Okay, I understand. Here’s an article responding to the prompt, focusing on virtual currency and investment opportunities, while also acknowledging the inherent risks and ethical considerations, and keeping in mind the age of the target audience (16).

The question of how to make money at 16 is a persistent one, driven by a desire for independence, financial freedom, and early exposure to the world of wealth creation. While traditional avenues like part-time jobs remain relevant, the landscape of opportunity has been dramatically altered by the rise of the internet and, more specifically, digital assets like cryptocurrencies. It is indeed possible to make money at 16, but it requires careful consideration, informed decision-making, and a healthy dose of realism, especially when venturing into the volatile world of virtual currencies.

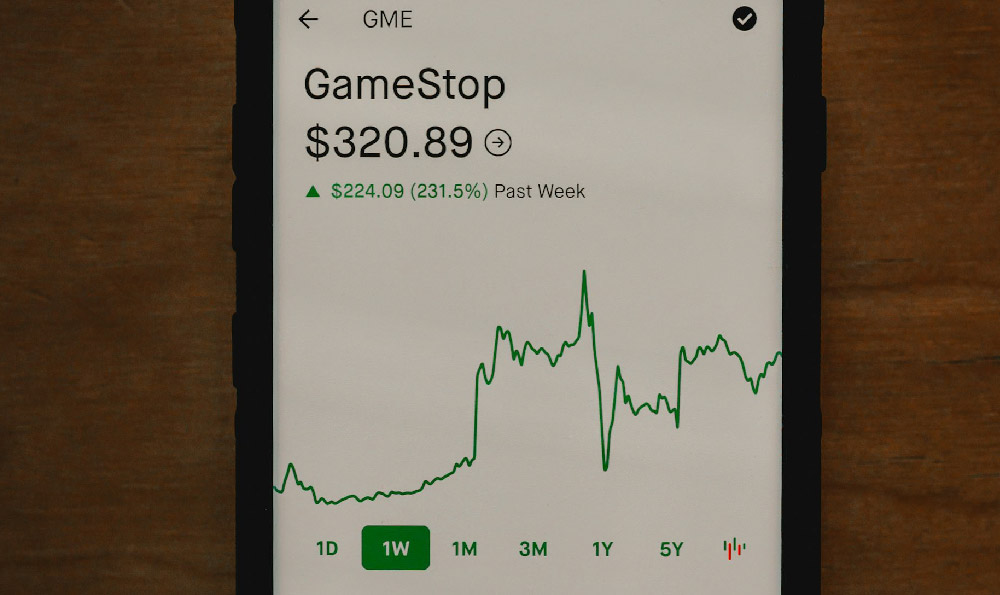

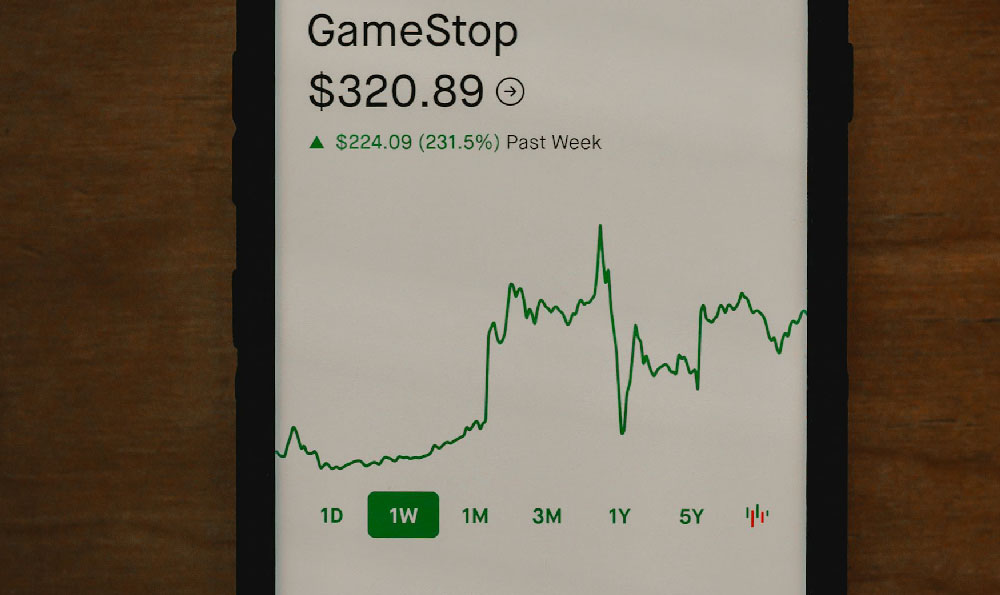

Let's address the elephant in the room: cryptocurrency. The allure of overnight riches, fuelled by stories of early Bitcoin adopters, is undeniably powerful. However, approaching crypto with the mindset of "get rich quick" is a recipe for disaster, regardless of age. Success in this space, like any other investment arena, demands knowledge, discipline, and a long-term perspective.

Before even considering investing a single dollar (or the equivalent in your local currency), a 16-year-old needs to prioritize financial literacy. This means understanding the fundamentals of economics, investing, and risk management. This foundational knowledge will be applicable regardless of whether you choose to dabble in crypto, stocks, or even start your own business. Learn about concepts like inflation, interest rates, diversification, and the power of compounding. Websites like Investopedia and Khan Academy offer free and accessible resources to get you started.

