Unlocking the Potential of Digital Assets: A Strategic Approach to Quick Online Earnings in the Modern Financial Landscape

In an era where digital transformation reshapes traditional paradigms, the prospect of generating income online has evolved into a multifaceted opportunity that blends innovation, risk management, and long-term wealth creation. While the allure of rapid financial gains is tempting, it’s crucial to navigate this terrain with precision, understanding that sustainability often outpaces speed. This article explores actionable strategies to capitalize on digital assets and online ventures, emphasizing the balance between ambition and caution.

The intersection of cryptocurrency and online income generation has become a focal point for many seeking alternative financial paths. Digital currencies such as Bitcoin and Ethereum offer unique mechanisms for wealth accumulation, but their volatility demands a calculated approach. For instance, the liquidity of major cryptocurrencies allows for participation in trading, staking, or yield farming, which can yield returns in a matter of days or weeks. However, success in this domain hinges on a deep comprehension of market cycles, technical indicators, and operational risk mitigation. A deep learning model analyzing Bitcoin’s price fluctuations over the past decade reveals that periods of exponential growth are often preceded by strategic accumulation phases, where informed investors can secure positions with lower risk. Similarly, Ethereum’s recent embrace of decentralized finance (DeFi) protocols has created avenues for passive income through liquidity provision, but such opportunities require thorough vetting of smart contracts and a clear understanding of blockchain fundamentals.

Quick online earnings are not limited to cryptocurrency alone. Emerging technologies like artificial intelligence and blockchain have given rise to platforms that automate income generation. For example, AI-driven trading tools can execute high-frequency trades based on algorithmic analysis, but their effectiveness is contingent on the quality of the underlying data and the adaptability of the system to shifting market conditions. Conversely, blockchain-based applications such as NFT marketplaces or decentralized lending platforms provide opportunities for value creation through content curation, capital lending, or tokenized assets. However, these avenues often demand a dual focus on technical execution and risk-aware decision-making. A case study of a successful NFT trader illustrates the importance of selecting high-quality digital assets, understanding market demand, and hedging against speculative downturns.

Online services and remote work have also transformed into viable sources of quick income. Freelancing platforms like Upwork or Fiverr enable individuals to monetize their skills instantly, but the competition in these marketplaces requires a strategic differentiation. For example, securing a niche in high-demand areas such as cybersecurity consulting or data science can yield faster returns than generalist services. Similarly, affiliate marketing programs leverage high-traffic websites and digital products to generate commissions, though their success depends on audience engagement, SEO optimization, and transparent partnerships. A notable advantage of this method is its accessibility, allowing individuals to start with minimal investment while scaling their income through recurring commissions. However, the time-sensitive nature of these opportunities means that proactive strategy and continuous adaptation are essential.

