Understanding the Landscape of Online Earnings: A Strategic Approach

The digital age has revolutionized the way we generate income, creating unprecedented opportunities for financial growth through a blend of innovation, technology, and global connectivity. While traditional avenues like remote work or online freelancing remain popular, the emergence of decentralized financial systems has positioned virtual currencies as a compelling asset class for those seeking to diversify their portfolios. However, navigating this complex landscape requires more than casual interest—it demands a deep understanding of market dynamics, technical analysis, and risk mitigation techniques. This comprehensive guide explores how to leverage virtual currencies strategically while avoiding common pitfalls that could jeopardize financial stability.

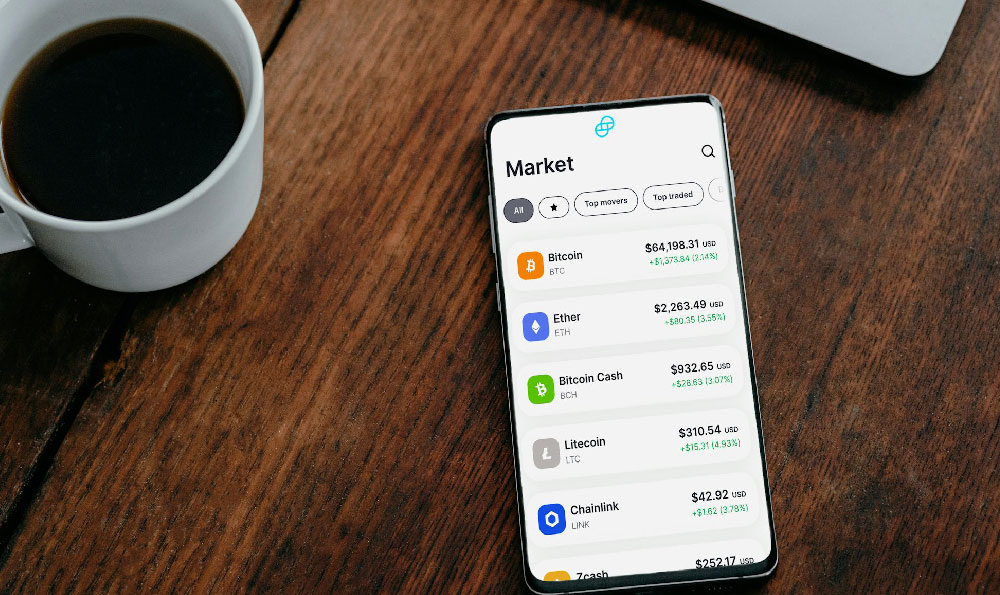

Virtual currencies, often referred to as cryptocurrencies, operate on blockchain technology, which enables peer-to-peer transactions without intermediaries. This decentralization not only reduces transaction costs but also introduces a unique level of volatility that can be both a challenge and an opportunity. For instance, the rise of decentralized finance (DeFi) platforms has allowed users to earn interest on their crypto holdings, participate in yield farming, or engage in staking—processes that capitalize on the inherent features of blockchain networks. Similarly, non-fungible tokens (NFTs) have opened doors to digital asset ownership, enabling creators and collectors to monetize unique virtual items. These innovations underscore the importance of adopting a flexible mindset, as the online earnings ecosystem is constantly evolving.

However, the allure of quick profits in crypto markets can be deceptive. Unlike traditional investments, where historical data and regulatory oversight provide a degree of predictability, the crypto space is characterized by rapid price fluctuations, speculative behavior, and regulatory uncertainty. For example, the surge of meme coins in 2021 demonstrated how market sentiment can drive prices to unsustainable levels, often leading to sharp corrections. This volatility necessitates a disciplined approach to investment, where technical indicators and fundamental analysis are used in tandem to identify trends and evaluate intrinsic value.

