Okay, I understand. Here's an article addressing the prompt "What are effective methods to earn money, and how can you start?", adhering to your specified guidelines.

Earning money is a pursuit that resonates with almost everyone, regardless of their background or stage in life. The motivations are diverse – from achieving financial independence and building wealth to simply covering everyday expenses or pursuing a long-held dream. The landscape of earning opportunities is vast and ever-evolving, presenting a range of options tailored to different skills, interests, and risk tolerances. The key to success lies in identifying methods that align with your personal circumstances and committing to consistent effort.

One of the most traditional, yet enduring, paths to earning money is through employment. Securing a job, whether full-time, part-time, or freelance, provides a consistent and predictable income stream. The specific amount earned depends on factors like your skills, experience, the industry, and the geographic location. While employment often necessitates adhering to an employer's directives, it also offers stability, benefits (such as health insurance and retirement plans), and opportunities for career advancement. Before embarking on a job search, a crucial step involves self-assessment: identifying your strengths, weaknesses, and areas where you excel. Tailoring your resume and cover letter to highlight these relevant attributes can significantly improve your chances of securing an interview and ultimately landing the job. Networking, both online and offline, is also invaluable. Connecting with people in your desired industry or company can provide insights, leads, and even referrals.

Beyond traditional employment, the gig economy has exploded in recent years, offering a multitude of opportunities to earn money on a flexible basis. These gigs encompass a wide range of activities, from driving for ride-sharing services and delivering food to freelancing as a writer, designer, or consultant. The allure of the gig economy lies in its autonomy – you control your schedule, choose your projects, and set your rates. Platforms like Upwork, Fiverr, and TaskRabbit connect freelancers with clients seeking their skills, while companies like Uber, DoorDash, and Instacart provide earning opportunities through transportation and delivery services. Success in the gig economy requires discipline, self-promotion, and the ability to manage your time and finances effectively. Building a strong online presence, gathering positive reviews, and consistently delivering high-quality work are essential for attracting and retaining clients.

For those with an entrepreneurial spirit, starting a business presents a compelling path to earning money. This could involve launching an online store, developing a mobile app, providing a specialized service, or creating a unique product. While entrepreneurship offers the potential for significant financial rewards, it also entails considerable risk and requires a substantial investment of time, effort, and capital. A well-defined business plan is crucial, outlining your target market, competitive landscape, marketing strategy, and financial projections. Securing funding, whether through personal savings, loans, or investors, is often necessary to get the business off the ground. Building a strong team, managing cash flow effectively, and adapting to changing market conditions are all critical factors for success. It is important to note that many businesses fail within their first few years, so thorough research, careful planning, and a resilient mindset are essential.