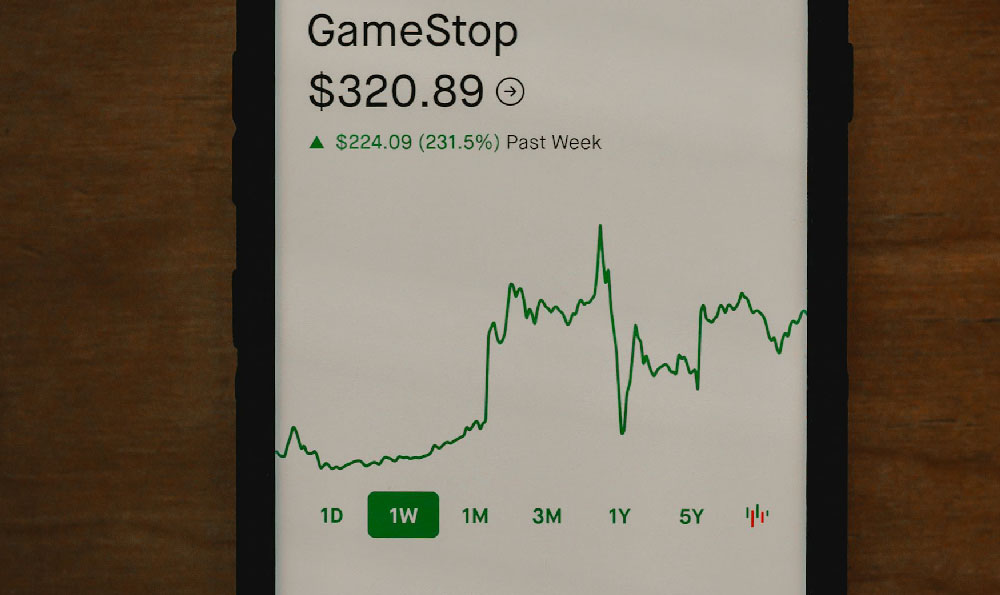

For those interested in digital currencies, the landscape offers a spectrum of options, from short-term trading to long-term hodling. Short-term trading strategies, such as day trading or swing trading, rely on technical analysis tools like moving averages, RSI (Relative Strength Index), and volume spikes to identify entry and exit points. These strategies can generate significant returns within a short timeframe, but their risk profile is inherently higher, requiring a disciplined approach to avoid emotional decisions. On the other hand, long-term investing in established cryptocurrencies with strong fundamentals and adoption rates can provide a more stable return, even if it takes months or years to materialize. The key is to align investment horizon with personal financial goals and risk tolerance.

The ethical and security considerations in online income generation cannot be overstated. As the market grows, so do the opportunities for exploitation, from rug pulls in DeFi projects to phishing scams in remote work environments. A proactive approach to cybersecurity, such as using multi-factor authentication and avoiding unverified platforms, is critical. Similarly, in the realm of digital assets, due diligence on project teams, audit trails, and decentralized governance structures can minimize exposure to fraudulent schemes. For example, a thorough analysis of a cryptocurrency’s whitepaper and community engagement can distinguish legitimate opportunities from speculative traps.

The digital economy’s fastest-growing sectors, such as Web3 and metaverse platforms, present unique avenues for quick income. Web3 applications, which leverage decentralized technologies, often offer revenue streams through protocol participation or token staking. Metaverse ventures, including virtual real estate or digital content creation, provide the potential for capital appreciation as the ecosystem matures. However, these opportunities require a blend of technical aptitude, market insight, and a clear understanding of the underlying infrastructure. A strategic approach involves identifying high-potential projects with strong community support and scalable business models.

It’s important to recognize that quick income is not a one-size-fits-all solution. The speed of returns often inversely correlates with the complexity of the strategy. For instance, a secure approach to online income might involve a combination of low-risk investments, such as dividend-paying stocks or stablecoins, and high-risk opportunities, such as venture capital in emerging technologies. A balanced portfolio that diversifies across different asset classes and market conditions can optimize returns while minimizing exposure to downside risks.

To harness the benefits of quick online income, individuals must invest in continuous learning and adaptability. Staying informed about market trends, technological advancements, and regulatory changes is essential for making data-driven decisions. Additionally, cultivating a mindset of risk-awareness and financial discipline can help avoid common pitfalls, such as over-leveraging or neglecting due diligence. A successful investor in the digital space often combines strategic patience with rapid execution, ensuring that opportunities are seized when the timing is optimal.

In conclusion, the path to quick online earnings requires a nuanced understanding of the digital ecosystem, a commitment to risk management, and a strategic approach to asset allocation. Whether through cryptocurrency, online services, or emerging technologies, the key lies in aligning opportunities with personal capabilities and long-term objectives. While rapid returns are possible, the focus should remain on creating sustainable value that endures beyond short-term fluctuations. By integrating technical analysis, ethical considerations, and adaptive strategies, investors can navigate the complexities of the digital economy with confidence, securing both immediate gains and long-term financial stability.