In the ever-evolving digital landscape, the pursuit of financial independence has become increasingly accessible for those seeking to generate income from the comfort of their homes. As we navigate through 2023, a plethora of opportunities have emerged, each offering distinct advantages and challenges. From the dynamic world of virtual currency to the versatility of remote work, understanding the nuances of these avenues is essential for crafting a sustainable strategy. With the rise of online platforms and the decentralization of financial systems, individuals now have more tools than ever to explore diverse income streams, but the key lies in knowledge, patience, and a well-balanced approach to risk management.

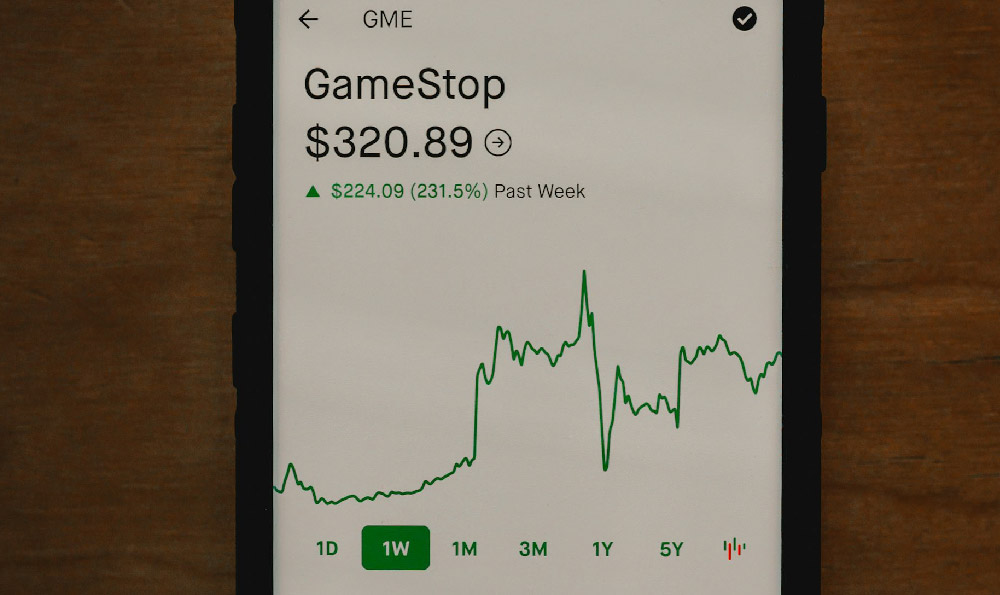

Virtual currency investments have emerged as one of the most intriguing options for those looking to capitalize on the digital economy's growth. The widespread adoption of cryptocurrency by major financial institutions and companies has solidified its role as a legitimate asset class. However, the market remains volatile, requiring investors to stay informed about macroeconomic trends, regulatory developments, and technological advancements. One of the most promising areas within virtual currency is the integration of blockchain technology into traditional finance, creating hybrid models that merge the benefits of decentralization with institutional security. Staking, for instance, offers an opportunity to earn passive income by supporting the infrastructure of blockchain networks, while decentralized finance (DeFi) platforms enable users to access lending, borrowing, and trading services without intermediaries. To succeed in this space, it is crucial to analyze market cycles, track price movements using technical indicators such as moving average convergence divergence (MACD), relative strength index (RSI), and stochastic oscillators, and understand the fundamental drivers behind market fluctuations, including supply and demand dynamics, macroeconomic policies, and technological innovations.

The rise of remote work, driven by advancements in digital communication and the global shift toward flexible work arrangements, has opened new pathways for income generation. Freelancing platforms such as Upwork and Fiverr have made it possible for individuals to offer services in fields ranging from graphic design to software development, reaching a global audience without the need for physical presence. Additionally, the growing demand for online education has created opportunities for content creators, tutors, and professionals to monetize their expertise through platforms like Udemy, YouTube, or Patreon. However, the success of these ventures depends on building a strong online presence, developing specialized skills, and maintaining consistent effort. For those new to remote work, starting with part-time projects or microtasks can serve as an effective way to gain experience while testing the waters. It is also important to consider the financial implications, such as setting aside savings for unexpected market changes or investing in tools that enhance productivity.

Online real estate investment has gained traction as a viable alternative for those looking to diversify their portfolios. Platforms like Airbnb and Zillow have made it easier to rent out properties or invest in fractional ownership models, allowing individuals to generate passive income from real estate without the burden of physical management. However, this approach requires careful consideration of market demand, location value, and property maintenance. For instance, investing in short-term rental properties in high-demand areas can yield substantial returns, but it is essential to conduct thorough market research, analyze property performance data, and understand the legal frameworks governing online real estate transactions. Additionally, the rise of non-fungible tokens (NFTs) has introduced new opportunities for digital collectibles and virtual land ownership, though these markets carry unique risks and require a deep understanding of intellectual property laws and digital asset valuation.

Financial literacy and diversification are critical components of any successful income strategy. The importance of educating oneself about different investment vehicles cannot be overstated, as it enables informed decision-making and the identification of potential opportunities. For example, understanding the fundamentals of stock investing, index funds, and dividend-paying stocks can help individuals build a diversified portfolio that mitigates risk and maximizes returns. Additionally, the emergence of robo-advisors and automated investment platforms has made it easier to manage financial portfolios with minimal effort, providing a structured approach to long-term wealth growth. However, it is crucial to recognize that while automation can enhance efficiency, it should not replace human oversight, especially in volatile markets where rapid adjustments may be necessary.

In navigating the complexities of online income generation, it is essential to stay informed and avoid common pitfalls. The rise of online scams and fraudulent schemes has made it necessary for individuals to conduct due diligence before committing to any investment opportunity. This includes verifying the credibility of platforms, understanding the risks associated with leveraged trading, and ensuring that digital assets are stored securely using cold wallets or hardware security modules (HSMs). Additionally, the importance of setting financial goals and maintaining a long-term perspective cannot be ignored, as many online opportunities require patience and a strategic approach. For instance, the growth of crypto markets is often cyclical, with periods of rapid appreciation followed by market corrections, necessitating a disciplined approach to buying and selling.

In conclusion, the digital economy has created a multitude of opportunities for generating income from home, but success requires a combination of knowledge, caution, and strategic planning. Whether it is through virtual currency investing, remote work, or online real estate, individuals must stay informed about market trends, leverage appropriate tools, and prioritize risk management. By adopting a diversified approach, continuously educating oneself, and maintaining discipline in decision-making, it is possible to navigate the challenges of the online income landscape and achieve financial growth. However, it is also important to recognize that no strategy is foolproof, and the key to long-term success lies in adaptability, persistence, and a commitment to learning.