Technical analysis plays a pivotal role in crypto trading, offering insights into price patterns and market psychology. Tools like moving averages, relative strength index (RSI), and Fibonacci retracement levels help traders anticipate potential support and resistance levels, while volume analysis can indicate buying or selling pressure. For instance, a trader might use the 50-day moving average crossover strategy to determine entry and exit points, or monitor RSI values to gauge overbought or oversold conditions. Yet, it is crucial to recognize that no technical indicator is foolproof, as market anomalies and unpredictable events can disrupt even the most well-structured strategies.

Risk management is equally vital, as the crypto market’s inherent volatility exposes investors to significant financial risks. Diversification remains a cornerstone of prudent investing, but its application in crypto requires careful consideration. For example, allocating a portion of capital to established cryptocurrencies like Bitcoin or Ethereum while experimenting with smaller projects can balance stability and growth potential. Similarly, staking or lending crypto assets to DeFi platforms offers passive income but also carries risks such as smart contract vulnerabilities or liquidity issues. Effective risk management involves setting stop-loss orders, limiting exposure to any single asset, and maintaining a long-term perspective to avoid emotional decision-making.

Another critical aspect of online earnings is the importance of education and adaptability. The crypto market is highly competitive, with new projects, protocols, and opportunities emerging daily. For instance, the rise of decentralized autonomous organizations (DAOs) has introduced novel ways to participate in governance and profit from collective decision-making. Staying informed through credible sources, such as whitepapers, industry reports, and reputable news outlets, enables investors to make data-driven choices. Moreover, continuous learning about blockchain technology, market mechanics, and risk assessment frameworks ensures that strategies remain relevant in the face of rapid innovation.

The intersection of online earnings and crypto investment also highlights the significance of security and privacy. Unlike traditional banking systems, which offer FDIC insurance and regulatory protections, crypto investments are susceptible to hacking, fraud, and loss due to human error. For example, the 2018 Coincheck hack resulted in the loss of $534 million in cryptocurrency, underscoring the need for robust security measures. Implementing hardware wallets, enabling two-factor authentication (2FA), and avoiding phishing scams are essential steps to protect one’s digital assets. Furthermore, understanding the importance of private key management and regular software updates can prevent irreversible losses in an increasingly sophisticated threat landscape.

In addition to active strategies like trading and investing, passive income opportunities in the digital realm deserve attention. For instance, the growing popularity of crypto-based lending platforms allows users to earn interest on their holdings by depositing them as collateral. This model has gained traction due to its low entry barrier and the potential for consistent returns, although it requires careful evaluation of platform reliability and interest rate structures. Similarly, yield farming in DeFi ecosystems offers higher returns through liquidity provision, but it also involves complex mechanisms like token rewards and impermanent loss—a concept that demands thorough research before participation.

The psychological dimension of online earnings cannot be overlooked. The crypto market’s speculative nature often leads to emotional decision-making, where fear and greed drive market cycles. For example, the 2020 Bitcoin bull run was fueled by a combination of macroeconomic factors and bullish sentiment, resulting in a 40% price increase within a year. However, such momentum can reverse abruptly, necessitating emotional discipline and adherence to predefined strategies. Building a mindset that prioritizes patience, objectivity, and long-term goals is essential for sustained success in the online earnings space.

Ultimately, the key to navigating this landscape lies in balancing opportunity with caution. While virtual currencies offer transformative potential for financial growth, their volatility and complexity require a well-structured approach. By integrating technical analysis, risk management, and continuous education, investors can position themselves to thrive in the digital economy. However, the absence of a one-size-fits-all strategy means that adaptability and a long-term perspective are indispensable. The digital world rewards those who think critically, act strategically, and remain committed to lifelong learning—qualities that can transform online earning endeavors into a sustainable path to financial empowerment.

The journey of generating income through virtual currencies is not merely about timing market movements but about cultivating a holistic understanding of the digital ecosystem. Whether through active trading, passive income streams, or innovative DeFi projects, success hinges on a combination of technical acumen, financial discipline, and forward-thinking strategies. By staying informed, mitigating risks, and adapting to market changes, individuals can harness the power of virtual currencies to create a resilient and profitable online earning portfolio.