Investing in stocks can be a powerful tool for wealth creation, but it's essential to understand how it works and the strategies involved to maximize your potential returns. At its core, making money in the stock market boils down to two primary mechanisms: capital appreciation and dividends.

Capital appreciation occurs when the price of a stock increases. You buy a share of a company at a certain price, and if the market value of that share rises, you can sell it for a profit. This is often driven by factors like the company's performance, overall economic conditions, and investor sentiment. For example, if you purchase shares of a technology company poised for growth in a burgeoning market, the demand for those shares might increase as more investors recognize the company's potential. This increased demand pushes the price of the stock upward, leading to capital gains when you eventually sell. Successful capital appreciation hinges on your ability to identify companies with solid fundamentals, strong growth prospects, and a competitive advantage. This requires diligent research and a keen understanding of the industries you're investing in. It's not about finding a "get rich quick" scheme but rather about recognizing long-term value creation.

Dividends, on the other hand, are direct cash payments that some companies distribute to their shareholders. These payments are typically made from the company's profits and are a way of sharing their success with the investors who have provided capital. Dividends can be a steady source of income, especially for investors seeking passive income streams. Companies that consistently pay dividends are often established, mature businesses with stable earnings. These are typically found in sectors like utilities, consumer staples, and real estate. While dividend yields (the dividend amount as a percentage of the stock price) may be lower than the potential capital gains from growth stocks, they offer a buffer against market volatility and provide a tangible return on investment even when the stock price remains stagnant. Furthermore, dividends can be reinvested back into the stock, creating a compounding effect that further accelerates wealth accumulation over time. This is known as Dividend Reinvestment Plan (DRIP).

The process of investing in stocks typically involves the following steps:

First, determine your investment goals and risk tolerance. Are you saving for retirement, a down payment on a house, or a child's education? How much risk are you comfortable taking? Understanding your objectives and risk profile is crucial for selecting appropriate investment strategies and asset allocations. A young investor with a long time horizon might be willing to take on more risk by investing in growth stocks, while a retiree seeking income might prefer dividend-paying stocks or bonds.

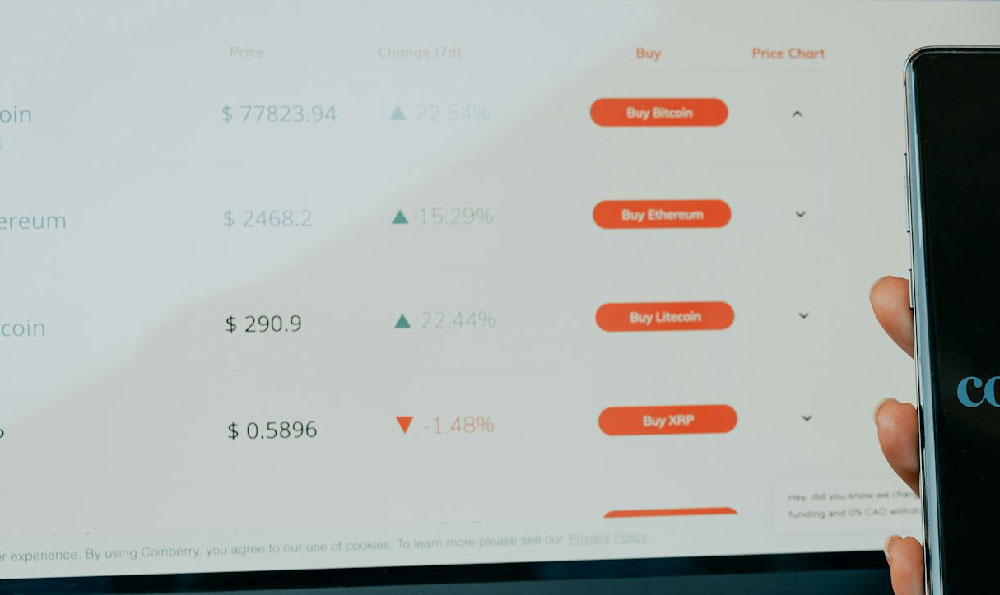

Next, open a brokerage account. Several online brokerage platforms offer access to the stock market, with varying fees, features, and research tools. Consider factors like commission fees, account minimums, platform usability, and available investment options when choosing a broker. Some brokers offer commission-free trading, which can significantly reduce transaction costs, especially for frequent traders.