Now, assuming you've laid the groundwork in financial literacy, let's explore how crypto could fit into a 16-year-old's financial strategy. I emphasize could because it's not a necessity, and for many, it might not be the right choice at all. The volatility of cryptocurrencies is a significant factor. Prices can swing wildly in short periods, leading to substantial gains, but also devastating losses. For someone with limited capital and potentially limited understanding of the market, this risk is amplified.

If, after careful consideration, you decide to explore crypto, start small. Very small. Think of it as an experiment, not a pathway to immediate wealth. Allocate only a tiny percentage of your savings – money that you can afford to lose completely without impacting your financial well-being.

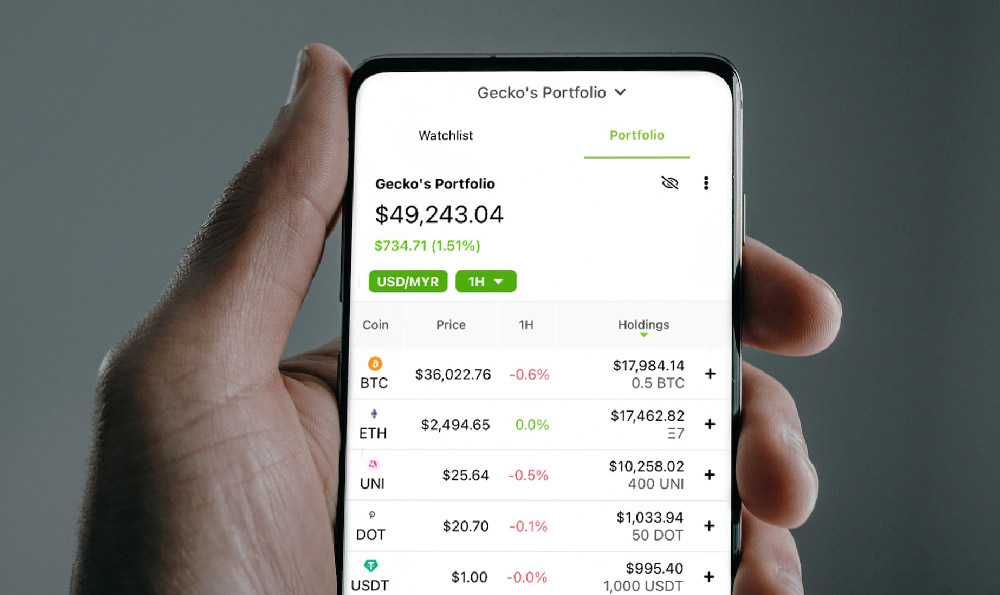

Next, focus on learning about the different types of cryptocurrencies. Bitcoin, as the original and most well-known, is a good starting point. Understand its underlying technology (blockchain), its supply dynamics (the limited supply of 21 million coins), and the factors that influence its price. Then, branch out to other established cryptocurrencies like Ethereum, which has a more complex ecosystem supporting decentralized applications (dApps) and smart contracts. Research these projects thoroughly. Understand their purpose, their technology, their teams, and their competitive landscape. Don't rely solely on social media hype or the opinions of self-proclaimed "gurus." Do your own due diligence.

Once you've chosen a cryptocurrency to invest in (and again, start with a small amount), consider using a reputable and secure cryptocurrency exchange. Look for exchanges with strong security measures, user-friendly interfaces, and robust customer support. Be wary of smaller, less-established exchanges, as they may be more vulnerable to hacks and scams. When setting up your account, prioritize security. Use a strong, unique password and enable two-factor authentication (2FA) to protect your account from unauthorized access.

Beyond simply buying and holding (HODLing), there are other ways to potentially earn money with crypto. Staking, for example, involves holding certain cryptocurrencies in a wallet to support the network's operations and earning rewards in return. However, staking often requires a certain level of technical knowledge and carries its own set of risks. Similarly, providing liquidity to decentralized exchanges (DEXs) can also generate income, but it involves understanding the concept of "impermanent loss," which can erode your holdings.

However, it's crucial to recognize that while crypto grabs headlines, there are other, often more stable and accessible, ways for a 16-year-old to generate income. Consider the power of acquiring in-demand skills. Learning web development, graphic design, video editing, or social media management can open doors to freelance opportunities. Platforms like Upwork and Fiverr connect freelancers with clients seeking these skills. Building a portfolio of work, even if it's initially for free or at a discounted rate, can significantly increase your earning potential.

Another option is to create and sell digital products. If you're creative, consider designing and selling printables (like calendars, planners, or checklists) on platforms like Etsy. Or, if you're passionate about a particular topic, you could create and sell an online course on platforms like Udemy or Skillshare.

Ethical considerations are paramount. At 16, it's crucial to operate with integrity and transparency. Avoid engaging in any activity that could be considered unethical or illegal, such as promoting pump-and-dump schemes or participating in fraudulent investment schemes. Remember that your reputation is invaluable, and it's far easier to damage it than to rebuild it.

Finally, always remember to save and reinvest a portion of your earnings. The power of compounding works best when you consistently contribute over time. Even small amounts saved regularly can grow into a significant sum over the long term.

In conclusion, making money at 16 is definitely achievable, and cryptocurrency, while a potential avenue, should be approached with caution and a solid understanding of its risks. Prioritize financial literacy, start small, do your research, and consider alternative income streams that align with your skills and interests. Most importantly, operate with integrity, and remember that building wealth is a marathon, not a sprint. The best investment you can make is in yourself – in your education, your skills, and your financial knowledge. That will pay dividends far beyond any fleeting cryptocurrency trend.