Investing in cryptocurrencies presents a unique opportunity for financial growth, yet it requires a blend of strategic thinking, technical knowledge, and disciplined risk management. As the digital asset market continues to evolve, understanding both its potential and pitfalls is essential. Whether you're a seasoned trader or a newcomer to the field, navigating this landscape demands more than luck—it requires informed decisions and a long-term perspective. Here's a detailed exploration of actionable strategies to capitalize on cryptocurrency investments while safeguarding your capital against the volatile nature of this emerging market.

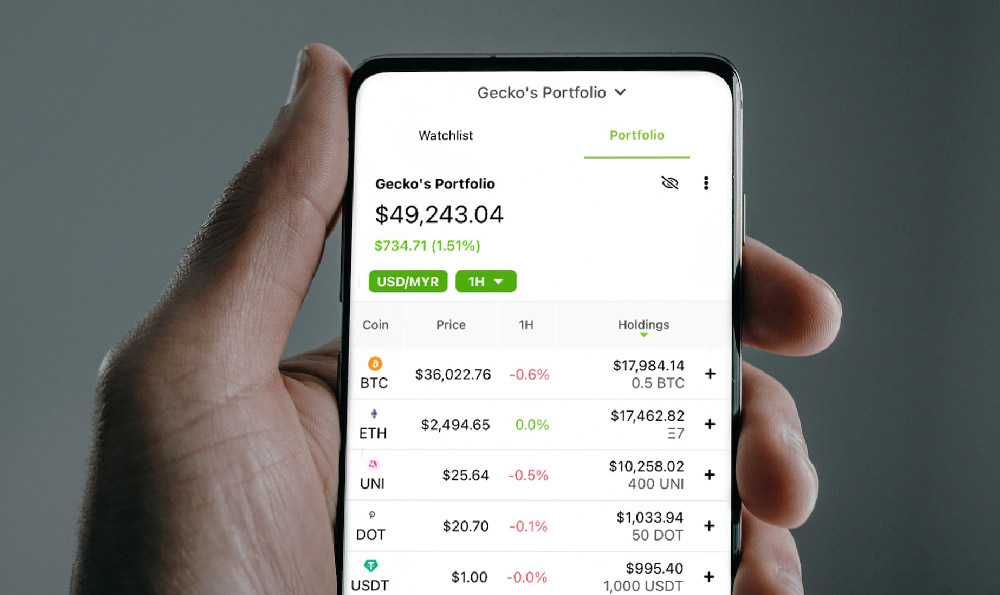

Diversification is a cornerstone of successful crypto investing, yet it's often overlooked in favor of chasing high-profile projects. While it's tempting to focus on Bitcoin or Ethereum due to their market dominance, a well-rounded portfolio should include a mix of established cryptocurrencies and emerging projects. This approach not only spreads risk but also allows investors to take advantage of different sectors within the blockchain ecosystem. For instance, incorporating stablecoins like USDT or USDC provides a hedge against price fluctuations, while allocating a portion to promising altcoins such as Solana or Cardano can yield significant returns if those projects gain traction. The key lies in balancing exposure across market capitalizations, technologies, and use cases to create a resilient wealth strategy.

Beyond diversification, mastering the art of timing is critical. While some investors believe in "buying the dip," the reality is that market timing in crypto is both an art and a science. Monitoring macroeconomic trends, such as interest rates and inflation, can provide insights into the broader financial environment. Additionally, analyzing technical indicators such as moving averages, RSI (Relative Strength Index), and Bollinger Bands helps identify potential entry and exit points. The 200-day moving average, for example, often serves as a benchmark for long-term trends, while the RSI can signal overbought or oversold conditions. Combining fundamental analysis with technical tools enables investors to make data-driven decisions rather than reacting impulsively to market noise.

Leveraging blockchain fundamentals is another vital step. The underlying technology of cryptocurrencies continues to mature, and understanding a project's use case, team, and development roadmap can reveal its long-term viability. For example, Bitcoin's decentralized ledger and limited supply make it a digital store of value, while Ethereum's smart contract capabilities position it as a platform for innovation. Investors should prioritize projects with real-world applications, transparent governance, and active development. The rise of decentralized finance (DeFi) and non-fungible tokens (NFTs) illustrates how innovative use cases can drive adoption and value, even in a market prone to speculation. However, not all projects are created equal, and due diligence is necessary to avoid investing in scams or poorly executed ventures.

Risk management is not optional—it's non-negotiable. The cryptocurrency market is notorious for its volatility, with prices capable of swinging drastically in short periods. Setting clear stop-loss orders and taking profits at predetermined levels can help mitigate potential losses. For instance, with a stop-loss at a 10% drawdown and a take-profit target at a 20% gain, investors can protect their capital while securing returns. Additionally, avoiding overexposure to any single asset or market is crucial. Allocating no more than 5-10% of your total portfolio to high-risk assets ensures that a single misstep doesn't erode your overall gains. Regularly reviewing and rebalancing your portfolio can also adapt to changing market conditions, maintaining a strategic edge.

A critical strategy involves staying abreast of regulatory developments. Governments worldwide are increasingly scrutinizing cryptocurrencies, with some imposing restrictions and others embracing them as part of the financial infrastructure. Staying informed about regulatory changes can prevent unexpected risks, such as a sudden ban on exchanges or a crackdown on initial coin offerings (ICOs). For example, the SEC's actions in the United States have had a profound impact on the crypto market, influencing investor confidence and project viability. Investors must navigate this landscape carefully, ensuring compliance with local laws and avoiding projects that may be vulnerable to regulatory action.

Long-term holding, or "HODLing," as a strategy has gained popularity for its potential to weather short-term fluctuations. However, the decision to HODL should not be based solely on optimism. Assessing a cryptocurrency's adoption rate, network growth, and technological advancements can indicate its long-term potential. Bitcoin's network has grown significantly over the years, with increased institutional adoption and infrastructure improvements, which have driven its value despite market volatility. Similarly, the adoption of Ethereum's Layer 2 solutions has enhanced scalability, making it more viable for mainstream use. By focusing on projects with sustainable growth and meaningful impact, investors can position themselves for long-term success.

Finally, avoiding common pitfalls is essential. The allure of quick profits often tempts investors to engage in high-risk activities such as day trading, speculative investments in meme coins, or engaging with unverified projects. However, these approaches can lead to significant losses, especially without proper knowledge. For example, the collapse of TerraUSD in 2022 highlighted the dangers of algorithmic stablecoins, which can fail under market stress due to poor design or coordination attacks. Educated investors avoid such risks by focusing on well-established projects, emphasizing security, and maintaining a rational approach grounded in thorough research and analysis.

In a market that thrives on innovation and disruption, the most successful investors are those who balance ambition with caution. By diversifying their holdings, analyzing technical and fundamental factors, managing risks effectively, and staying informed about regulatory and market trends, investors can navigate the complexities of cryptocurrency with confidence. Each decision made in this space should align with a long-term vision of financial growth, ensuring that the journey through this volatile but promising market is both sustainable and rewarding.