ARK Investment Management, spearheaded by Cathie Wood, has garnered significant attention in the investment world due to its focus on disruptive innovation. The ARK Innovation ETF (ARKK) is arguably its flagship fund, but ARK offers several other thematic ETFs, each targeting specific areas of technological advancement. One such fund, which you might be referring to as "ARK7" (though no ETF is officially named "ARK7," let's assume you're referring to one of the less prominent ARK ETFs or perhaps the broader ARK investment philosophy and its potential downsides), warrants careful consideration before investing. Evaluating its worth requires analyzing its strategy, historical performance, risk profile, and the current market environment.

The core appeal of ARK's investment approach lies in its high-conviction, long-term investment in companies involved in disruptive technologies. These technologies often include genomics, automation, robotics, energy storage, artificial intelligence, and blockchain technology. The potential upside is substantial if these companies successfully revolutionize their respective industries. ARK actively manages its funds, meaning its analysts and portfolio managers are constantly researching and adjusting the portfolio based on their evolving views on the market and the underlying companies. This active management is a key differentiator, as it allows ARK to respond to market changes and capitalize on emerging opportunities. However, it also introduces the risk of human error and the possibility that the fund managers' predictions might not materialize.

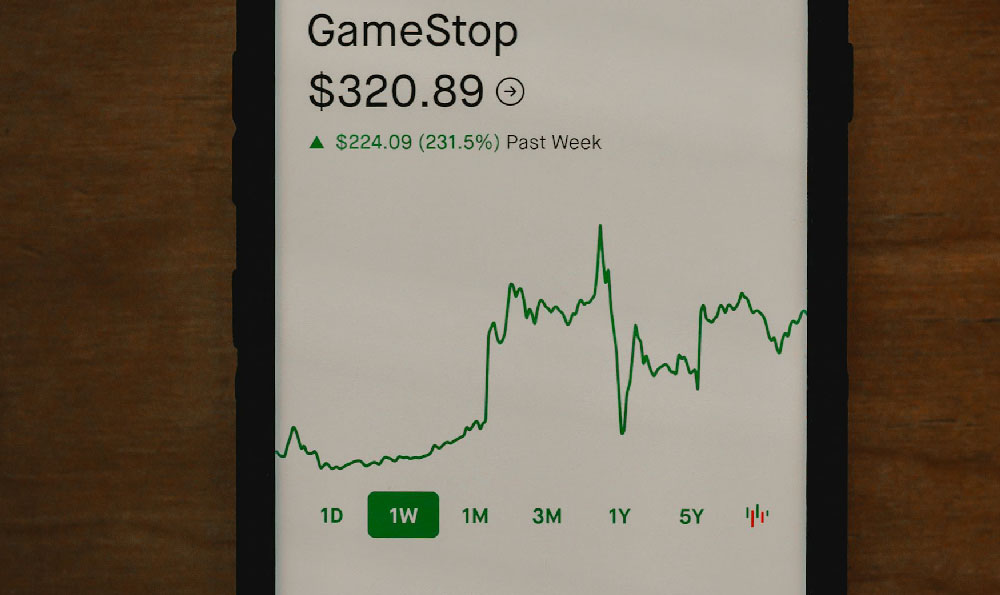

Analyzing historical performance is crucial. During the period of extremely low interest rates and rapid technological adoption, particularly in the early stages of the COVID-19 pandemic, ARK funds, especially ARKK, experienced explosive growth. This performance attracted a massive influx of capital, further fueling the upward momentum. However, past performance is not indicative of future results. As interest rates rose and the market shifted away from growth stocks and towards value stocks, ARK funds experienced significant drawdowns. Many of the companies in ARK's portfolio are growth-oriented, meaning they prioritize reinvesting profits into expansion rather than paying dividends. This makes them particularly sensitive to changes in interest rates, as higher rates reduce the present value of future earnings. A thorough analysis of the specific ETF's (assuming you're referring to one of the more specialized ARK funds) historical returns, volatility, and Sharpe ratio is essential to understanding its risk-adjusted performance. Comparing its performance to relevant benchmarks, such as a broad market index or a technology sector index, provides valuable context.

The risk profile associated with ARK's investment strategy is undeniably high. Disruptive innovation, by its very nature, involves significant uncertainty. Many of the companies ARK invests in are early-stage, unproven, and operate in highly competitive environments. Their success is not guaranteed, and there is a considerable risk of failure. Moreover, these companies often have high valuations, reflecting the market's expectations for future growth. If these expectations are not met, the stock prices can decline sharply. The concentrated nature of ARK's portfolios also amplifies the risk. These funds typically hold a relatively small number of stocks, meaning that the performance of a few key holdings can have a disproportionate impact on the overall fund performance. This concentration risk makes the funds more volatile and susceptible to market swings. Furthermore, the high trading volume within ARK's ETFs can contribute to price volatility. When investors rush to buy or sell ARK funds, it can create significant price fluctuations, which can be detrimental to long-term investors. Considering your own risk tolerance and time horizon is paramount. If you are a risk-averse investor or have a short time horizon, investing in ARK funds may not be suitable.

The current market environment plays a crucial role in evaluating the potential of ARK funds. As interest rates rise and inflation persists, the market's preference has shifted towards value stocks and companies with strong cash flows. This environment poses a challenge for growth-oriented companies, particularly those with high valuations. However, it is important to remember that innovation remains a powerful force in the long run. If you believe that disruptive technologies will continue to transform the economy and that ARK's fund managers possess the expertise to identify and invest in the winners, then investing in an ARK ETF may be worthwhile. However, it is crucial to approach this investment with a long-term perspective and a willingness to accept significant volatility. A diversified portfolio, incorporating both growth and value stocks, is generally a more prudent approach for most investors.

Before investing in any ARK fund, it's vital to conduct thorough due diligence. Carefully review the fund's prospectus, which provides detailed information about its investment strategy, holdings, risks, and expenses. Understand the specific technologies and industries the fund focuses on, and assess your own understanding of these areas. Consider the fund's expense ratio, which can impact your overall returns. Compare the expense ratio to similar ETFs and actively managed funds. Keep in mind the tax implications of investing in actively managed funds, which may generate more frequent capital gains distributions. Furthermore, actively follow ARK's research and commentary on the market and the companies it invests in. This will help you stay informed about the fund's strategy and its performance drivers. Ultimately, the decision of whether or not to invest in an ARK ETF should be based on your individual circumstances, risk tolerance, investment goals, and a thorough understanding of the fund's strategy and the associated risks. Consider consulting with a qualified financial advisor to discuss your investment options and develop a personalized financial plan. Avoid blindly following market trends or hype, and always prioritize a disciplined and informed investment approach. Remember that diversification is key to managing risk and achieving long-term financial success.