Investing daily, the concept whispers of constant engagement and potentially, constant returns. But can you really make money by investing daily, and if so, how? The answer, as with most things in finance, is nuanced and depends heavily on your individual circumstances, risk tolerance, and investment strategy.

Before diving into the mechanics, it's crucial to distinguish between different types of "daily investing." One might interpret it as actively trading – making multiple buy and sell decisions every day based on short-term market fluctuations. This is day trading, and it’s a high-risk, high-reward game best left to experienced professionals with specialized knowledge and tools. Another interpretation is dollar-cost averaging (DCA), where you invest a fixed amount of money into a specific asset at regular intervals, regardless of the price. This could be daily, weekly, or monthly, but the principle remains the same: consistent, systematic investing. Finally, it could simply mean regularly monitoring your portfolio and making adjustments as needed based on your long-term financial goals.

Day trading, with its intense focus on short-term price movements, requires a significant time commitment and a deep understanding of technical analysis, charting patterns, and market psychology. The vast majority of day traders lose money. The market is inherently unpredictable in the short term, and even seasoned professionals struggle to consistently outperform the market. Transaction costs, including brokerage fees and taxes, can quickly eat into any potential profits. Furthermore, the emotional toll of constantly monitoring market fluctuations and making split-second decisions can be overwhelming. If you're drawn to the excitement of day trading, consider starting with a small amount of money you're willing to lose and dedicating significant time to education and practice. Simulation accounts, which allow you to trade with virtual money, are a great way to hone your skills without risking real capital.

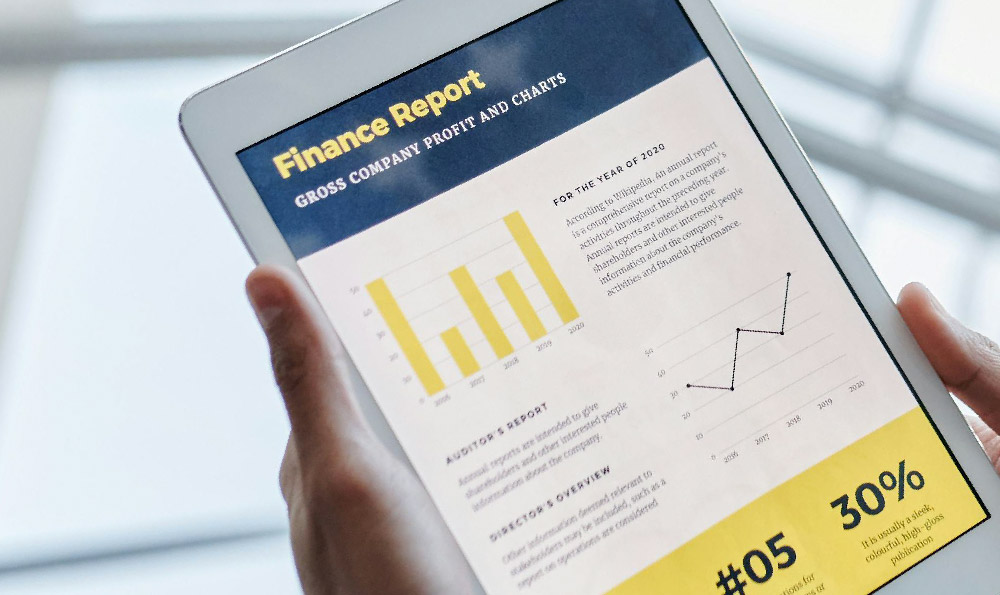

Dollar-cost averaging, on the other hand, offers a more sustainable and less stressful approach to daily investing. By investing a fixed amount regularly, you automatically buy more shares when prices are low and fewer shares when prices are high. Over time, this can lead to a lower average cost per share compared to trying to time the market and invest a lump sum. DCA is particularly beneficial in volatile markets, as it helps to smooth out the ups and downs and reduce the risk of investing a large sum right before a market downturn. While DCA doesn't guarantee profits, it can be a prudent strategy for long-term investors looking to build wealth gradually. For example, consider investing $10 daily into an S&P 500 index fund. Even seemingly small amounts, compounded over decades, can result in substantial returns. This approach removes the emotional element of trying to perfectly time the market, allowing investors to stay disciplined and stick to their investment plan.

Beyond active trading and DCA, regular portfolio monitoring and adjustments are essential for long-term financial success. This doesn't necessarily mean making daily trades, but it does involve staying informed about market trends, rebalancing your portfolio to maintain your desired asset allocation, and making adjustments as your financial goals and risk tolerance evolve. For instance, if you're approaching retirement, you may want to gradually shift your portfolio from riskier assets like stocks to more conservative assets like bonds. Similarly, if your income or expenses change, you may need to adjust your investment contributions accordingly. Regularly reviewing your portfolio allows you to identify potential problems and take corrective action before they become major setbacks. This includes evaluating the performance of your investments, reassessing your risk tolerance, and ensuring that your portfolio is aligned with your long-term financial goals.

Several platforms facilitate daily investing, catering to different styles and preferences. Robo-advisors, for example, offer automated investment management services, using algorithms to build and manage your portfolio based on your risk profile and financial goals. These platforms often utilize DCA strategies and automatically rebalance your portfolio to maintain your desired asset allocation. Traditional brokerage accounts provide access to a wider range of investment options, including stocks, bonds, mutual funds, and ETFs. These accounts are suitable for investors who prefer to manage their own investments and make their own trading decisions. Micro-investing apps allow you to invest small amounts of money, often just a few dollars, into stocks and ETFs. These apps are particularly popular among young investors who are just starting out. No matter which platform you choose, it's important to do your research and understand the fees and risks involved.

Successfully investing daily requires a solid understanding of your financial goals, risk tolerance, and time horizon. Are you saving for retirement, a down payment on a house, or your children's education? How much risk are you comfortable taking? How long do you have to achieve your goals? Answering these questions will help you determine the appropriate investment strategy and asset allocation. It's also crucial to diversify your investments across different asset classes, sectors, and geographies to reduce risk. Diversification doesn't guarantee profits, but it can help to mitigate losses in a downturn.

Furthermore, continuously educating yourself about investing is paramount. Read books, articles, and financial blogs, attend seminars and workshops, and follow reputable financial advisors. The more you know about investing, the better equipped you'll be to make informed decisions and achieve your financial goals. The financial landscape is constantly evolving, so it's important to stay up-to-date on the latest trends and developments.

In conclusion, investing daily can be a viable strategy for building wealth, but it's not a get-rich-quick scheme. Day trading is highly risky and requires specialized knowledge and skills. Dollar-cost averaging offers a more sustainable and less stressful approach to daily investing. Regardless of your chosen strategy, it's essential to have a clear understanding of your financial goals, risk tolerance, and time horizon. Regular portfolio monitoring, rebalancing, and continuous education are also crucial for long-term financial success. By adopting a disciplined and informed approach, you can harness the power of daily investing to achieve your financial goals and build a secure future. Remember that consistency and patience are key ingredients to investment success. Building wealth is a marathon, not a sprint.