Okay, here's an article addressing the question of how to make money work for you, focusing on cryptocurrency investment strategies.

Making your money work for you is the cornerstone of building wealth and achieving financial freedom. It's about transforming savings into income-generating assets that grow over time, ultimately freeing you from the necessity of solely relying on active income. In today's complex financial landscape, cryptocurrencies present a unique and potentially lucrative avenue for achieving this, but it demands a measured and informed approach. The allure of high returns needs to be balanced with a deep understanding of the associated risks.

The first crucial step is understanding the fundamental principles of investing. Diversification is key. Don't put all your eggs in one basket, especially within the volatile crypto market. Spread your investments across different asset classes, including stocks, bonds, real estate, and, yes, a portion allocated to cryptocurrencies. The percentage of your portfolio dedicated to crypto should align with your risk tolerance and investment timeline. Younger investors with longer time horizons may be able to allocate a larger percentage, while those closer to retirement may prefer a more conservative approach.

Within the cryptocurrency realm itself, diversification remains vital. Consider investing in a basket of different cryptocurrencies, rather than solely focusing on Bitcoin or Ethereum. While these established cryptocurrencies are often seen as safer bets, smaller-cap altcoins offer the potential for higher growth, albeit with significantly higher risk. Researching the underlying technology, the team behind the project, and the market capitalization of each cryptocurrency is paramount. Look for projects that are solving real-world problems, have a strong community, and demonstrate clear roadmap for future development. Red flags include unrealistic promises, lack of transparency, and a reliance on hype rather than substance.

Beyond simply buying and holding (hodling), several strategies can be employed to make your crypto work harder. Staking, for example, involves holding certain cryptocurrencies in a wallet to support the network's operations, and in return, earning rewards in the form of additional coins. This is similar to earning interest on a savings account, but typically offers higher returns. However, staking often involves locking up your coins for a specific period, making them inaccessible for trading. Careful consideration of the staking terms and the underlying cryptocurrency's price stability is crucial.

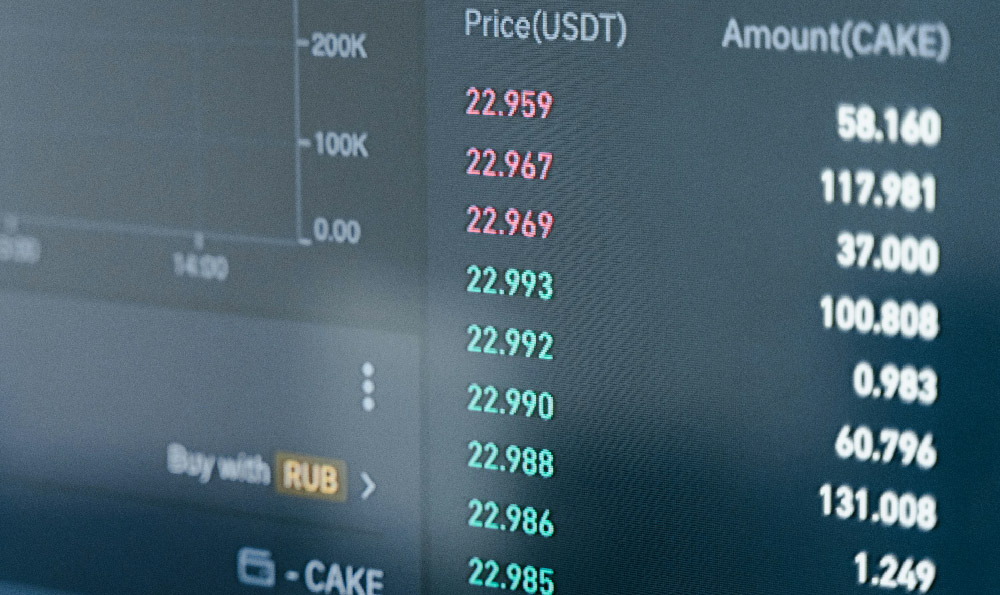

Another avenue is yield farming, which involves providing liquidity to decentralized finance (DeFi) platforms. By depositing your cryptocurrencies into liquidity pools, you earn a portion of the transaction fees generated by the platform. Yield farming can be highly lucrative, but it also carries significant risks, including impermanent loss, smart contract vulnerabilities, and rug pulls (where the developers of a project abandon it and run off with the funds). Extensive research and a thorough understanding of DeFi protocols are essential before engaging in yield farming.

