In the ever-evolving landscape of digital assets and decentralized finance, the concept of "winning a heart with money" transcends mere financial gain. It represents a delicate interplay between trust, strategy, and long-term vision. For those navigating the complexities of cryptocurrency investments, the key lies in understanding that true success is not dictated by short-term volatility or speculative hype but by the ability to cultivate integrity, foresight, and stability in financial decision-making. The digital currency market, often perceived as a high-risk frontier, offers unparalleled opportunities for growth when approached with discipline and awareness. Let’s explore how aligning financial principles with strategic acumen can lead not only to profitable outcomes but also to the establishment of trust—both in oneself and with others.

Trust is the bedrock of any sustainable investment approach. In the realm of blockchain technology and virtual currencies, this trust is not only about fulfilling promises but also about demonstrating transparency and accountability. A reputable investor understands that credibility is earned through consistent actions, whether it's maintaining a clear record of transactions, adhering to ethical standards, or prudently managing risks. The importance of trust cannot be overstated, as it influences both personal financial growth and the broader adoption of digital assets. By prioritizing openness and reliability, investors can forge relationships with peers, institutions, and the market itself, creating a foundation for long-term success.

To navigate the digital currency market effectively, one must first grasp the fundamental drivers of its evolution. The integration of blockchain technology has redefined traditional finance, enabling decentralized systems that operate beyond the control of central authorities. However, this decentralization also introduces unique challenges, from regulatory uncertainty to the potential for market manipulation. Staying ahead of these dynamics requires a deep understanding of macroeconomic trends, such as inflation rates, monetary policies, and technological advancements. For instance, the adoption of central bank digital currencies (CBDCs) and the continuous innovation in smart contracts are reshaping the ecosystem, creating new opportunities and risks. An astute investor will monitor these developments closely, positioning themselves to capitalize on emerging trends while mitigating potential pitfalls.

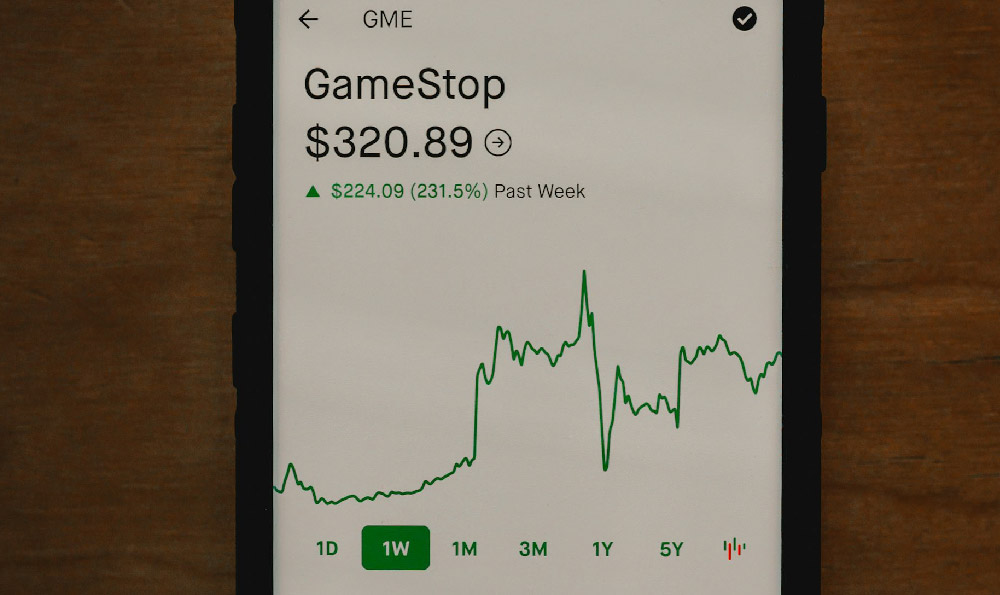

Technical analysis serves as a critical tool for interpreting market behavior and making informed decisions. While blockchain technology underpins the value of digital assets, the markets themselves are influenced by a myriad of factors, including supply and demand, liquidity, and investor sentiment. A skilled investor will leverage indicators such as moving averages, relative strength index (RSI), and volume analysis to forecast price movements. However, it's equally important to recognize that these tools are not infallible. The volatility of virtual currencies often undermines traditional technical patterns, necessitating a flexible and adaptive approach. By combining quantitative analysis with qualitative insights—such as the sociological impact of decentralization or the geopolitical implications of digital currencies—investors can develop a more holistic view of the market.

