KKR, or Kohlberg Kravis Roberts & Co., is a global investment firm renowned for its expertise in private equity, credit, and real estate investments, among other alternative asset classes. Understanding KKR's operations and how individual investors can potentially benefit from its strategies requires a nuanced approach, as direct investment in KKR's private equity funds is typically reserved for institutional investors and high-net-worth individuals. However, indirect exposure is possible and can be a valuable component of a diversified investment portfolio.

At its core, KKR specializes in acquiring, restructuring, and improving existing businesses. The firm identifies companies with strong potential but underperforming assets or management teams. Through a combination of financial engineering, operational improvements, and strategic guidance, KKR aims to unlock the inherent value within these businesses, ultimately selling them at a profit. This process, known as leveraged buyout (LBO), involves using a significant amount of debt to finance the acquisition, thereby amplifying returns on equity if the turnaround is successful. While LBOs are a significant part of KKR's history and continue to be relevant, the firm has broadened its scope considerably, investing in growth equity, infrastructure, real estate, and credit opportunities across various sectors and geographies. This diversification allows KKR to navigate different market cycles and capitalize on evolving economic trends.

The appeal of KKR's investment strategy lies in its potential for generating higher returns than traditional asset classes like stocks and bonds. Private equity, in particular, offers the opportunity to access companies that are not publicly traded, providing exposure to sectors and industries often unavailable to retail investors. KKR's active management approach, where it directly intervenes in the operations of its portfolio companies, can lead to significant improvements in efficiency, profitability, and market share. The firm's extensive network of industry experts and operational specialists further enhances its ability to identify and execute successful turnaround strategies.

However, it's crucial to acknowledge the inherent risks associated with private equity and alternative investments. Illiquidity is a primary concern. Unlike publicly traded stocks, private equity investments are not easily bought or sold. Funds typically have a long-term investment horizon, often spanning 10 years or more, meaning investors must be prepared to tie up their capital for an extended period. The valuation of private equity investments can also be complex and subjective, making it difficult to assess performance accurately. Furthermore, the use of leverage in LBOs can amplify losses if the acquired company fails to perform as expected. Economic downturns and unforeseen events can also negatively impact the value of private equity investments.

So, how can an individual investor gain exposure to KKR's investment prowess? Direct investment in KKR's private equity funds is typically out of reach for most retail investors, given the high minimum investment requirements and accredited investor status required. These funds are generally structured as limited partnerships, requiring investors to commit large sums of capital over several years. However, several avenues exist for indirect exposure:

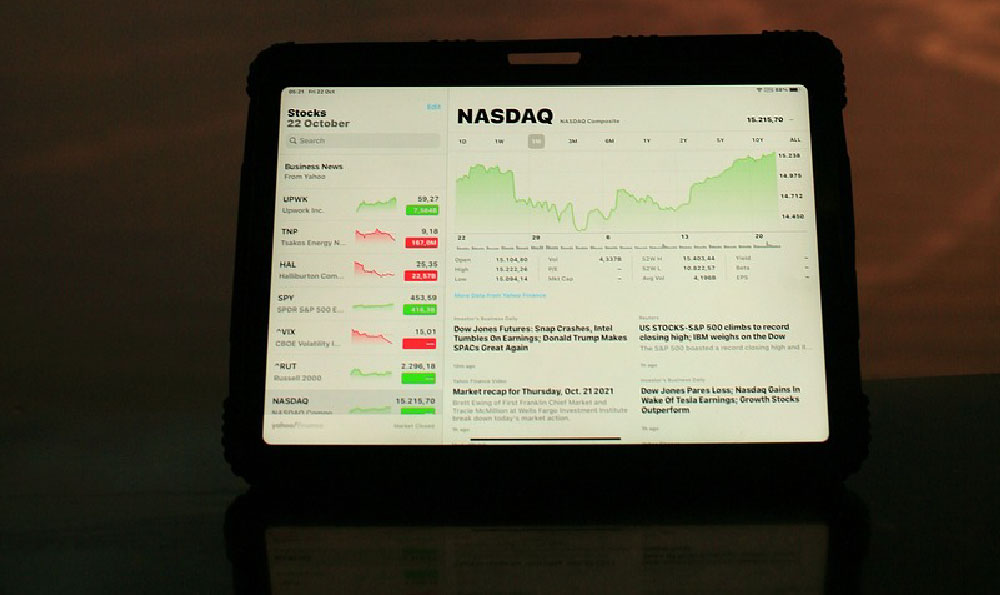

One primary route is through publicly traded investment vehicles that hold positions in KKR or similar private equity firms. KKR itself is a publicly traded company (KKR & Co. Inc., listed on the NYSE). Investing in KKR's stock provides indirect exposure to the firm's overall performance, including its management fees, carried interest (a share of the profits generated by its funds), and the appreciation of its portfolio companies. However, it's important to recognize that KKR's stock price will be influenced by factors beyond the performance of its individual investments, such as market sentiment, investor confidence in the private equity industry, and broader economic conditions.

Another possibility is through Business Development Companies (BDCs). BDCs are publicly traded companies that invest in small and medium-sized businesses, often providing debt or equity financing. Some BDCs may have relationships with KKR or other private equity firms, co-investing in deals or utilizing their expertise. However, BDCs can be complex and require careful due diligence, as their investment strategies and risk profiles can vary significantly. Investors should thoroughly research the BDC's management team, portfolio composition, and fee structure before investing.

Closed-end funds and exchange-traded funds (ETFs) may also offer exposure to private equity, although this exposure is often indirect or diluted. Some funds may invest in publicly traded companies that are involved in private equity activities or hold a small allocation to private equity funds. Investors should carefully examine the fund's prospectus to understand its investment strategy and the extent of its exposure to private equity.

Finally, high-net-worth individuals may have access to private wealth management platforms that offer curated investment opportunities, including access to private equity funds managed by KKR or other leading firms. These platforms typically provide personalized investment advice and due diligence support, helping investors navigate the complexities of private equity investing.

Before considering any investment in KKR or related vehicles, it's essential to conduct thorough due diligence and consult with a qualified financial advisor. Understanding your own risk tolerance, investment goals, and time horizon is crucial. Private equity investments are not suitable for all investors and should only be considered as part of a well-diversified portfolio. Evaluate the investment's fee structure, liquidity constraints, and potential tax implications. A financial advisor can help you assess whether private equity is an appropriate addition to your portfolio and guide you through the process of selecting the right investment vehicle. The key is to approach KKR investment with a realistic understanding of the opportunities and risks involved, making informed decisions that align with your overall financial plan.