In the realm of financial planning, the pursuit of quick income often reflects a desire to accelerate wealth accumulation, yet it is crucial to distinguish between genuine opportunities and enticing yet risky ventures. While the allure of rapid returns can be alluring, it is imperative to approach such strategies with a balanced perspective, recognizing that sustained financial growth typically necessitates a combination of strategic thinking, risk management, and patience. Bear in mind that the most straightforward yet effective methods often require leveraging existing resources or capitalizing on short-term market dynamics, rather than pursuing speculative endeavors that promise unverified gains. The essence of smart investing lies not merely in the speed of returns, but in the alignment of methodologies with personal financial goals, risk tolerance, and market conditions.

One of the most underutilized approaches to quick income is the strategic use of time to enhance personal value. In an era where skills are constantly evolving, investing in self-improvement can yield tangible financial benefits in a relatively short timeframe. For instance, acquiring a certification in a high-demand field such as digital marketing, software development, or data analysis can open doors to higher-paying freelance opportunities or part-time work. However, the efficacy of this strategy hinges on the ability to prioritize learning that directly contributes to marketability, while avoiding the trap of chasing fads or unnecessary credentials. Tangible results often emerge when the acquisition of knowledge is paired with practical application, such as working on personal projects or contributing to online communities to build a track record of expertise.

Another viable avenue involves the utilization of short-term investment instruments that are less volatile than traditional stock markets. Instruments such as high-yield savings accounts, short-term government bonds, or money market funds offer competitive returns with lower risk profiles, making them suitable for conservative investors seeking immediate liquidity. The interest rates on these platforms can fluctuate based on macroeconomic conditions, but they generally provide a stable foundation for capital preservation. For instance, in a low-interest environment, the returns may be modest, yet they remain attractive compared to savings accounts with lower yields. It is essential to monitor these instruments closely, as interest rates are influenced by factors such as inflation, monetary policy, and global economic trends, which can create opportunities for strategic reallocation of funds to maximize returns.

The proliferation of digital platforms has also democratized access to income-generating opportunities, particularly for those with a willingness to adapt and innovate. Freelance marketplaces such as Upwork or Fiverr allow individuals to monetize their skills in a variety of fields, from graphic design to content writing, often with flexible working hours and the potential for passive income over time. Similarly, the rise of e-commerce and online tutorials has enabled numerous individuals to generate revenue through dropshipping or virtual courses, provided they invest time in building a customer base and optimizing their offerings. These opportunities are not without challenges, as competition in digital markets is fierce, and success often requires a unique value proposition, consistent effort, and a keen understanding of consumer behavior.

For those with physical assets, the ability to generate rental income can be a particularly lucrative strategy when executed with foresight and diligence. Properties such as vacation homes or commercial spaces can produce steady cash flow, especially in markets experiencing sustained demand. However, the success of such ventures depends on factors such as location, property management, and market conditions, which must be analyzed before committing to a long-term investment. Additionally, the rise of short-term rental platforms like Airbnb has created new opportunities for property owners to maximize their returns by catering to transient guests, but these require careful consideration of legal, tax, and maintenance-related obligations. The potential for quick returns in this arena is most evident when the property is situated in a high-demand area and the owner is adept at managing operational challenges.

In addition to these avenues, the ability to generate income through strategic use of technology and automation can significantly enhance efficiency, leading to quicker returns. For instance, the development of automated trading systems or robo-advisors can streamline the process of managing investment portfolios, reducing the time required for research and decision-making. Similarly, the monetization of digital assets such as domain names, online accounts, or subscription-based content can provide recurring revenue streams, particularly when these are managed with a long-term perspective. However, the technological landscape is subject to rapid changes, requiring continuous adaptation to remain competitive. Success in this domain often demands not only technical proficiency but also an understanding of market trends and user preferences.

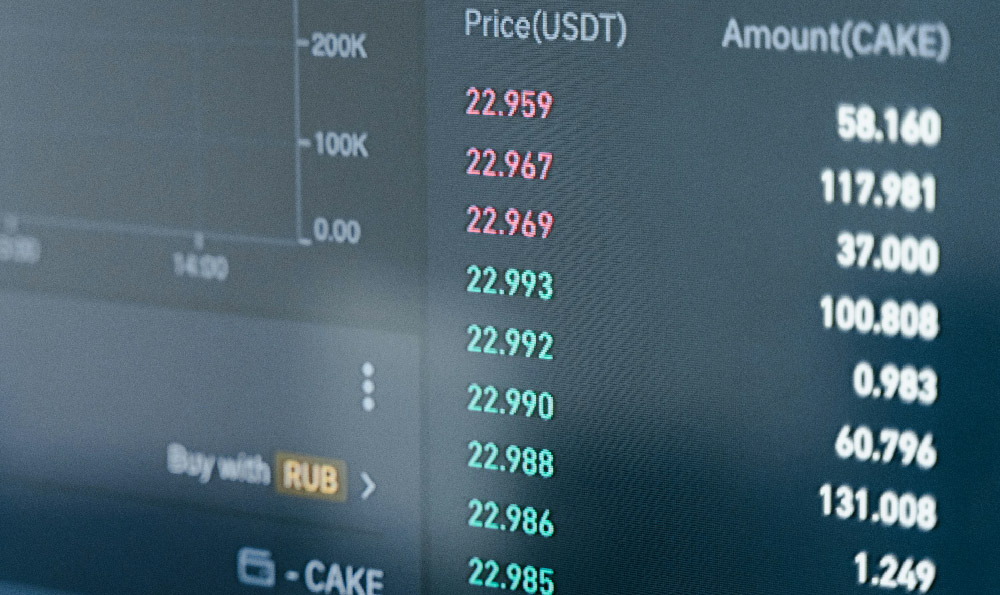

Despite the allure of quick income strategies, it is imperative to recognize that they are not without risks. The promise of rapid returns can be misleading, especially when associated with scams, overhyped projects, or unregulated financial instruments. For instance, schemes that claim to generate substantial income with minimal effort often operate on dubious principles, necessitating thorough research and due diligence before commitment. Furthermore, the volatility of certain investment avenues, such as cryptocurrency or forex trading, can lead to significant losses if not approached with caution. It is essential to evaluate the potential risks associated with each strategy, ensuring that the pursuit of quick income does not compromise long-term financial stability.

Ultimately, the pursuit of quick income should not be viewed as a standalone solution but as an integral component of a broader financial strategy. The key to maximizing returns lies in the ability to balance immediate opportunities with long-term goals, ensuring that each decision contributes to the overall objective of wealth accumulation. While some strategies may provide swift returns, they often require a deeper understanding of financial principles, risk management, and market dynamics. The path to financial success is rarely linear, but with informed decisions and strategic planning, it is possible to navigate the complexities of the financial landscape and achieve meaningful returns.