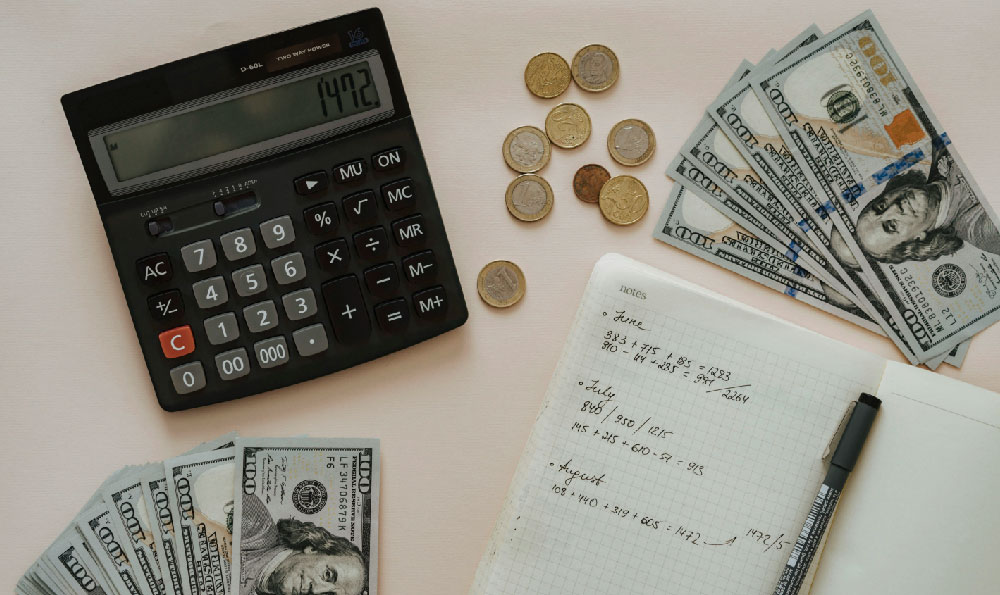

Risk management is the cornerstone of any profitable investment strategy. In the digital currency space, risks are omnipresent, ranging from cybersecurity threats to regulatory changes and market crashes. The most successful investors treat risk not as an obstacle but as a variable to be measured and controlled. This involves diversifying portfolios across different asset classes, setting clear boundaries for capital allocation, and maintaining a buffer against unexpected downturns. For example, allocating a portion of one's investment to stablecoins or traditional assets can provide stability in turbulent times. Additionally, implementing automated trading systems or employing hedging techniques can offer further protection. The goal is not to eliminate risk but to manage it intelligently, ensuring that the potential for loss is always balanced against the rewards.

A long-term perspective is essential for maximizing the benefits of digital asset investments. While short-term gains may be tempting, they often come with significant volatility and uncertainty. A forward-thinking investor understands that the true value of cryptocurrencies lies in their ability to disrupt traditional financial systems and redefine value storage. This requires patience, a willingness to withstand market fluctuations, and an understanding that digital assets are part of a larger technological and economic transformation. Over time, the compounding effect of well-timed investments can yield substantial returns, even in the face of short-term setbacks. By focusing on the broader trajectory of blockchain innovation and the adoption of decentralized technologies, investors can position themselves to benefit from this long-term evolution.

The digital currency market is not without its challenges. Scams, pump-and-dump schemes, and misinformation are prevalent, often luring inexperienced investors into precarious situations. To avoid these traps, one must cultivate critical thinking and a deep understanding of the underlying technology. This involves verifying the legitimacy of projects, scrutinizing whitepapers, and analyzing the track record of teams. Additionally, staying informed about regulatory developments and market sentiment can help identify potential red flags. The importance of personal responsibility cannot be overstated; no strategy or technology can guarantee success without a commitment to continuous learning and ethical practices.

Ultimately, the synergy between trust, strategy, and technology defines the trajectory of any digital asset investment. The decentralization of financial systems offers a unique opportunity to build credibility, foster innovation, and achieve growth. However, this potential can only be realized through a disciplined approach that prioritizes transparency, risk management, and long-term vision. By embracing these principles, investors can not only navigate the challenges of the digital currency market but also position themselves to benefit from its transformative potential. The journey may be complex, but with the right mindset and tools, it is possible to achieve financial success that is both sustainable and resilient.