In the digital age, the internet has become a powerful tool for generating income, but it's essential to approach it with both strategy and awareness. While the idea of "easy" money online is often a myth, there are legitimate opportunities that require minimal initial investment and offer sustainable returns. These strategies typically hinge on leveraging existing skills, capitalizing on niche markets, or utilizing automation tools that reduce the need for constant manual effort. The key lies in understanding that consistent results are seldom instant, yet with careful planning and execution, online earnings can complement traditional income sources or even become a primary livelihood.

One of the most accessible entry points is monetizing digital skills through platforms like Upwork, Fiverr, or LinkedIn. Many individuals offer services such as graphic design, copywriting, or virtual assistance, which can be done from anywhere and scaled over time. For those with technical expertise, coding and freelancing in software development offer steady demand, particularly in industries reliant on digital transformation. However, success in this space requires not only proficiency but also a strong portfolio and consistent engagement with clients. While the income potential is substantial, it's crucial to manage expectations, as freelance work often involves irregular hours and fluctuating pay rates.

Another avenue is participating in online marketplaces that allow individuals to sell niche products or services. Platforms such as Etsy, eBay, or even niche Amazon stores have enabled entrepreneurs to reach global audiences without needing a physical storefront. This model works well for those with a knack for creating unique items or identifying underserved markets. For example, crafting and selling handmade jewelry or digital downloads like templates and ebooks can generate passive income if managed properly. However, competition in these spaces is fierce, and while some may achieve rapid success, the long-term viability depends on quality, branding, and customer retention strategies.

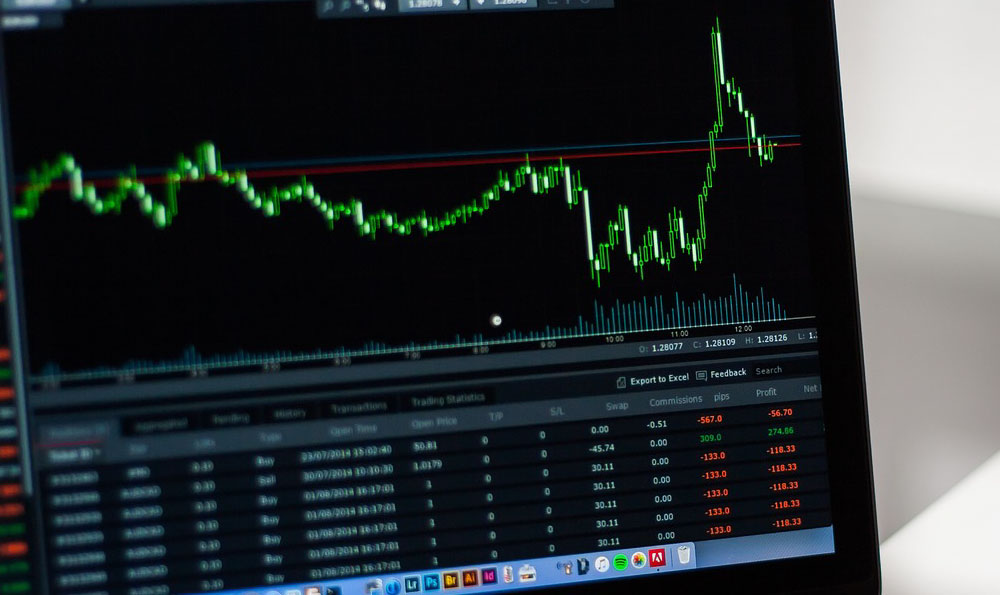

For those comfortable with investing, online financial instruments offer the potential for growth. Robo-advisors and automated trading platforms have made it easier for individuals to manage portfolios with minimal expertise, but the risks are significant. Cryptocurrency trading, for instance, has attracted many investors due to its volatility and potential for quick gains, though it's not without pitfalls. Similarly, stock market investments require research into market trends and company fundamentals. The key here is risk management—diversifying investments, using stop-loss orders, and avoiding emotional decision-making. While these strategies can yield substantial returns, they also demand discipline and a long-term perspective, as short-term gains often come at the expense of financial stability.

Content creation has emerged as a viable method for generating online revenue, particularly in the realms of YouTube, blogging, or social media marketing. By producing valuable content, individuals can attract an audience and monetize through ads, sponsorships, or affiliate marketing. This approach suits those with a passion for writing, photography, or video production, but it requires consistent effort to build an audience. The challenge lies in balancing content quality with scalability, as high engagement often correlates with niche expertise. Additionally, while some creators achieve rapid growth, the competitive nature of online content means that algorithms and audience preferences are constantly evolving.

The rise of AI and automation tools has also opened new doors for passive income generation. Tools like chatbots, automated email marketing campaigns, or trading algorithms can reduce the need for constant labor, though they require initial setup investment. For example, creating a digital product such as an online course or eBook with AI assistance can distribute the workload, allowing income to be generated over time. However, the effectiveness of these tools depends on the user's ability to integrate them into a broader strategy, as automation alone cannot guarantee success.

Lastly, exploring alternative income streams such as online surveys, microtasks, or participation in affiliate programs can provide supplemental revenue with minimal effort. These methods often require an initial investment in time or access to platforms, but they offer flexibility for those with limited financial resources. However, it's important to recognize that these streams typically provide low returns, and success is limited by the number of tasks completed or the quality of marketing.

In conclusion, the path to online income involves a mix of skill, strategy, and patience. While some methods promise quick returns, they often come with greater risks. The most sustainable approaches typically combine active effort with passive income generation. For instance, building a blog or YouTube channel requires consistent content creation but can yield long-term rewards through monetization. Conversely, investing in financial instruments or using automation tools requires initial learning and possibly capital but can generate returns with minimal ongoing effort. Regardless of the chosen method, it's crucial to avoid scams by verifying the legitimacy of platforms and services, and to focus on building value that aligns with personal interests and market demand. The digital landscape offers limitless opportunities, but each requires a tailored approach and a commitment to continuous learning and adaptation.