After opening an account, fund it with the amount you're comfortable investing. Start small if you're new to the stock market and gradually increase your investment amount as you gain experience and confidence. Remember, never invest more than you can afford to lose.

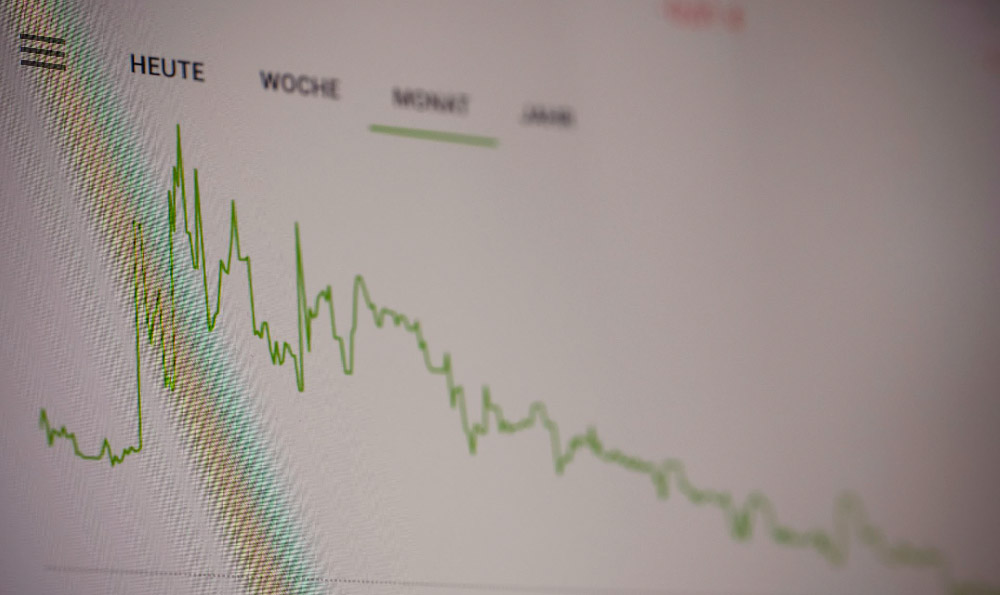

Then, research and select stocks to invest in. This is where fundamental analysis and technical analysis come into play. Fundamental analysis involves evaluating a company's financial statements, industry trends, and competitive landscape to determine its intrinsic value. Technical analysis, on the other hand, focuses on studying price charts and trading volumes to identify patterns and predict future price movements. A combination of both approaches can provide a more comprehensive understanding of a stock's potential.

Once you've identified potential investments, place your order through your brokerage account. You can choose between different order types, such as market orders (which execute immediately at the best available price) and limit orders (which allow you to specify the price at which you're willing to buy or sell).

Finally, monitor your investments regularly and adjust your portfolio as needed. The stock market is constantly fluctuating, so it's essential to stay informed about the companies you've invested in and the overall market conditions. Rebalance your portfolio periodically to maintain your desired asset allocation and diversify your holdings to mitigate risk.

Diversification is a key principle in stock investing. Don't put all your eggs in one basket. Spreading your investments across different companies, industries, and asset classes can reduce the impact of any single investment performing poorly. Consider investing in index funds or exchange-traded funds (ETFs), which offer instant diversification by tracking a specific market index or sector.

It's also critical to understand that investing in stocks involves inherent risks. Market volatility, economic downturns, and company-specific challenges can all impact stock prices. Be prepared for fluctuations in the value of your investments and avoid making emotional decisions based on short-term market movements.

Furthermore, be wary of scams and get-rich-quick schemes. Do your own research and avoid investing in companies or products that seem too good to be true. Consult with a qualified financial advisor if you need help understanding the complexities of the stock market or developing a personalized investment strategy.

In conclusion, making money in stocks involves a combination of capital appreciation and dividends. The process requires careful planning, research, and a long-term perspective. By understanding the fundamentals of stock investing, diversifying your portfolio, and managing your risk tolerance, you can increase your chances of achieving your financial goals.