Penny stocks have long been a controversial but intriguing segment of the financial market, offering the potential for significant gains with relatively low initial capital. In 2023, the dynamics surrounding these stocks have evolved, influenced by shifting global economic conditions, technological advancements, and evolving investor behaviors. While the inherent risks remain, the strategies for capitalizing on penny stocks have become more sophisticated, catering to both experienced traders and newcomers eager to explore high-impact opportunities. Understanding the nuances of this market requires a combination of research, adaptability, and strategic thinking, as the path to profitability in 2023 is shaped by external factors such as macroeconomic trends, sector performance, and geopolitical shifts.

The foundation of successful penny stock trading begins with identifying promising companies that operate within volatile or emerging industries. Industries like biotechnology, renewable energy, or electric vehicles have shown erratic price movements in recent years, often driven by speculative demand or breakthrough innovations. Traders who focus on these sectors can benefit from short-term volatility, but it demands a deep understanding of the underlying business fundamentals and the ability to anticipate market sentiment. For instance, during periods of economic uncertainty, investors might gravitate toward companies perceived as having transformative potential, even if their financial statements are incomplete or unproven. This speculative nature, however, carries substantial risks, as companies with weak fundamentals may experience abrupt declines in share prices.

A critical component of modern penny stock strategies is leveraging technological tools to analyze market trends and identify undervalued stocks. Advanced platforms provide real-time data on trading volume, price fluctuations, and social media sentiment, enabling traders to make informed decisions. For example, tracking the performance of similar stocks within the same industry can reveal patterns that indicate potential for growth. If a smaller competitor experiences a surge in price due to a successful product launch, it could signal a renewed interest in the sector. Similarly, monitoring short-interest data can help identify stocks at risk of a short squeeze, which often leads to sudden price spikes. These tools, combined with a disciplined approach, allow traders to capitalize on short-term opportunities without relying solely on guesswork.

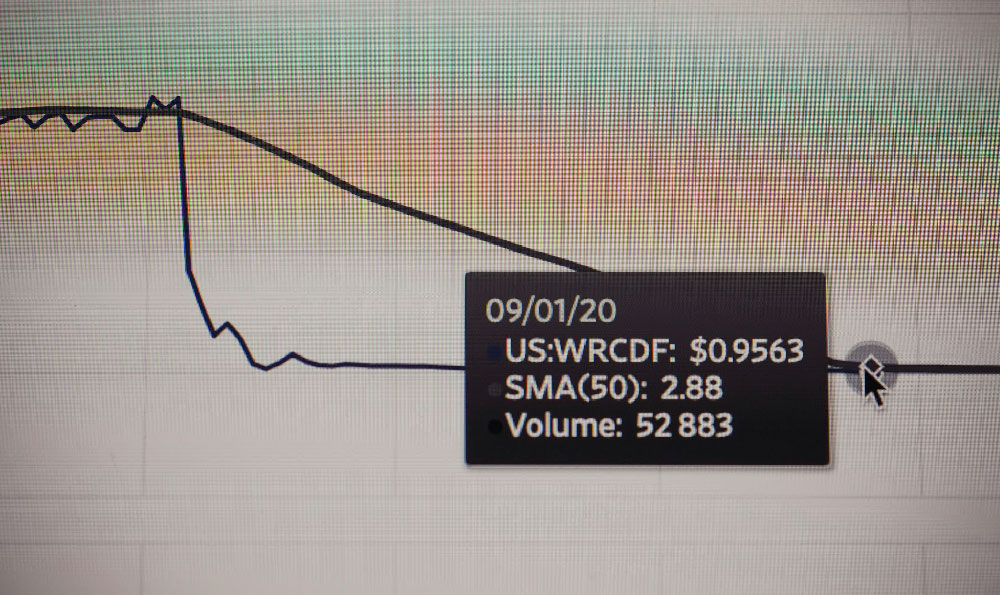

While technical analysis offers insights into market behavior, fundamental analysis remains essential for evaluating the long-term viability of a company. Many investors view penny stocks as speculative, but a thorough examination of financial reports can uncover overlooked potential. For instance, a company with a robust management team, innovative products, or a competitive edge in its industry might be undervalued despite its small market capitalization. Analyzing key metrics such as revenue growth, earnings reports, and future projections can help traders determine whether a stock is a true investment opportunity or merely a price fluctuation. However, the lack of transparency in some penny stock companies necessitates caution, as incomplete financial information can lead to misjudged investments.

In 2023, the integration of social media and online communities has reshaped the way traders approach penny stocks. Platforms like Reddit, Twitter, and specialized forums provide real-time discussions that can influence market sentiment and stock performance. For example, a viral post about a company's recent partnership or product development can drive demand and cause a swift price increase. Traders who monitor these channels can gain early insights into market trends, but they must be wary of misinformation or hype-driven speculation. The ability to distinguish between genuine opportunities and overhyped rumors is a crucial skill in navigating this landscape.

Risk management has become increasingly important as the volatility of penny stocks continues to challenge traditional investment approaches. The unpredictable nature of these stocks means that even the most promising investments can turn into losses if not properly managed. Traders often use stop-loss orders to limit potential damage, setting predefined thresholds to exit a trade if the stock price drops below a certain level. Diversification is another key strategy, as concentrating investments in a single penny stock can expose traders to significant downside risk. For example, a portfolio spread across multiple sectors reduces the impact of a single stock's poor performance. Additionally, maintaining a disciplined approach to trading, such as adhering to a strict risk-to-reward ratio, helps prevent emotional decision-making in volatile markets.

The psychological aspect of trading penny stocks cannot be overlooked, as the market's rapid fluctuations often test an investor's patience and discipline. Successful traders in 2023 emphasize the importance of maintaining a long-term perspective, even when short-term gains are tempting. FOMO, or the fear of missing out, can lead to impulsive trades that result in losses, while overconfidence might result in holding onto underperforming stocks. Building a solid strategy that includes both technical and emotional factors is essential for navigating this high-risk environment. Some traders recommend starting with small investments to gain experience before committing larger sums, as the learning curve for penny stock trading is steep.

The effectiveness of these strategies is ultimately determined by the trader's ability to adapt to changing market conditions. As 2023 progresses, factors like inflation, interest rates, and regulatory changes continue to impact the stock market. Traders who remain agile and adjust their strategies in response to these shifts may find greater success in the penny stock arena. For example, a trader who pivots from speculative stocks to undervalued companies during periods of economic contraction might avoid some of the market's most volatile swings. The key lies in combining research, technology, and psychological resilience to create a profitable approach that aligns with the unique challenges of 2023.

While the potential for earnings in penny stocks is significant, the market's inherent risks mean that success is not guaranteed. Traders who approach this segment with a clear plan, continuous learning, and a focus on both short-term and long-term opportunities may achieve better results. The intersection of financial theory, technology, and market psychology creates a dynamic environment where careful strategy can lead to substantial gains, but it requires a level of expertise that separates the experienced from the novice. For those willing to invest the time and resources into mastering these strategies, the penny stock market can still offer rewarding opportunities in 2023.