Lawrence Stroll, a name synonymous with high-end fashion, motorsports, and astute business acumen, built his considerable fortune through a combination of strategic investments, brand building, and a keen eye for identifying undervalued assets. His journey is a testament to entrepreneurial spirit and a calculated approach to risk-taking.

Stroll's initial foray into the business world was deeply intertwined with the apparel industry. His father, Leo Strulovitch (later Stroll), owned a garment manufacturing business, providing Lawrence with early exposure to the inner workings of the fashion world. However, instead of merely inheriting a legacy, Stroll displayed his own entrepreneurial drive by focusing on licensing and brand development, a significantly more lucrative and scalable path than simply manufacturing.

One of Stroll's earliest and most successful ventures was securing the licensing rights for Pierre Cardin children's wear in Canada. This proved to be a highly profitable venture, laying the foundation for his future success. He then went on to play a pivotal role in bringing the Ralph Lauren and Tommy Hilfiger brands to Canada. By understanding the power of brand recognition and leveraging licensing agreements, Stroll demonstrated a remarkable ability to tap into existing market demand and establish successful retail operations.

His ambition extended beyond Canadian borders. Along with Silas Chou, Stroll recognized the global potential of Tommy Hilfiger, an American designer brand that was rapidly gaining popularity. In the late 1980s, they acquired a significant stake in Tommy Hilfiger Corporation, providing the capital and strategic guidance necessary to fuel its international expansion. Stroll and Chou’s expertise in manufacturing and distribution, combined with Hilfiger’s design talent and marketing prowess, transformed the brand into a global fashion powerhouse. Their ownership stake proved exceptionally profitable when Tommy Hilfiger Corporation went public in 1992, and they continued to profit handsomely as the brand continued to thrive. This success cemented Stroll’s reputation as a savvy investor and a force to be reckoned with in the fashion industry.

Following the success with Tommy Hilfiger, Stroll and Chou turned their attention to another iconic brand: Michael Kors. Recognizing the brand's potential for growth and expansion, they invested heavily in Michael Kors Holdings in 2003. Their investment coincided with a strategic shift in the company's focus, emphasizing luxury accessories and a broader retail presence. Under their guidance, Michael Kors experienced a remarkable period of growth, becoming one of the most recognizable and sought-after brands in the fashion world. The brand's successful IPO in 2011 generated significant returns for Stroll and Chou, further solidifying their reputation as astute investors capable of identifying and nurturing promising fashion brands. He eventually divested his holdings in Michael Kors, realizing substantial profits.

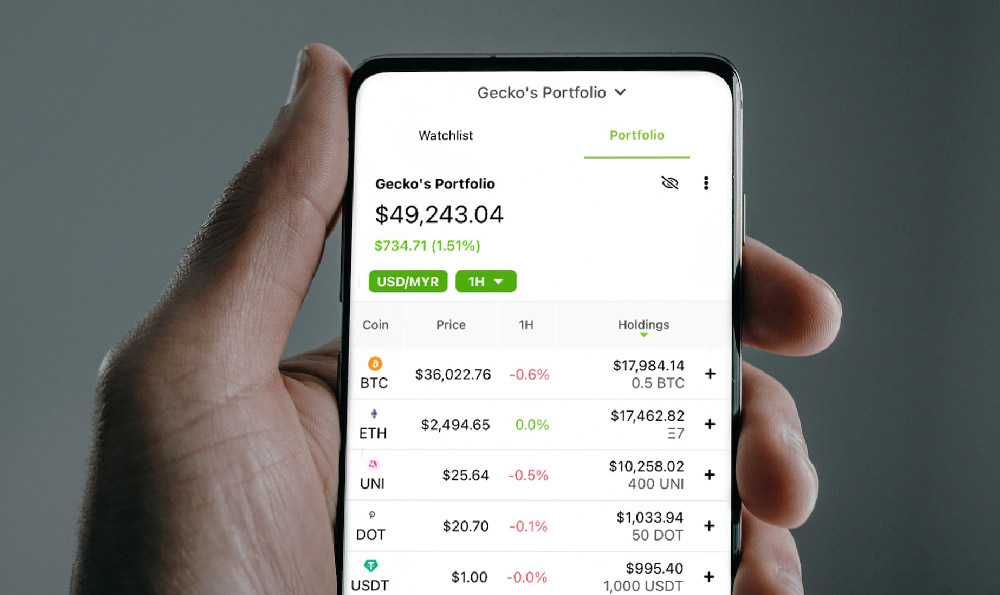

Beyond the fashion world, Stroll's business ventures have extended into other sectors, including real estate and luxury goods. He has invested in high-end properties and luxury lifestyle brands, demonstrating a continued interest in markets catering to affluent consumers. His strategic investments in these areas further diversify his portfolio and demonstrate his understanding of market trends and consumer behavior.

In recent years, Stroll's passion for motorsports has led him to make significant investments in Formula One. He initially backed his son, Lance Stroll's, racing career, supporting his ascent through the junior ranks. He then led a consortium to acquire the Force India Formula One team in 2018, rescuing it from administration and rebranding it as Racing Point. This move not only secured his son's future in Formula One but also marked Stroll's entry into the world of team ownership.

More recently, Stroll spearheaded a strategic investment in Aston Martin, the iconic British luxury car manufacturer. In 2020, he led a consortium that acquired a significant stake in the company, becoming its executive chairman. This investment not only provided Aston Martin with much-needed capital but also paved the way for the company's return to Formula One as a works team, rebranding the Racing Point team as Aston Martin F1. Stroll's vision for Aston Martin is to transform it into a leading global luxury brand, leveraging its heritage and iconic status to attract a new generation of customers. His commitment to innovation and performance is evident in the team's ongoing development and investment in cutting-edge technology.

Lawrence Stroll's success is not simply a matter of luck. It is the result of a combination of factors, including a keen eye for identifying undervalued assets, a strategic approach to brand building, a willingness to take calculated risks, and a deep understanding of consumer behavior. He has consistently demonstrated an ability to spot potential in emerging brands and to transform them into global powerhouses. His ventures in both fashion and motorsports demonstrate his entrepreneurial spirit and his passion for high-performance and luxury goods. His story is a testament to the power of strategic investment and the importance of building strong brands. His journey serves as an inspiration for aspiring entrepreneurs and investors alike, demonstrating that with vision, determination, and a keen understanding of market dynamics, it is possible to achieve significant success in the business world. He continues to shape the landscape of the fashion and automotive industries, leaving an indelible mark on the global economy.