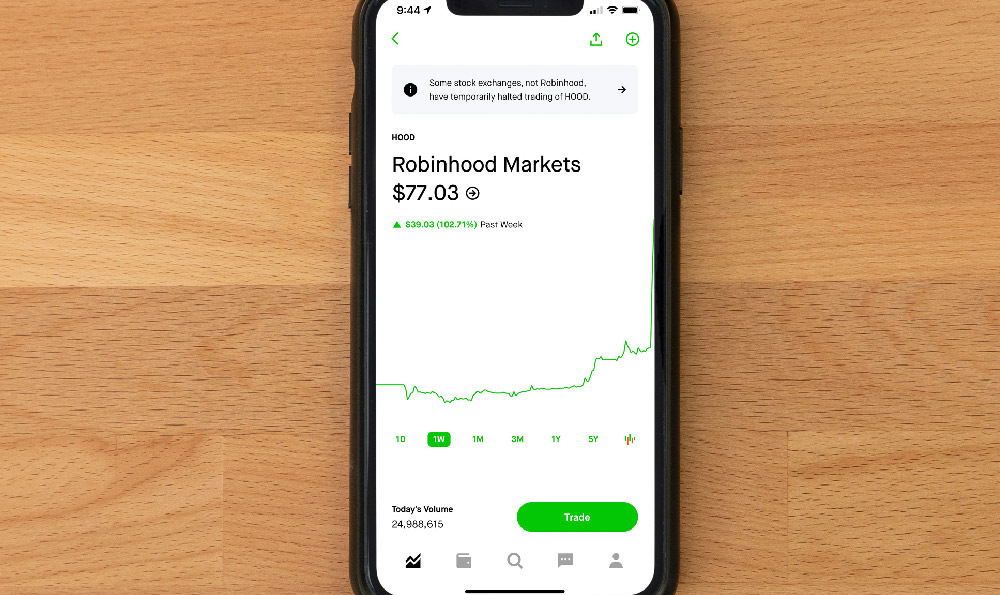

Active trading presents another option, but it is not for the faint of heart. Successful trading requires a deep understanding of technical analysis, market psychology, and risk management. Learn to read candlestick charts, identify support and resistance levels, and utilize technical indicators like moving averages, RSI, and MACD. Developing a trading plan that outlines your entry and exit points, position sizing, and risk tolerance is crucial. Emotional trading, driven by fear or greed, is a recipe for disaster. Discipline and patience are key attributes of a successful trader. Consider using stop-loss orders to limit your potential losses and take-profit orders to lock in gains.

No discussion of cryptocurrency investment is complete without emphasizing the importance of security. Cryptocurrencies are digital assets and are vulnerable to hacking and theft. Employ strong security measures to protect your investments. Use a hardware wallet, also known as a cold wallet, to store your cryptocurrencies offline. This significantly reduces the risk of online hacking. Enable two-factor authentication (2FA) on all your cryptocurrency exchange accounts. Be wary of phishing scams and never share your private keys or seed phrases with anyone. Regularly back up your wallet and store the backup in a safe place.

Tax implications should also be a major consideration. Cryptocurrency gains are typically taxable, and the specific rules vary depending on your jurisdiction. Keep accurate records of all your cryptocurrency transactions, including purchase prices, sale prices, and dates. Consult with a tax professional to ensure you are compliant with all applicable tax laws.

The cryptocurrency market is constantly evolving, so continuous learning is essential. Stay up-to-date on the latest news, trends, and technological developments. Follow reputable news sources, participate in online communities, and attend industry events. Be skeptical of hype and always do your own research before investing in any cryptocurrency.

Finally, remember that investing in cryptocurrencies is inherently risky. There is no guarantee of profit, and you could lose your entire investment. Only invest what you can afford to lose, and never borrow money to invest in cryptocurrencies. View cryptocurrency investment as a long-term strategy, not a get-rich-quick scheme. By approaching cryptocurrency investment with a measured, informed, and disciplined approach, you can increase your chances of making your money work for you and achieving your financial goals.