Okay, I'm ready. Here's an article based on the title "How to Get Rich Young: Is It Possible, and How?", aiming for 800+ words, comprehensive advice, and a style suitable for an investment/financial audience, avoiding numbered lists and formulaic transitions:

How attainable is the dream of achieving significant wealth before the traditional retirement age? The answer, while nuanced, leans towards a qualified yes. It's not merely a matter of luck or inheriting a fortune. Getting rich young requires a potent combination of strategic financial planning, disciplined execution, and a healthy appetite for calculated risk. The path isn't paved with guarantees, but by understanding the fundamental principles and adopting the right mindset, the odds can be dramatically improved.

One of the earliest and most crucial steps is cultivating a high savings rate. This goes beyond simply putting a few dollars aside each month. It demands a conscious re-evaluation of spending habits and a commitment to living below one's means. Examine your current expenses with a critical eye. Where can you cut back without significantly impacting your quality of life? Could you downsize your living space, reduce entertainment costs, or find more affordable transportation options? The money saved becomes the fuel for your investment engine. Aim for a savings rate of at least 15% of your income, and ideally, much higher if you're truly serious about accelerating your wealth accumulation. Automating savings through direct deposit into investment accounts helps enforce discipline and prevent impulsive spending.

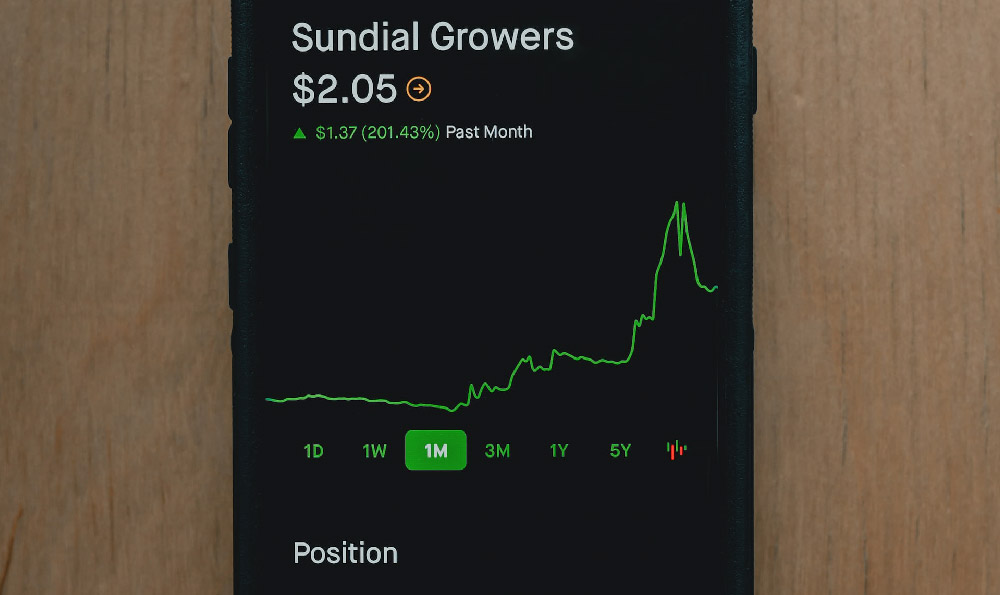

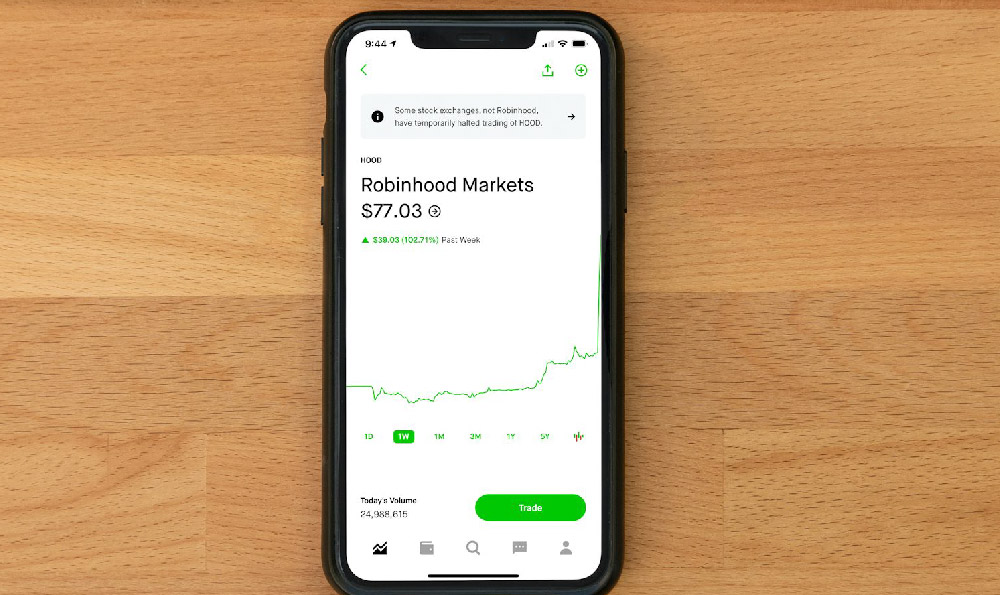

Investing wisely is equally paramount. Simply saving money in a low-yield savings account is unlikely to generate the returns necessary to achieve significant wealth quickly. Understanding different asset classes and their associated risks is crucial. The stock market, while volatile, has historically provided the highest returns over the long term. Investing in a diversified portfolio of stocks, either through individual stock selection or index funds, is a fundamental building block of wealth accumulation. Real estate can also be a valuable asset, offering both rental income and potential appreciation. However, real estate investments require careful due diligence and a significant upfront investment. Consider the potential for crowdfunding real estate platforms to diversify with smaller capital outlays.

The notion of "getting rich" inherently involves some level of risk-taking. However, it's critical to distinguish between calculated risk and reckless gambling. Avoid get-rich-quick schemes and promises of guaranteed high returns. These are often scams designed to prey on unsuspecting individuals. Instead, focus on understanding the underlying fundamentals of your investments and diversifying your portfolio to mitigate risk. Diversification doesn't eliminate risk entirely, but it reduces the impact of any single investment performing poorly. Furthermore, continuously educate yourself about financial markets and investment strategies. Read books, articles, and attend seminars to expand your knowledge base. The more you understand about investing, the better equipped you will be to make informed decisions.

