Investing in Bitcoin can be a lucrative opportunity for those who approach it with a clear understanding of the market, disciplined strategies, and a focus on long-term goals. However, the volatile nature of cryptocurrency makes it essential to separate hype from substance and differentiate between short-term speculation and sustainable value creation. As a seasoned investor in this space, I emphasize that success in Bitcoin trading hinges not on luck but on meticulous preparation, continuous learning, and strategic patience. Let’s explore a comprehensive framework that equips beginners with the tools to navigate this complex landscape while safeguarding their capital.

Understanding the Fundamentals of Bitcoin

Before diving into strategies, it is crucial to grasp the basics of Bitcoin as both a technology and an asset. Bitcoin is a decentralized digital currency built on blockchain technology, which operates without a central authority or intermediaries. Its value is driven by factors such as adoption rates, scarcity (limited supply of 21 million coins), network security, and macroeconomic trends. For beginners, allocating time to study whitepapers, understand the underlying technology, and track real-world applications—such as Bitcoin’s use in cross-border payments or institutional custody—provides a deeper perspective. This foundational knowledge helps in distinguishing between legitimate opportunities and speculative bubbles, ensuring decisions are based on broader context rather than fleeting market noise.

Selecting the Right Investment Approach

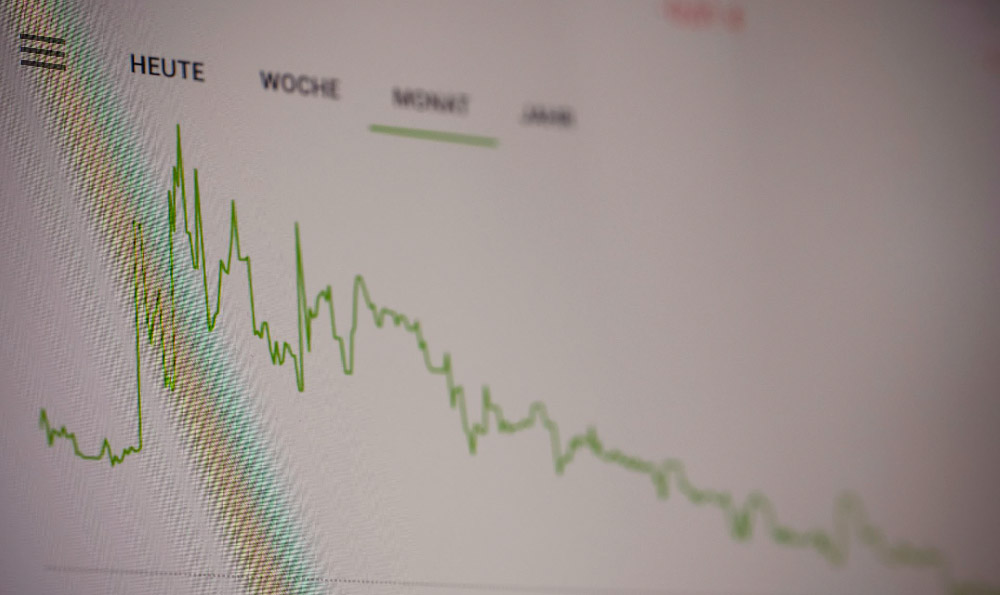

Bitcoin’s price fluctuations often create confusion for novice investors. The key lies in aligning your approach with your financial objectives and risk tolerance. Long-term investors might adopt a "buy and hold" strategy, capitalizing on Bitcoin’s historical trend of increasing value despite short-term volatility. Conversely, day traders may focus on technical indicators, such as moving averages, RSI (Relative Strength Index), and Fibonacci retracements, to identify short-term entry and exit points. However, it is vital to recognize that technical analysis alone is insufficient; successful strategies integrate fundamental insights, market sentiment, and macroeconomic factors. For example, assessing Bitcoin’s price relative to other major cryptocurrencies or its performance against fiat currencies can provide critical signals for timing entries.

Establishing a Risk Management Framework

A significant portion of Bitcoin’s appeal lies in its potential for high returns, but this also amplifies the risk of substantial losses. Beginners should prioritize building a robust risk management framework before engaging in any trades. Setting a clear stop-loss level, such as a 10% or 15% decline from a purchase price, ensures that losses are limited and capital is preserved during downturns. Diversification is another critical component—rather than investing all funds into Bitcoin, allocate capital to a mix of other cryptocurrencies, stablecoins, or traditional assets to mitigate exposure. Furthermore, adhering to a strict allocation rule, such as investing only a small percentage of your total portfolio into Bitcoin, prevents over-leveraging and safeguards against market crashes.

