The allure of quick and easy money is a powerful siren song, particularly in the volatile and often unpredictable world of cryptocurrency. The stories of overnight millionaires, fueled by meme coins and sudden price surges, are pervasive, creating a perception that substantial wealth can be generated with minimal effort and risk. However, this perception is largely a mirage. The reality of successful cryptocurrency investment demands a measured approach, grounded in due diligence, risk management, and a realistic understanding of market dynamics. Chasing quick and easy profits is a surefire way to lose capital, often succumbing to scams, pump-and-dump schemes, or simply making poorly informed investment decisions driven by FOMO (Fear Of Missing Out).

Before even considering which cryptocurrency to invest in, it's crucial to establish a solid foundation of financial literacy. This includes understanding basic economic principles, the mechanics of blockchain technology, and the specific nuances of the cryptocurrency market. Neglecting this foundational knowledge is akin to navigating a complex maze blindfolded. Resources like reputable online courses, academic papers, and financial news outlets dedicated to cryptocurrencies can provide invaluable insights. Don't rely solely on social media hype or influencer endorsements, as these are often biased or even deliberately misleading.

Instead of seeking instant riches, focus on building a sustainable and diversified investment portfolio. Diversification is a cornerstone of risk management, mitigating the potential impact of any single investment performing poorly. This means allocating your capital across multiple cryptocurrencies, each with different market caps, use cases, and risk profiles. A balanced portfolio might include established cryptocurrencies like Bitcoin and Ethereum, which offer relative stability, alongside smaller-cap altcoins with higher growth potential but also greater volatility.

Furthermore, consider diversifying beyond cryptocurrencies altogether. Traditional assets like stocks, bonds, and real estate can provide a hedge against cryptocurrency market fluctuations and contribute to a more stable overall investment strategy. Remember, the goal is to build long-term wealth, not to gamble on short-term gains.

Conducting thorough research is paramount before investing in any cryptocurrency. This involves analyzing the project's whitepaper, which outlines its goals, technology, and team. Evaluate the team's expertise and track record, the project's underlying technology, and its potential for real-world adoption. Scrutinize the project's community and its level of engagement, as a strong and active community can be a valuable indicator of long-term sustainability.

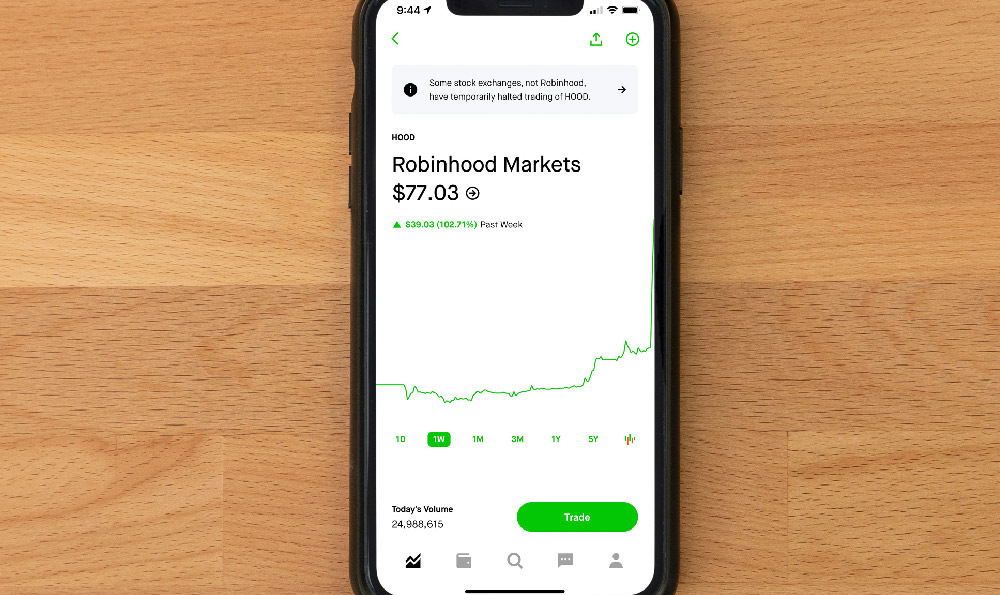

Beyond fundamental analysis, technical analysis can provide valuable insights into market trends and potential entry and exit points. Technical analysis involves studying price charts and using indicators like moving averages, RSI (Relative Strength Index), and MACD (Moving Average Convergence Divergence) to identify patterns and predict future price movements. While technical analysis is not foolproof, it can be a useful tool for making informed trading decisions. However, it's essential to remember that past performance is not necessarily indicative of future results, and no technical indicator is 100% accurate.

Another critical aspect of responsible cryptocurrency investment is risk management. This involves setting clear investment goals, defining your risk tolerance, and establishing stop-loss orders to limit potential losses. A stop-loss order automatically sells your cryptocurrency if the price drops below a predetermined level, preventing significant losses in the event of a market downturn.

Never invest more than you can afford to lose. The cryptocurrency market is inherently volatile, and there is always a risk of losing your entire investment. Treat cryptocurrency investment as a speculative endeavor and allocate only a small percentage of your overall portfolio to it.

Beware of scams and Ponzi schemes that promise guaranteed returns or easy money. These schemes often lure unsuspecting investors with unrealistic promises and sophisticated marketing tactics. Always be skeptical of any investment opportunity that seems too good to be true, and do your own research before investing any money. A common tactic is to create artificial scarcity or manipulate trading volumes to create the illusion of high demand.

Pay close attention to security measures. Cryptocurrency wallets and exchanges are vulnerable to hacking and theft. Use strong passwords, enable two-factor authentication, and store your cryptocurrencies in a secure hardware wallet. Be wary of phishing scams that attempt to steal your private keys or login credentials. Never share your private keys with anyone, and always double-check the website address before entering your personal information.

Stay informed about regulatory developments. Cryptocurrency regulations are constantly evolving, and these regulations can have a significant impact on the market. Keep abreast of the latest news and developments in cryptocurrency regulation, and be prepared to adapt your investment strategy accordingly. Regulations can sometimes stifle innovation, but often they are implemented to protect consumers from fraud and manipulation.

Finally, remember that building wealth through cryptocurrency investment is a marathon, not a sprint. Avoid chasing quick and easy profits, and instead focus on building a sustainable and diversified portfolio based on sound financial principles and thorough research. The best way to "earn" in the long run is through disciplined investing, continuous learning, and a healthy dose of skepticism. While the potential rewards of cryptocurrency investment can be significant, the risks are equally substantial. Approaching the market with caution, patience, and a long-term perspective is the most prudent path to achieving financial success.