Beyond traditional investing, consider the power of entrepreneurship. Starting your own business can offer the potential for significantly higher returns than simply working for someone else. Identify a problem that needs solving, develop a viable business plan, and be prepared to work long hours and make sacrifices. Entrepreneurship is not for the faint of heart, but it can be incredibly rewarding both financially and personally. If you choose this route, focus on building a scalable business model that can generate passive income or be sold for a profit in the future. This could involve developing software, creating online courses, or establishing a franchise system.

Developing additional income streams outside of your primary job can also accelerate wealth accumulation. This could involve freelancing, consulting, or developing online content. The key is to leverage your existing skills and knowledge to generate additional income without significantly impacting your time or energy. Even small amounts of extra income can make a big difference over time when invested wisely. Furthermore, multiple income streams provide a safety net in case one source of income dries up.

Another crucial element is managing debt effectively. High-interest debt, such as credit card debt, can quickly erode your wealth and hinder your progress towards financial independence. Prioritize paying off high-interest debt as quickly as possible. Consider consolidating debt or transferring balances to a lower-interest credit card. Avoid taking on unnecessary debt, especially for depreciating assets like cars or consumer goods. A mortgage can be a reasonable form of debt, but be sure to shop around for the best interest rates and terms.

Finally, cultivate a long-term perspective. Getting rich young is not a sprint; it's a marathon. There will be ups and downs along the way. The key is to stay focused on your goals, remain disciplined in your approach, and learn from your mistakes. Avoid getting discouraged by short-term market fluctuations or setbacks in your business ventures. The most successful investors are those who remain patient and consistent over the long term. Remember that compounding is your ally; the longer your money has to grow, the more significant the returns will be. Celebrate milestones, but don't become complacent. Continuously seek out new opportunities and refine your strategies to maximize your wealth accumulation potential.

While external factors like economic conditions and market performance will inevitably play a role, ultimately, your success in getting rich young depends on your own actions and choices. By adopting a proactive and strategic approach to financial planning, investing wisely, managing debt effectively, and cultivating a long-term perspective, you can significantly increase your chances of achieving your financial goals and living the life you desire. It's a journey that requires dedication and perseverance, but the rewards can be substantial.