Okay, I understand. Here's an article addressing the question of how to start investing in stocks, aimed at providing a comprehensive overview for beginners and those seeking to refine their understanding.

Investing in the stock market represents a powerful avenue for wealth creation, but it can also appear daunting to those unfamiliar with its intricacies. The allure of potentially high returns is often tempered by anxieties about risk and a perceived lack of knowledge. However, with a strategic approach and a commitment to continuous learning, navigating the stock market can become a manageable and rewarding endeavor.

The initial and perhaps most crucial step involves defining your investment goals. Are you saving for retirement, a down payment on a house, your children's education, or simply seeking to grow your capital over time? Your objectives will directly influence your investment timeline and risk tolerance, both of which are vital factors in shaping your investment strategy. A shorter time horizon necessitates a more conservative approach, prioritizing capital preservation over aggressive growth. Conversely, a longer time horizon allows for greater risk-taking, as there's more time to recover from potential market downturns.

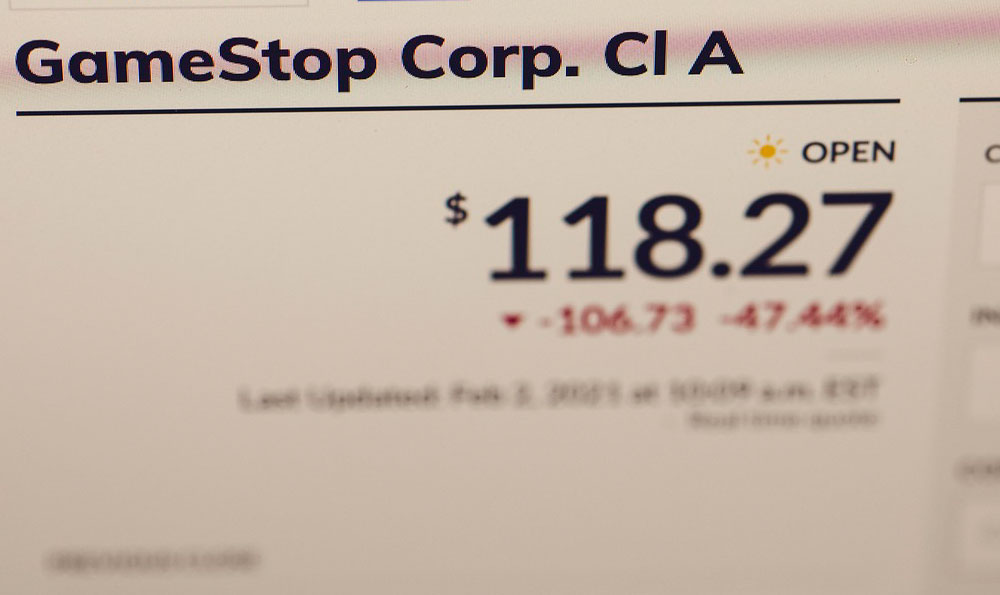

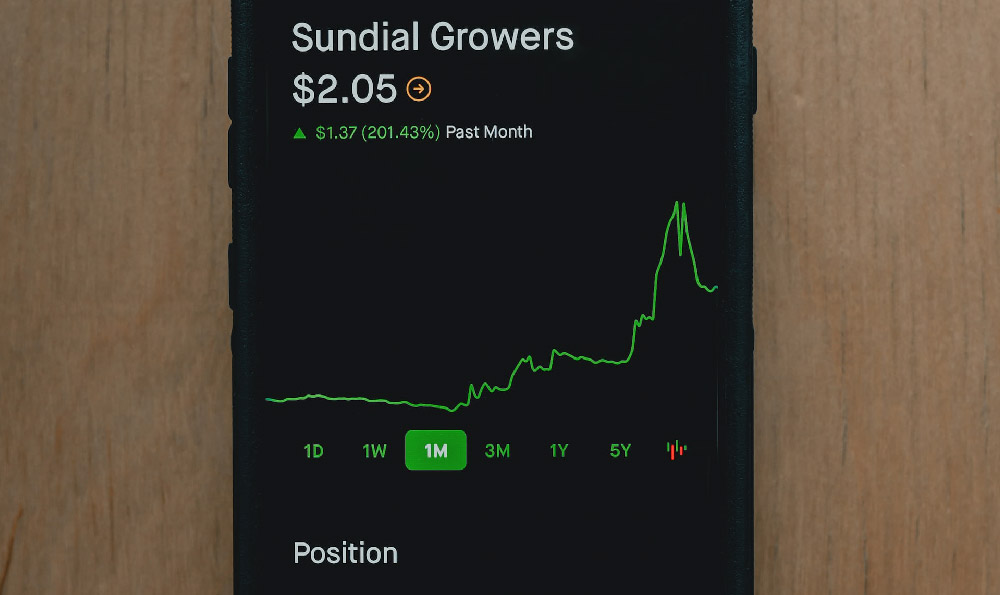

Once your goals are established, the next consideration is your risk tolerance. This refers to your ability to withstand potential losses in your investment portfolio. Are you comfortable seeing your investments fluctuate in value, even significantly, knowing that they have the potential to rebound and grow over time? Or do you prefer a more stable, predictable path, even if it means sacrificing some potential upside? A low-risk tolerance generally translates to a preference for less volatile investments, such as bonds or dividend-paying stocks, while a higher risk tolerance opens the door to growth stocks, small-cap companies, and even more speculative investments.

Following the evaluation of goals and risk tolerance comes the practical matter of opening a brokerage account. Numerous online brokerages offer a user-friendly platform for buying and selling stocks. Factors to consider when choosing a brokerage include the commission fees charged per trade (some brokerages offer commission-free trading), the range of investment options available, the research and educational resources provided, and the overall user experience. Popular online brokerages include Fidelity, Charles Schwab, Vanguard, and Robinhood. Researching and comparing different brokerages before making a decision is highly recommended.

With a brokerage account established, you're ready to begin building your portfolio. A fundamental principle of investing is diversification, which means spreading your investments across a variety of different stocks, sectors, and even asset classes. Diversification helps to mitigate risk by reducing the impact of any single investment on your overall portfolio. For example, if you invest solely in technology stocks and the technology sector experiences a downturn, your entire portfolio will suffer. However, if you've diversified across different sectors, such as healthcare, consumer staples, and energy, the impact of a technology downturn will be lessened.