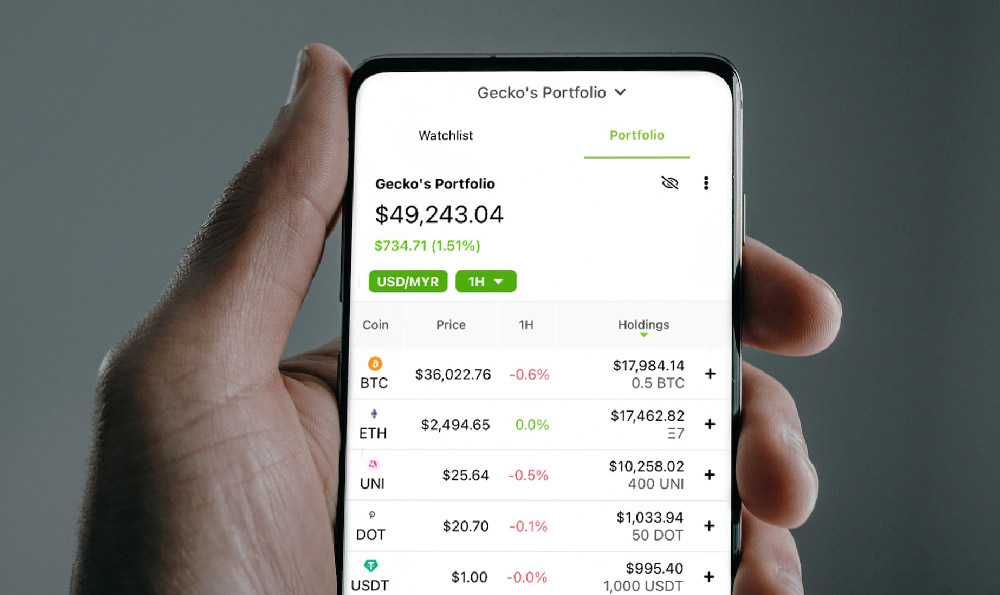

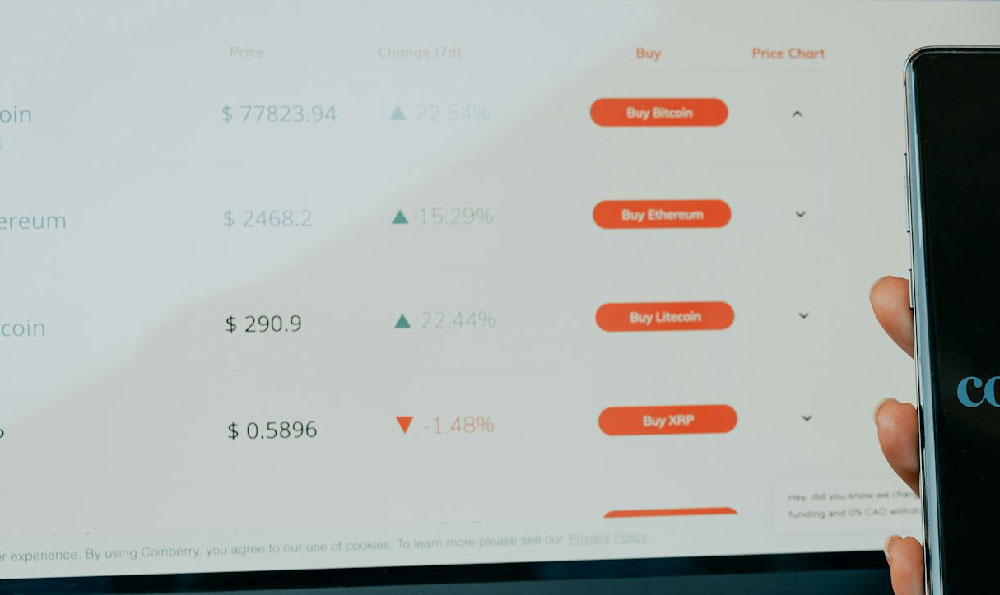

Another avenue for generating income involves investing. Investing allows your money to grow over time through various instruments like stocks, bonds, real estate, and mutual funds. While investing carries inherent risks, it also offers the potential for significant returns. The key to successful investing is diversification – spreading your investments across different asset classes to mitigate risk. It's also crucial to understand your risk tolerance and investment horizon before making any investment decisions. Consulting with a financial advisor can provide valuable guidance in developing a personalized investment strategy. Real estate, in particular, can be a powerful investment tool, offering both rental income and potential appreciation in value. However, it also requires significant capital and ongoing management.

Passive income streams are another attractive way to earn money. Passive income involves generating income without requiring constant active involvement. This could include creating and selling online courses, writing and publishing ebooks, investing in dividend-paying stocks, or renting out properties. While passive income typically requires upfront effort to set up, it can provide a steady stream of income with minimal ongoing work. Building a successful online course, for example, requires creating high-quality content, marketing it effectively, and providing ongoing support to students. The initial investment of time and effort can be substantial, but the potential for long-term passive income is significant.

Finally, consider leveraging existing skills and assets. Do you have a knack for writing? Offer freelance writing services. Are you a skilled photographer? Sell your photos online. Do you have a spare room in your house? Rent it out on Airbnb. Identifying and monetizing your existing talents and resources can be a relatively low-risk way to start earning money.

No matter which method you choose, it's essential to start with a plan, be patient, and persist through challenges. Success rarely comes overnight, and it requires dedication, hard work, and a willingness to learn and adapt. Continuously seeking knowledge, developing new skills, and staying informed about industry trends are all crucial for long-term financial success. Building a solid financial foundation requires not only earning money but also managing it wisely, saving diligently, and investing strategically.