Okay, I'm ready. Here's an article addressing the investment potential of AI stocks, avoiding excessive bullet points or numbered lists, and refraining from using the exact title within the text:

The Allure and Risks of Investing in Artificial Intelligence

Artificial Intelligence (AI) is no longer a futuristic fantasy confined to science fiction. It's rapidly transforming industries, reshaping business models, and permeating our daily lives. From self-driving cars and personalized medicine to sophisticated financial algorithms and hyper-targeted marketing, the impact of AI is undeniable, and its potential seems limitless. This profound shift has naturally sparked considerable interest among investors, leading to a surge in the popularity – and often the price – of companies associated with AI technologies. But is investing in these AI-related entities a wise move, or are investors getting caught up in the hype?

The appeal of AI stocks stems from the expectation of substantial growth. Projections for the AI market are consistently optimistic, forecasting exponential expansion in the coming years. This anticipated growth is fueled by several factors. First, the increasing availability of massive datasets, often referred to as "big data," provides the raw material necessary for AI algorithms to learn and improve. Second, advancements in computing power, particularly in the realm of specialized chips designed for AI workloads, are enabling the development and deployment of more complex and sophisticated AI models. Third, the proliferation of cloud computing platforms makes AI infrastructure accessible to a wider range of businesses, lowering the barriers to entry and accelerating innovation.

Investing in AI, however, is not without its challenges and risks. One crucial consideration is the inherent complexity of the technology. Understanding the nuances of different AI subfields, such as machine learning, natural language processing, and computer vision, is essential for evaluating the competitive landscape and identifying companies with a sustainable advantage. It's not enough to simply see the label "AI" attached to a company; investors need to dig deeper and understand the specific applications, technological capabilities, and intellectual property underlying the business.

Furthermore, the competitive landscape in the AI space is intensely dynamic. Startups with groundbreaking innovations are constantly emerging, challenging the dominance of established players. Larger technology companies are also aggressively investing in AI, either through internal research and development or through strategic acquisitions of smaller AI firms. This intense competition can create volatility in the market and make it difficult to predict which companies will ultimately emerge as winners. Identifying sustainable competitive advantages, like specialized datasets, proprietary algorithms, or strong customer relationships, is crucial for long-term investment success.

Another risk factor is the potential for ethical and societal concerns to negatively impact the growth of the AI market. As AI systems become more powerful and pervasive, issues such as bias, fairness, and accountability become increasingly important. Concerns about job displacement due to automation, the use of AI in surveillance technologies, and the potential for autonomous weapons systems are all legitimate concerns that could lead to increased regulation and public scrutiny. Companies that fail to address these ethical considerations proactively may face reputational damage and regulatory hurdles, potentially impacting their financial performance.

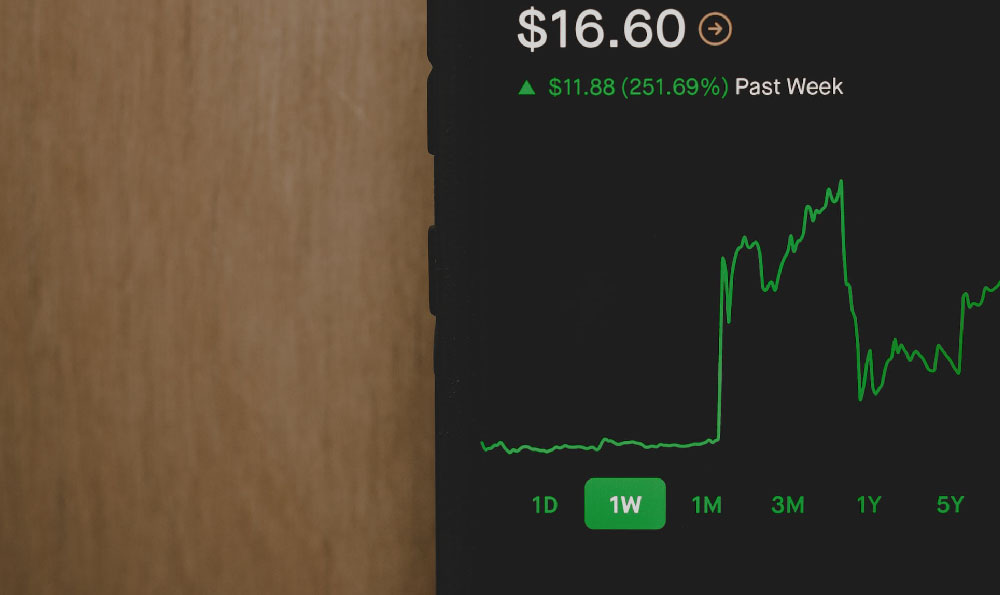

The hype surrounding AI can also lead to inflated valuations. Many AI stocks are trading at high multiples of earnings or revenue, reflecting the market's expectation of future growth. However, these high valuations may not be sustainable if the actual growth of the AI market falls short of expectations or if competition intensifies. Investors should carefully consider the valuation of AI stocks and avoid getting caught up in speculative bubbles. Look beyond the buzzwords and focus on companies with strong fundamentals, a clear path to profitability, and a proven ability to execute their business plans.

Diversification is also essential when investing in this rapidly evolving space. Rather than putting all your eggs in one basket, consider investing in a basket of AI-related companies across different sectors and subfields. This can help to mitigate the risk of investing in individual companies that may not succeed. Another option is to invest in exchange-traded funds (ETFs) that focus on AI. These ETFs provide instant diversification and allow investors to gain exposure to a broad range of AI companies.

Before diving into the AI stock market, conducting thorough due diligence is paramount. This includes understanding the company's business model, assessing its competitive advantages, evaluating its financial performance, and considering the regulatory and ethical risks it faces. It's also important to stay informed about the latest developments in the AI field and to monitor the performance of your investments regularly.

In conclusion, the AI sector presents both tremendous opportunities and significant risks for investors. While the potential for growth is undeniable, it's crucial to approach these investments with caution and to conduct thorough research. By focusing on companies with strong fundamentals, a clear path to profitability, and a commitment to ethical principles, investors can increase their chances of success in this dynamic and transformative space. Remember that investing in AI is a long-term game, and patience and discipline are essential for achieving your financial goals. Don't get swept away by the hype; instead, make informed decisions based on a thorough understanding of the technology, the market, and the risks involved.