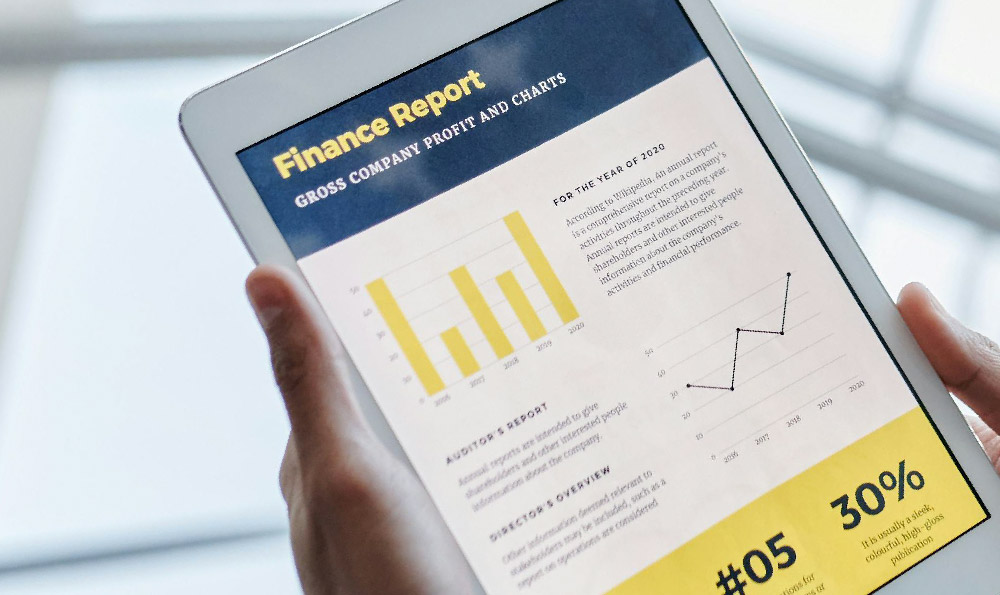

Performance Tracking: The final step is to track the performance of the executed trades. KCE should provide detailed reports on trade history, profitability, and risk metrics. This data is crucial for evaluating the effectiveness of the signal provider and refining the trading strategy. A comprehensive system will show win rates, average profit per trade, and risk-adjusted return. This insight is essential for adapting and optimizing.

The advantages of using KCE are numerous. The primary benefit is, obviously, automation. Traders can free up their time and focus on other aspects of their lives while the system automatically executes trades based on predefined signals. This can be especially beneficial for those who are new to cryptocurrency trading or who lack the time to actively monitor the market. Furthermore, KCE can help eliminate emotional decision-making, which is a common pitfall in trading. By following a systematic approach based on objective signals, traders can avoid impulsive decisions driven by fear or greed. The speed of execution can also be a key advantage, especially in volatile markets where prices can change rapidly. An automated system can react to signals much faster than a human trader, potentially capturing profitable opportunities that would otherwise be missed.

However, using KCE also comes with risks. One of the biggest risks is relying on unreliable signal providers. Not all signal providers are created equal, and some may generate inaccurate or even fraudulent signals. It's important to carefully research and vet any signal provider before entrusting them with your capital. Another risk is the potential for technical glitches or errors in the system. Bugs in the software or connectivity issues can lead to unexpected or incorrect order executions. A third is over-reliance: automation should not mean abdication of responsibility. Regularly review performance, understand the signals, and be prepared to intervene if needed.

The choice of signals is critical. Many platforms offer a range of signals or integrate with third-party providers. The most important aspects to consider are the proven historical performance of the signals, their risk profile (some strategies may be highly profitable but also highly volatile), and their suitability to your trading style and risk tolerance. A highly aggressive day-trading strategy will not suit a risk-averse, long-term investor.

In conclusion, Keepbit Cue Execution, and similar systems, offer a powerful way to automate cryptocurrency trading and potentially improve profitability. However, it's important to understand the risks involved and to carefully evaluate the signal provider and the system itself before entrusting it with your capital. Thorough research, ongoing monitoring, and a healthy dose of skepticism are essential for success in this rapidly evolving field. Furthermore, remember that past performance is not necessarily indicative of future results. Always invest responsibly and only risk what you can afford to lose. Understanding both the "how" and the "why" empowers you to use this technology effectively, not recklessly. ```