Okay, I'm ready. Here's an article based on the title "Investing Now: Wise Choice or Risky Move?" written as requested, with no explicit headings, no numbered lists, no "firstly/secondly" style transitions, and exceeding 800 words.

The siren song of investment opportunities beckons constantly, promising future riches and financial security. Whether it's the allure of a burgeoning tech company, the steadfast reliability of real estate, or the volatile excitement of cryptocurrency, the question remains: Is investing right now a wise choice, or a plunge into perilous territory? The answer, as with most things in the financial realm, lies in a complex interplay of factors, dependent on individual circumstances, market conditions, and a healthy dose of risk assessment.

To simply declare investing "good" or "bad" in any given moment is a vast oversimplification. The wisdom of investing hinges on several critical considerations, the most fundamental being your own financial foundation. Before even contemplating which stocks to buy or which properties to acquire, a hard look at your personal financial landscape is absolutely crucial. Do you have a solid emergency fund – ideally, covering 3-6 months of living expenses? Are you carrying high-interest debt, such as credit card balances? Are you actively saving for retirement through employer-sponsored plans or individual retirement accounts? Addressing these core areas is paramount. High-interest debt, for instance, can erode returns far faster than most investments can generate. An insufficient emergency fund could force you to liquidate investments prematurely, potentially at a loss, if unexpected expenses arise.

Once these foundational elements are in place, the next layer of consideration is your risk tolerance. This isn't merely a theoretical exercise; it's an honest self-assessment of how you emotionally react to potential financial setbacks. Are you comfortable with the possibility of seeing your investment value fluctuate significantly? Can you stomach short-term losses without panicking and selling at the wrong time? A conservative investor might favor lower-risk options like bonds or dividend-paying stocks, even if the potential returns are more modest. A more aggressive investor might be willing to venture into higher-growth sectors or even more speculative investments, accepting the inherent volatility that comes with the territory. Your risk tolerance should directly inform your investment choices. Understanding your own psychology is key to making rational decisions, especially when markets become turbulent.

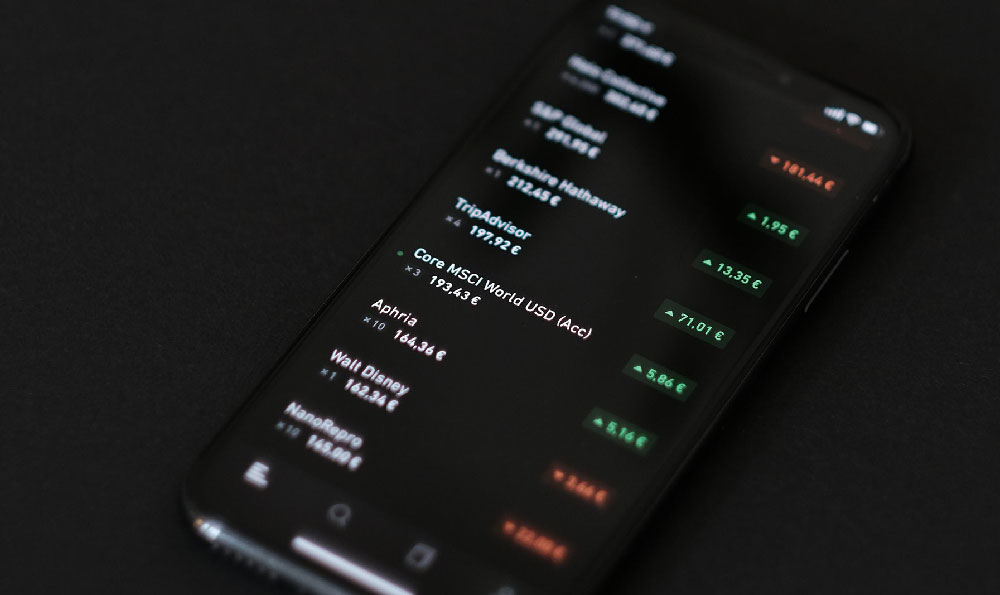

Then there’s the crucial element of diversification. The old adage "don't put all your eggs in one basket" remains profoundly relevant. Spreading your investments across different asset classes, industries, and geographical regions can significantly mitigate risk. If one sector experiences a downturn, the impact on your overall portfolio is lessened. Diversification doesn't guarantee profits or prevent losses, but it does provide a buffer against excessive exposure to any single point of failure. Consider including a mix of stocks, bonds, real estate (through REITs or direct ownership), and even commodities in your portfolio, tailoring the allocation to your specific risk tolerance and investment goals.