Analyzing Market Trends and News Cycles

Bitcoin’s price movements are heavily influenced by news cycles and macroeconomic events. For instance, regulatory announcements, technological upgrades, and macroeconomic factors like inflation or interest rates can sway its value significantly. Beginners should develop a habit of monitoring news sources, social media sentiment, and market analysis platforms to stay ahead of these trends. However, it is equally important to filter through noise and focus on high-impact events. A structured approach could involve identifying key themes—such as Central Bank Digital Currencies (CBDCs) or geopolitical stability—and assessing how they might affect Bitcoin’s future trajectory. Many investors also use tools like technical charts and on-chain analytics to visualize market patterns and detect anomalies, providing a more data-driven decision-making process.

Choosing a Secure Investment Platform

The selection of a reliable and secure platform is a pivotal step in Bitcoin investing. Whether you’re buying, trading, or storing Bitcoin, the platform’s security measures, fees, and user experience can significantly impact your returns. Beginners should prioritize platforms with robust security protocols, such as cold storage options, two-factor authentication, and third-party audits. Additionally, comparing transaction fees, withdrawal limits, and integration with other financial tools can help in selecting a platform that aligns with your investment style. It is also crucial to consider the platform’s regulatory compliance, as some exchanges operate in jurisdictions with lenient rules, exposing users to potential legal or financial risks.

Implementing a Step-by-Step Investment Plan

A structured plan ensures that investments are made systematically rather than impulsively. The process begins with defining your investment goals—whether it’s capital appreciation, income generation, or diversification. Next, allocate funds based on your risk appetite and available capital, ensuring that no single investment compromises your financial stability. Then, select the right time to enter the market by analyzing technical and fundamental indicators. For instance, a beginner might wait for a price consolidation period following a major bullish phase, which often signals a potential reversal. After making a purchase, it is essential to monitor your position regularly, adjusting strategies as market conditions evolve.

Avoiding Common Pitfalls in Bitcoin Investment

The path to profitability in Bitcoin is fraught with potential traps, including market timing errors, emotional decision-making, and risky behavior. One of the most common mistakes is chasing prices, where investors buy during rapid上涨 without a clear rationale. This often leads to significant losses when the market corrects. To prevent this, beginners should focus on strategic timing, such as buying during dips or consolidations, and avoid speculative trading. Emotional biases, such as fear of missing out (FOMO) or panic selling, can also derail even the most well-planned strategies. Developing a mindset of discipline and patience, such as adhering to pre-defined rules, can counteract these impulses. Additionally, educating oneself about market risks—such as forks, rug pulls, and security breaches—helps in identifying and avoiding fraudulent projects.

The Power of Long-Term Vision in Bitcoin Investing

While short-term gains are tempting, the most sustainable returns in Bitcoin come from long-term vision. Historical data shows that Bitcoin’s price has steadily increased over multi-year cycles, driven by its adoption and technological advancements. For example, the 2021 bull run saw Bitcoin surge from around $20,000 to nearly $60,000, while the 2023 market dip presented an opportunity for long-term investors to buy at a discount. A beginner with a long-term horizon might focus on accumulating Bitcoin over time through dollar-cost averaging, which spreads risk across different price levels. This approach not only reduces the impact of short-term volatility but also aligns investments with the broader narrative of Bitcoin’s evolution as a digital asset.

Staying Informed and Adapting Strategies

The success of any investment strategy depends on its adaptability. Bitcoin’s market is dynamic, influenced by regulatory changes, technological innovations, and global economic conditions. For instance, the launch of Bitcoin ETFs or increased institutional participation could signal a new phase of growth. Beginners should stay informed by following reputable sources, such as financial news outlets, blockchain analytics platforms, and experienced investors. However, it is also important to avoid information overload and focus on actionable insights. Adapting strategies based on changing market dynamics could mean shifting from short-term trading to long-term holding or reassessing risk management rules as volatility patterns evolve.

In conclusion, making money with Bitcoin requires a combination of knowledge, strategy, and discipline. By understanding the fundamentals, selecting a secure platform, analyzing market trends, and implementing a structured investment plan, beginners can navigate the complexities of this market with confidence. The key to sustained success lies in balancing opportunity with caution, avoiding emotional traps, and maintaining a long-term vision. Whether you’re a passive holder or an active trader, adapting to the ever-changing landscape of Bitcoin is essential. This approach not only enhances the likelihood of profitability but also ensures that investments are made with responsibility and foresight.