Embarking on the journey of establishing an investment company is a significant undertaking, one that demands careful consideration, meticulous planning, and a robust understanding of the financial landscape. It's not merely about possessing investment acumen; it's about building a sustainable business model, navigating complex regulations, and fostering trust with potential clients. Before diving in, a thorough self-assessment is crucial to determine if this path aligns with your strengths, resources, and aspirations.

The allure of creating your own investment firm often stems from a passion for finance and a desire to help others achieve their financial goals. However, passion alone isn't enough. A successful investment company requires a blend of technical expertise, entrepreneurial spirit, and strong ethical principles. Ask yourself: Do you possess a demonstrable track record of successful investing? Do you have a comprehensive understanding of various asset classes, market trends, and risk management strategies? Can you effectively communicate complex financial concepts to clients with varying levels of financial literacy? Furthermore, are you prepared to handle the administrative, legal, and compliance responsibilities that come with running a business?

Beyond personal skills and knowledge, consider the resources at your disposal. Starting an investment company requires capital, not just for initial investments, but also for operating expenses, marketing, compliance costs, and regulatory fees. Develop a detailed business plan that outlines your target market, competitive advantages, revenue projections, and funding strategy. Consider bootstrapping, seeking angel investors, or exploring venture capital options. Remember, attracting and retaining clients is paramount, and this often requires a significant investment in marketing and brand building.

One of the most critical aspects of establishing an investment company is understanding and adhering to the regulatory framework. Depending on the jurisdiction and the services you offer, you may need to register with regulatory bodies such as the Securities and Exchange Commission (SEC) in the United States or equivalent organizations in other countries. This registration process involves stringent requirements, including background checks, proof of financial solvency, and adherence to ethical standards. Compliance with regulations is not a one-time event; it's an ongoing process that requires constant monitoring and adaptation to changing laws. Non-compliance can lead to hefty fines, legal repercussions, and irreparable damage to your reputation.

Building a team is another essential step. While you may possess strong investment skills, you'll likely need support in areas such as client servicing, marketing, compliance, and operations. Carefully consider the skills and experience required for each role and hire individuals who share your values and commitment to excellence. Fostering a culture of collaboration, transparency, and continuous learning is crucial for attracting and retaining top talent.

Defining your target market is crucial for crafting a targeted marketing strategy. Are you focusing on high-net-worth individuals, small businesses, or specific industries? Understanding your target audience allows you to tailor your services, messaging, and marketing channels to effectively reach potential clients. Conduct thorough market research to identify the needs and preferences of your target market, and use this information to develop a compelling value proposition.

Developing a robust investment strategy is fundamental to attracting and retaining clients. This strategy should be based on a clear understanding of your clients' risk tolerance, time horizon, and financial goals. Offer a range of investment options to cater to diverse needs, and provide regular performance reports and transparent communication. Building trust and maintaining open communication are essential for fostering long-term client relationships.

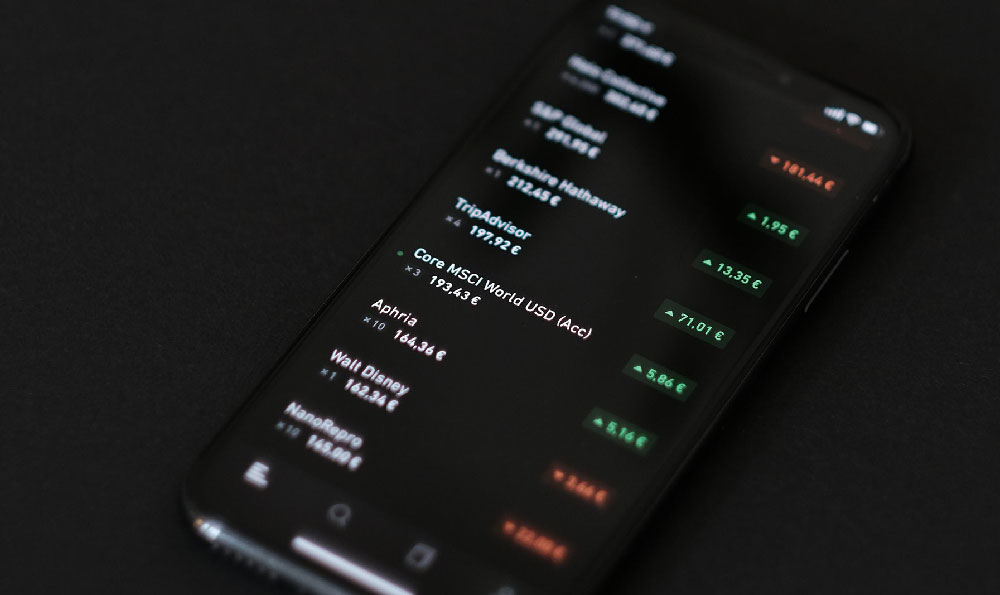

Technology plays a vital role in the modern investment landscape. Invest in robust portfolio management software, CRM systems, and communication tools to streamline your operations and enhance client service. Consider offering online account access and mobile apps to provide clients with convenient access to their investment information. Embracing technology can improve efficiency, reduce costs, and enhance the overall client experience.

Risk management is an integral part of any investment company. Implement robust risk management policies and procedures to protect your clients' assets and mitigate potential losses. This includes diversifying investments, setting stop-loss orders, and conducting regular risk assessments. Maintaining adequate insurance coverage is also essential to protect your business from unforeseen liabilities.

Finally, remember that building a successful investment company is a marathon, not a sprint. It requires patience, perseverance, and a willingness to adapt to changing market conditions. Continuously educate yourself on the latest investment trends and best practices, and seek guidance from experienced mentors and advisors. By combining financial expertise with sound business principles and a unwavering commitment to client success, you can increase your chances of building a thriving and reputable investment firm. Be prepared for challenges and setbacks, and learn from your mistakes. The road to success may be long and arduous, but the rewards of building a successful investment company can be significant, both financially and personally.