For a 14-year-old teen looking to make money, the journey begins with cultivating a mindset that values financial responsibility and smart decision-making. While it's true that youthful energy and creativity can be harnessed to generate income, the key lies in understanding that earning money at this stage is not about quick riches but building habits that will serve them throughout life. The first step is to recognize that money management starts with saving, and every teen should develop a budgeting habit that tracks expenses and allocates funds wisely. Even small amounts, like pocket money or allowances, can be directed into savings accounts that offer modest interest rates, teaching the importance of compounding over time.

Participating in part-time jobs, whether through family businesses, local stores, or online platforms, provides hands-on experience with earning and managing money. Teens can offer skills like babysitting, pet care, or tutoring to peers, or take on tasks such as helping with groceries or delivering packages. These experiences not only create immediate income but also build essential work ethic and time management skills. It's crucial to emphasize that work should be balanced with school and personal growth, ensuring that opportunities for financial gain do not overshadow academic responsibilities.

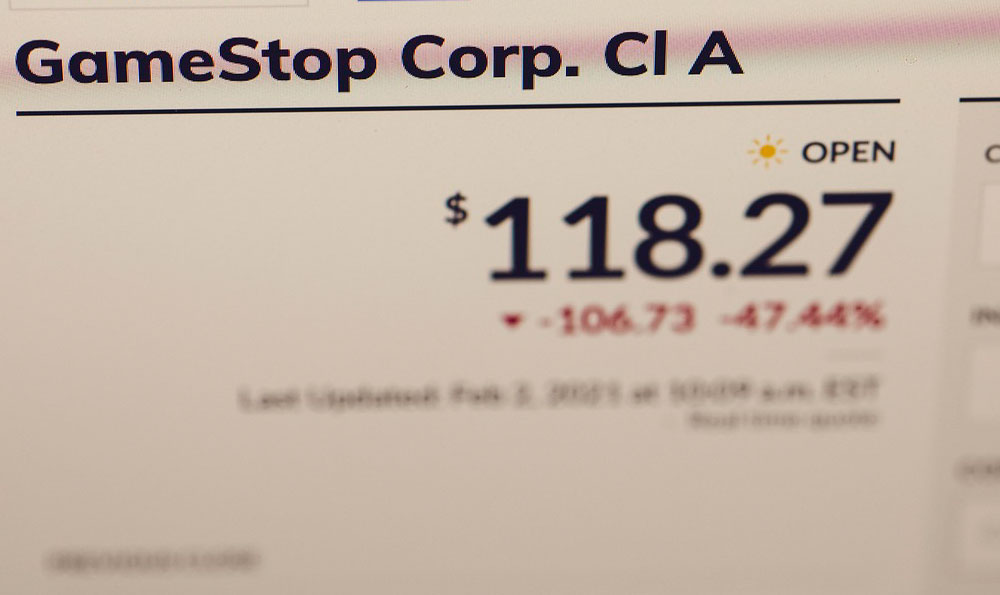

Investing, though often seen as a domain for adults, can be introduced to teens through low-risk, accessible options. For example, they might start by purchasing shares in companies through fractional investing platforms that allow small initial investments. Alternatively, setting up a savings plan in a high-yield account or a robo-advisor portfolio can serve as a gateway to understanding financial markets without significant risk. The importance of diversification and long-term perspective should be highlighted, encouraging teens to view money as a tool for growth rather than a quick solution to needs.

Education is another powerful avenue for financial empowerment. Teens can develop skills in areas like digital marketing, graphic design, or coding by taking online courses or workshops. Platforms like Coursera or Khan Academy offer free or affordable resources that can be leveraged to create side businesses, such as designing social media content for local businesses or offering coding tutorials to younger students. This approach not only generates income but also builds a foundation for future career opportunities, aligning financial goals with personal development.

Exploring creative avenues, such as starting a small blog or YouTube channel, can be a way to monetize passions and interests. Teens can begin by sharing content on topics they're enthusiastic about, like gaming, music, or DIY projects, and gradually introduce monetization strategies like affiliate marketing or sponsored content. The crucial aspect here is consistency and quality, as building an audience takes time and effort. It's also important to discuss the value of transparency and ethical considerations in monetized content, ensuring that financial success is aligned with positive impact.

Considering the power of compound interest, teens can start with micro-investments in low-risk assets. For example, setting up a regular savings plan to invest in index funds or bonds can teach the concept of growth over time. Additionally, exploring opportunities in gig economy platforms, such as ride-sharing or delivery services, can provide flexible income streams while developing practical skills. However, it's essential to stress the importance of safety and informed decision-making, as teens may not yet have the experience to navigate complex financial systems.

Lastly, engaging in entrepreneurial activities with a focus on problem-solving can be a transformative experience. Teens can identify needs in their community, such as organizing a small event, creating a school project, or developing a product that addresses a specific issue. For instance, a teen with artistic talent might start a small business selling handmade crafts or digital prints, while another with tech skills could develop a mobile app or website that solves a common problem. These initiatives not only create income but also instill a sense of ownership and innovation, preparing them for future financial independence.

In conclusion, the path to making money as a teen is multifaceted, combining practical skills with financial literacy. By focusing on habits like saving, balanced work, accessible investing, continuous learning, and entrepreneurial thinking, teenagers can build a foundation for financial success. The most important lesson is that money represents value and effort, and by approaching it with responsibility and creativity, they can create a sustainable way to grow their wealth while preparing for a brighter financial future. Remember, every step taken now, no matter how small, contributes to the building blocks of financial freedom, and the journey itself is as valuable as the destination.