Investing in the stock market has long been a popular avenue for wealth creation and financial security. However, it's crucial to understand that it's not a guaranteed path to riches and requires careful consideration, diligent research, and a healthy dose of patience. Whether investing in stocks is right for you depends heavily on your individual circumstances, risk tolerance, and financial goals.

Before diving into the specifics of how to profit from stocks, it's important to establish a solid foundation of knowledge. The stock market is essentially a marketplace where shares of publicly traded companies are bought and sold. When you buy a stock, you're purchasing a small piece of ownership in that company. The value of that ownership can fluctuate based on a multitude of factors, including the company's financial performance, industry trends, economic conditions, and even global events.

Profit from stocks primarily comes in two forms: capital appreciation and dividends. Capital appreciation refers to the increase in the price of a stock over time. If you buy a stock for $50 and it later rises to $75, you've experienced capital appreciation of $25 per share. You can then sell your shares and realize that profit. Dividends, on the other hand, are distributions of a company's earnings to its shareholders. Not all companies pay dividends, but those that do typically do so on a regular basis, such as quarterly or annually. Dividends provide a steady stream of income for investors, regardless of the stock's price fluctuations.

To maximize your potential for profit, a well-defined investment strategy is essential. There are numerous strategies to choose from, each with its own risk profile and potential return. Some popular strategies include:

-

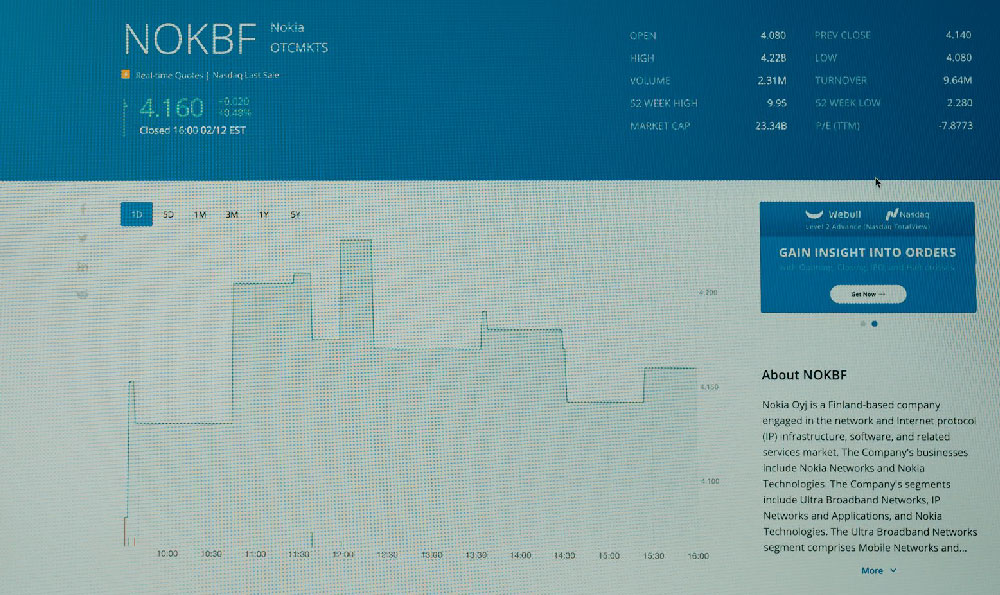

Value Investing: This strategy focuses on identifying undervalued stocks – companies whose stock prices are trading below their intrinsic value. Value investors believe that the market has temporarily mispriced these stocks and that their prices will eventually rise to reflect their true worth. Key indicators to look for include low price-to-earnings (P/E) ratios, price-to-book (P/B) ratios, and high dividend yields.

-

Growth Investing: Growth investors seek out companies that are expected to experience rapid growth in earnings and revenue. These companies are often in emerging industries or have innovative products and services. While growth stocks can offer significant returns, they also tend to be more volatile than value stocks.

-

Dividend Investing: This strategy focuses on investing in companies that consistently pay high dividends. Dividend investors prioritize income generation over capital appreciation. This strategy can be particularly attractive for retirees or those seeking a reliable source of passive income.

-

Index Investing: Index investing involves investing in a broad market index, such as the S&P 500. This is typically done through index funds or exchange-traded funds (ETFs) that track the performance of the index. Index investing is a low-cost and diversified way to participate in the stock market.

