As the stock market offers one of the most accessible avenues for wealth creation, newcomers often approach it with a mix of excitement and trepidation. The key to navigating this complex landscape lies not in chasing quick riches, but in cultivating a disciplined mindset and a well-thought-out strategy that aligns with personal financial goals. The journey begins with understanding that profitability in the stock market is not a linear path; it demands patience, adaptability, and a deep appreciation for market dynamics. For beginners, the most effective approach is to prioritize long-term growth while mitigating the risks inherent in short-term volatility. This requires a balance between prudent research and emotional restraint, as the market is as much a psychological test as it is a financial one.

The foundation of any successful investment strategy starts with education. Many new investors underestimate the value of foundational knowledge about financial markets, which can lead to costly mistakes. Understanding how stocks represent ownership in companies, the role of dividends, and the impact of market trends is essential. Equally important is familiarizing oneself with fundamental financial concepts such as compound interest, which illustrates how even modest regular investments can grow significantly over time through the reinvestment of earnings. This principle underscores the importance of consistency in investing, as sporadic transactions often fail to capitalize on the compounding effect.

While long-term strategies are crucial, they must be complemented by a robust risk management framework. The stock market is inherently unpredictable, and no approach can guarantee immunity from losses. Beginners should recognize that diversification is not merely a buzzword but a practical necessity. By spreading investments across different asset classes—such as blue-chip stocks, growth-oriented companies, and industry-specific exchange-traded funds (ETFs)—investors can reduce exposure to sector-specific shocks. For example, if a particular technology sector experiences a downturn, a well-diversified portfolio might cushion the impact by holding stocks in other industries. Diversification also extends to the number of holdings, as investing in too few stocks can magnify risk. However, it's important to note that over-diversification can dilute returns, so striking the right balance is critical.

Another pivotal strategy for beginners is the adoption of a disciplined approach to market analysis. This involves developing the ability to interpret financial statements, understand macroeconomic indicators, and assess market sentiment. While it might seem overwhelming at first, breaking down these elements into digestible parts can make the process more manageable. For instance, focusing on a company's revenue growth, profit margins, and debt levels can provide insights into its financial health. Similarly, monitoring trends such as inflation rates, interest changes, and geopolitical events can help anticipate market movements. Beginners should also explore tools like technical analysis, which examines stock price patterns and trading volumes, or fundamental analysis, which evaluates a company's intrinsic value. Combining these approaches can offer a more holistic view of potential opportunities and risks.

The practice of dollar-cost averaging is another valuable technique for beginners. Instead of attempting to time the market, this strategy involves investing a fixed amount regularly, regardless of market conditions. By doing so, investors can mitigate the impact of market fluctuations, as purchases are made at varying price points. For example, investing $100 every month in a high-quality index fund over several years can yield substantial returns, even if the market dips during certain periods. This approach is particularly effective for those who lack the ability to predict market timing, as it reduces the likelihood of buying at market peaks and selling at troughs.

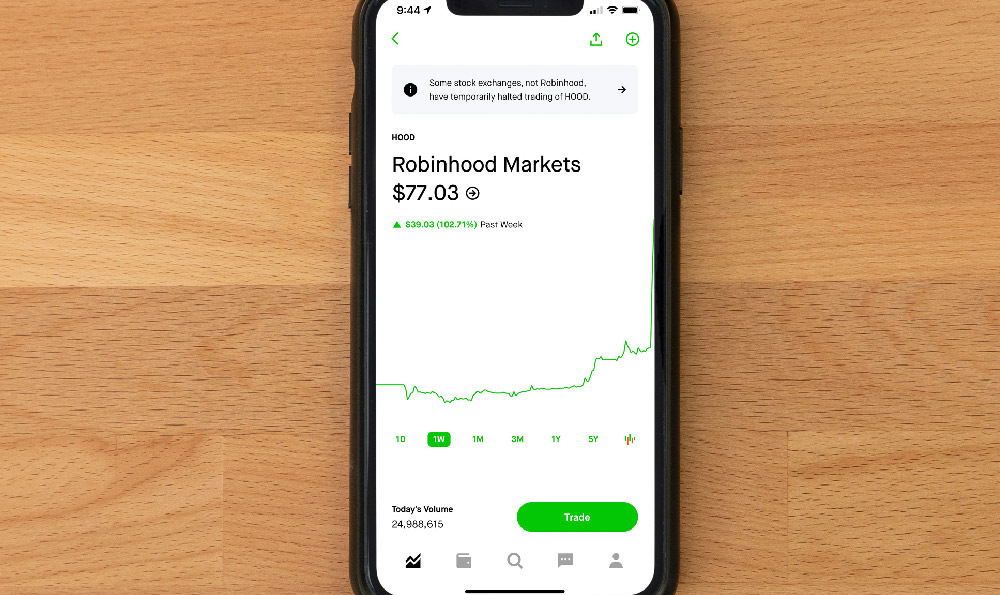

A critical aspect that often overlooked by novice investors is the importance of emotional discipline. The stock market is prone to cycles of euphoria and panic, and the ability to remain calm during these phases can mean the difference between profit and loss. For instance, during periods of market uncertainty, panic selling can lead to missed opportunities, while overconfidence might encourage entering the market at inflated prices. Beginners should cultivate the habit of adhering to their predetermined strategies rather than reacting impulsively to news or trends. This requires setting clear investment objectives, maintaining a long-term perspective, and avoiding the temptation to chase short-term gains.

In addition to passive strategies, active investing can also be a viable path for those willing to dedicate time to research and analysis. This involves identifying undervalued stocks, evaluating market trends, and staying informed about company developments. However, active investing demands a significant commitment to continuous learning and vigilance, as it requires monitoring numerous factors that can influence stock performance. For beginners, starting with a mix of passive and active strategies—one might allocate a portion of their portfolio to index funds while exploring individual stocks with strong fundamentals—can provide a balanced approach.

Lastly, the stock market offers a unique opportunity for beginners to build wealth, but it also demands a commitment to lifelong learning. As markets evolve, so too must the strategies and knowledge of investors. This involves staying updated on financial news, understanding new investment products, and refining one’s approach based on experience. For example, as technology advances, new sectors such as renewable energy or artificial intelligence may emerge as promising investment areas. Beginners who are willing to adapt and grow alongside the market are more likely to achieve sustainable success.

In conclusion, the path to profitability in the stock market begins with a comprehensive understanding of its mechanics, a disciplined approach to risk management, and a commitment to continuous learning. By embracing long-term strategies, diversifying investments, and maintaining emotional control, beginners can navigate the complexities of the market with confidence. The key is to recognize that while the stock market can be challenging, it is also one of the most rewarding financial tools available when approached with knowledge and patience.