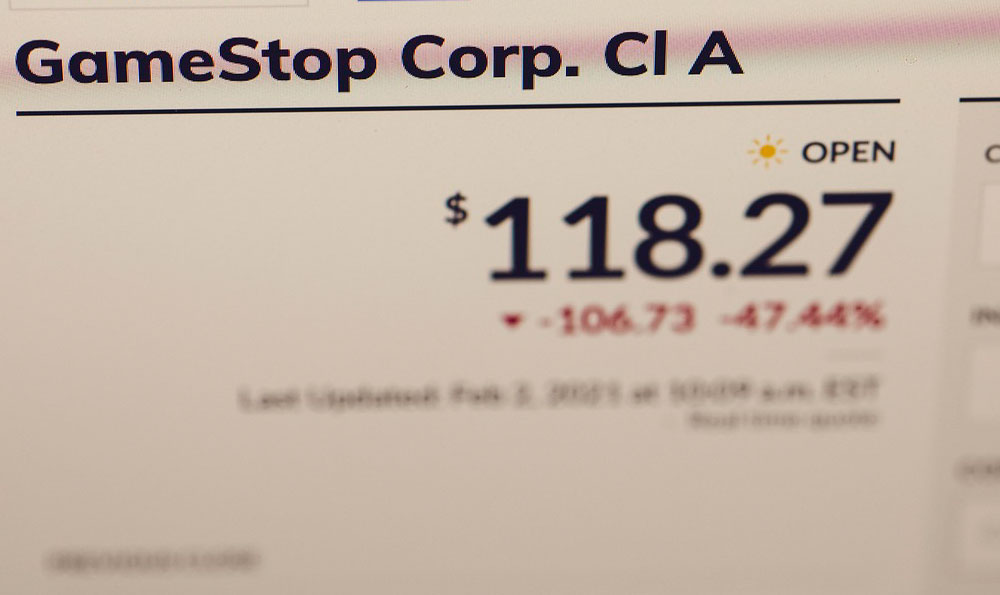

Market conditions also play a pivotal role in determining the suitability of investing at any given time. Is the economy experiencing robust growth, or is it teetering on the edge of recession? Are interest rates rising or falling? What are the prevailing inflation rates? These macroeconomic factors can significantly influence the performance of different asset classes. For instance, rising interest rates can put downward pressure on bond prices, while strong economic growth often fuels stock market rallies. Staying informed about economic trends and understanding their potential impact on your investments is essential for making informed decisions. This doesn’t necessarily mean becoming a day trader, constantly monitoring the news and reacting to every fluctuation. It means taking a long-term perspective and making adjustments to your portfolio based on broader economic signals.

Furthermore, understanding the specific investment vehicles you're considering is paramount. Don't invest in anything you don't fully understand. This applies to everything from individual stocks and bonds to mutual funds, exchange-traded funds (ETFs), and more complex instruments like options or futures. Research the underlying assets, understand the fees involved, and carefully consider the potential risks and rewards before committing any capital. Reading prospectuses, financial statements, and independent research reports can provide valuable insights. Consulting with a qualified financial advisor can also be beneficial, especially if you're new to investing or dealing with complex financial products.

Another factor is your investment timeline. Are you saving for retirement, which is decades away? Or are you looking to accumulate funds for a shorter-term goal, like a down payment on a house? Your time horizon significantly influences the types of investments that are appropriate. Longer time horizons allow for greater risk-taking, as you have more time to ride out market fluctuations. Shorter time horizons necessitate a more conservative approach, prioritizing capital preservation over high growth.

Finally, consider the emotional aspect of investing. Fear and greed can be powerful motivators, often leading to irrational decisions. Resist the urge to chase after "hot" stocks or to panic sell during market downturns. Develop a well-defined investment strategy and stick to it, even when the market becomes volatile. Regularly review your portfolio and make adjustments as needed, but avoid impulsive reactions based on short-term market noise. Investing is a long-term game, and patience is often rewarded.

In conclusion, the decision of whether to invest now is not a simple yes or no question. It requires a thorough assessment of your personal finances, risk tolerance, market conditions, investment knowledge, and time horizon. By carefully considering these factors and developing a well-thought-out investment strategy, you can significantly increase your chances of making wise investment choices and achieving your financial goals. Blindly following trends or succumbing to emotional impulses is a risky move; informed, disciplined, and patient investing is the path to sustainable financial success. Therefore, before diving in, take a step back, analyze your situation, and make informed decisions that align with your individual circumstances and goals.