Beyond selecting a strategy, effective risk management is paramount. The stock market is inherently volatile, and prices can fluctuate significantly in the short term. Therefore, it's crucial to diversify your portfolio by investing in a variety of stocks across different sectors and industries. This helps to reduce your exposure to any single company or industry.

Another important aspect of risk management is setting stop-loss orders. A stop-loss order is an instruction to your broker to automatically sell your shares if the price falls below a certain level. This helps to limit your potential losses if a stock declines sharply.

Thorough research is also non-negotiable. Before investing in any stock, it's essential to conduct thorough research on the company, its industry, and its competitors. Analyze the company's financial statements, including its balance sheet, income statement, and cash flow statement. Pay attention to key metrics such as revenue growth, profit margins, and debt levels. Read industry reports and news articles to stay informed about the company's industry trends and competitive landscape. Understanding the company's business model, competitive advantages, and management team is crucial for making informed investment decisions.

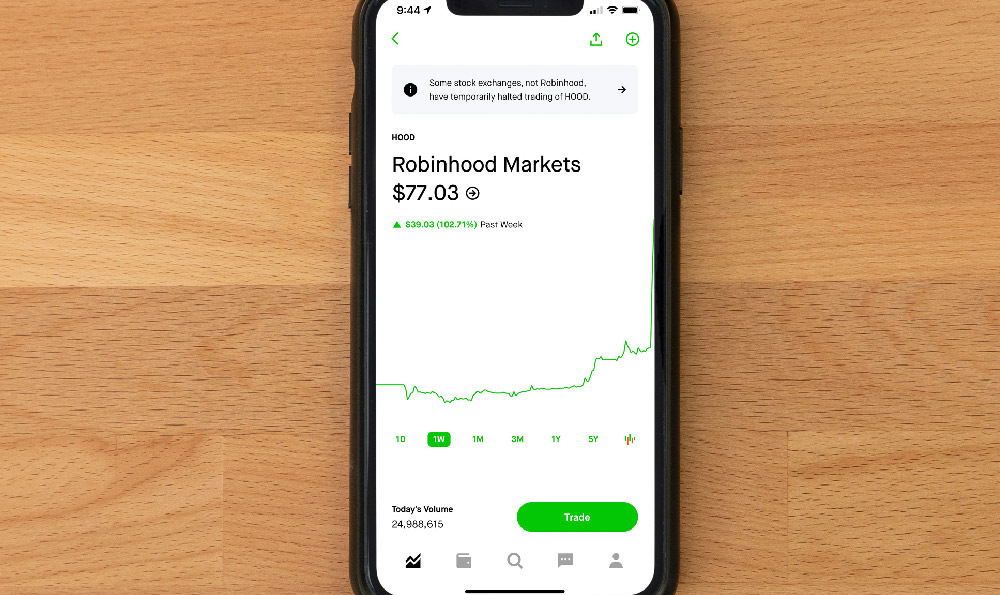

Furthermore, understanding technical analysis can be a valuable tool in your arsenal. Technical analysis involves analyzing historical price charts and trading volumes to identify patterns and trends that can help you predict future price movements. Technical indicators, such as moving averages, relative strength index (RSI), and MACD, can provide insights into the strength of a stock's price trend and potential buy or sell signals. While technical analysis is not foolproof, it can be a useful supplement to fundamental analysis.

Avoiding common investment traps is just as important as implementing sound investment strategies. One common mistake is chasing hot stocks or relying on tips from unreliable sources. Resist the temptation to jump on the bandwagon of the latest trending stock without doing your own research. Another common mistake is letting emotions drive your investment decisions. Fear and greed can cloud your judgment and lead you to make impulsive decisions. Develop a disciplined approach to investing and stick to your plan, even when the market is volatile.

Ultimately, whether investing in stocks is right for you depends on your individual circumstances. Consider your risk tolerance, time horizon, and financial goals. If you have a long-term investment horizon and are comfortable with the potential for short-term volatility, stocks can be a powerful tool for building wealth. However, if you have a short-term time horizon or a low risk tolerance, you may want to consider more conservative investment options. If you are unsure about whether investing in stocks is right for you, it's always a good idea to consult with a qualified financial advisor. They can help you assess your individual circumstances and develop a personalized investment plan that aligns with your goals. Remember that investing in the stock market involves risk, and there is no guarantee of profit. But with careful planning, diligent research, and a long-term perspective, you can increase your chances of achieving your financial goals.