In the bustling world of financial markets, the allure of effortless wealth often captivates individuals seeking swift financial gains. Rapid money-making schemes, while enticing, are frequently shrouded in complexities that demand careful scrutiny. The truth, however, is that generating substantial returns in a short period is rarely as straightforward as it appears. This phenomenon is largely attributed to the inherent unpredictability of markets and the myriad of risks that accompany higher potential rewards. For those genuinely interested in exploring avenues for rapid financial growth, a nuanced understanding of various strategies, their limitations, and the broader context of financial health is essential.

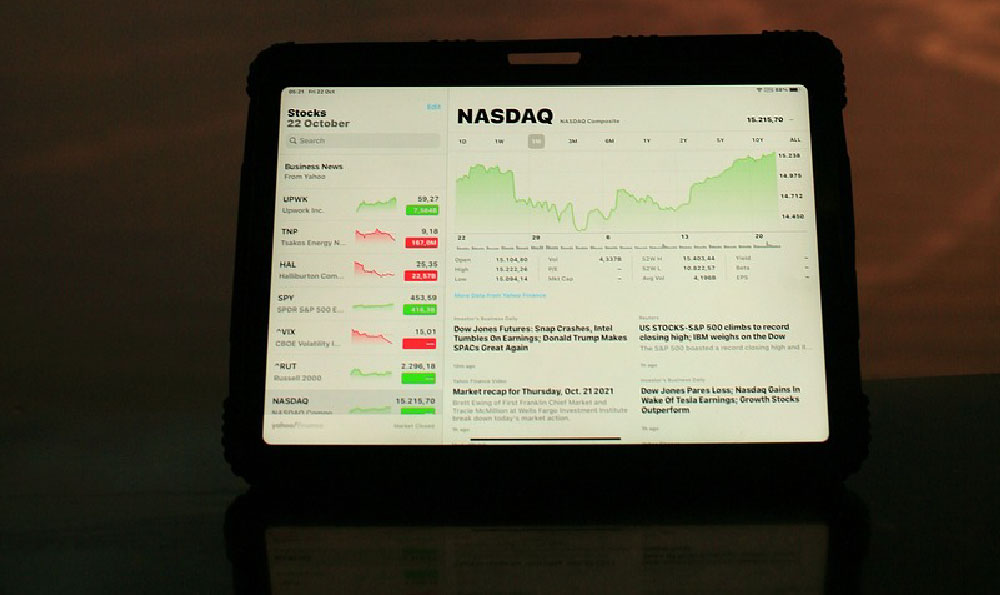

Consider the realm of high-risk investments, where quick profits may be achievable through the volatility of markets. Trading in stocks or cryptocurrencies, for instance, requires not only real-time analysis of trends but also a strategic approach to risk management. While the markets can present opportunities for capital appreciation, they are equally prone to sharp downturns. For example, the cryptocurrency market, known for its rapid fluctuations, can yield vast gains overnight but also wipe out significant wealth in an instant. Investors in such spaces must be prepared to allocate time and resources toward continuous education, as understanding market dynamics and technical indicators is crucial to making informed decisions. Additionally, leveraging tools like margin trading or leverage can amplify returns but also intensify losses, creating a precarious balance that demands vigilance.

Another pathway to quick money lies in exploiting technological advancements, such as online platforms that facilitate passive income generation. Freelancing or creating digital products can be rewarding, yet sustainability often hinges on niche expertise and consistent effort. For example, selling digital courses or affiliate marketing products may offer initial revenue streams, but these require a substantial investment in time to build credibility and attract a customer base. Similarly, investing in affiliate marketing or online rentals can be viable, but their success is contingent on market demand, competition, and the ability to maintain a steady income stream. It is important to note that such ventures rarely yield immediate results and often necessitate a long-term commitment, which contradicts the notion of quick financial growth.

The concept of quick money is also closely tied to the idea of identifying time-sensitive opportunities, such as market gaps or undervalued assets. However, these opportunities are often fleeting and require acute market intuition. For example, short-term trading in commodities or forex markets may offer rapid returns, but these markets are notoriously unpredictable and highly influenced by global events. A brief window of opportunity might arise due to political instability or economic shifts, yet accurately predicting and capitalizing on these events without incurring significant losses is a formidable challenge. In such cases, the risk of overexposure to volatile assets becomes evident, underscoring the need for a diversified portfolio to mitigate potential downturns.

Moreover, the pursuit of quick money frequently leads individuals to overlook the importance of financial literacy and discipline. Many investors are attracted to the idea of trading or investing without a solid understanding of underlying principles, which can result in poor decision-making. For instance, the rise of algorithmic trading has enabled individuals to automate strategies, but without a deep grasp of market mechanics and risk control measures, these systems can lead to catastrophic losses. The key to navigating this terrain lies in balancing opportunity with knowledge, ensuring that individuals are prepared to weather market downturns and adapt their strategies accordingly.

In conclusion, the quest for quick financial gains is a multifaceted endeavor that requires careful consideration of risk, opportunity, and personal financial goals. While various strategies exist, their effectiveness is often limited by market conditions, personal expertise, and the need for sustained effort. The most prudent approach is to adopt a holistic perspective that integrates financial literacy with disciplined investment practices, recognizing that lasting wealth is typically the product of patience, education, and strategic planning. By prioritizing these elements, individuals can navigate the complexities of the financial world with greater confidence and clarity, ultimately working toward their long-term financial aspirations.