There are several approaches to stock selection. One popular method is fundamental analysis, which involves evaluating a company's financial health, management team, and competitive landscape to determine its intrinsic value. This requires analyzing financial statements, such as the balance sheet, income statement, and cash flow statement, to assess the company's profitability, debt levels, and growth potential. Another approach is technical analysis, which focuses on studying stock charts and trading patterns to identify potential buy and sell signals. Technical analysts believe that past price movements can predict future price movements.

For beginners, a simpler and often more effective approach is to invest in index funds or exchange-traded funds (ETFs). These are investment vehicles that track a specific market index, such as the S&P 500, which represents the 500 largest publicly traded companies in the United States. Investing in an index fund or ETF provides instant diversification across a broad range of stocks, and it typically comes with low expense ratios. This can be a cost-effective way to gain exposure to the stock market without having to individually select stocks.

Beyond the initial setup, successful investing requires ongoing monitoring and adjustments. Regularly review your portfolio to ensure that it still aligns with your goals and risk tolerance. Rebalancing your portfolio periodically is also important. This involves selling some of your investments that have performed well and buying more of those that have underperformed to maintain your desired asset allocation. For example, if your target asset allocation is 70% stocks and 30% bonds, and your stock holdings have grown to 80% of your portfolio, you would sell some stocks and buy more bonds to bring your asset allocation back to the target levels.

Finally, continuous learning is paramount. The stock market is constantly evolving, and it's important to stay informed about market trends, economic developments, and company-specific news. Read books, articles, and blogs on investing, attend seminars and webinars, and consider seeking advice from a qualified financial advisor. Remember, investing is a long-term endeavor, and consistent effort and learning will significantly improve your chances of success. Understand that losses are a part of the game, and it's crucial not to panic sell during market downturns. Instead, view these downturns as opportunities to buy high-quality stocks at discounted prices, provided your financial situation allows it. With patience, discipline, and a well-defined strategy, investing in the stock market can be a rewarding path towards achieving your financial goals.