In the digital age, the internet has become a double-edged sword for those seeking financial growth. While it offers unprecedented access to tools and platforms that can generate wealth, it also presents a vast array of opportunities that are often shrouded in hype and misinformation. The allure of quick riches has fueled the rise of various online methods, from high-risk investments to skill-based entrepreneurial ventures, each promising substantial returns with minimal effort. However, understanding the true nature of these strategies requires a nuanced perspective that separates genuine opportunities from fleeting illusions.

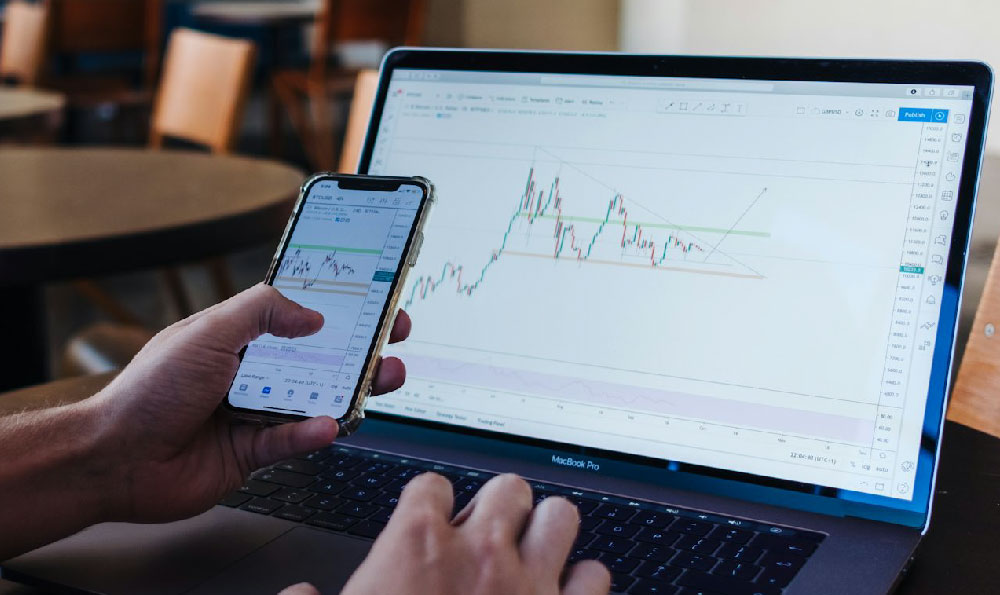

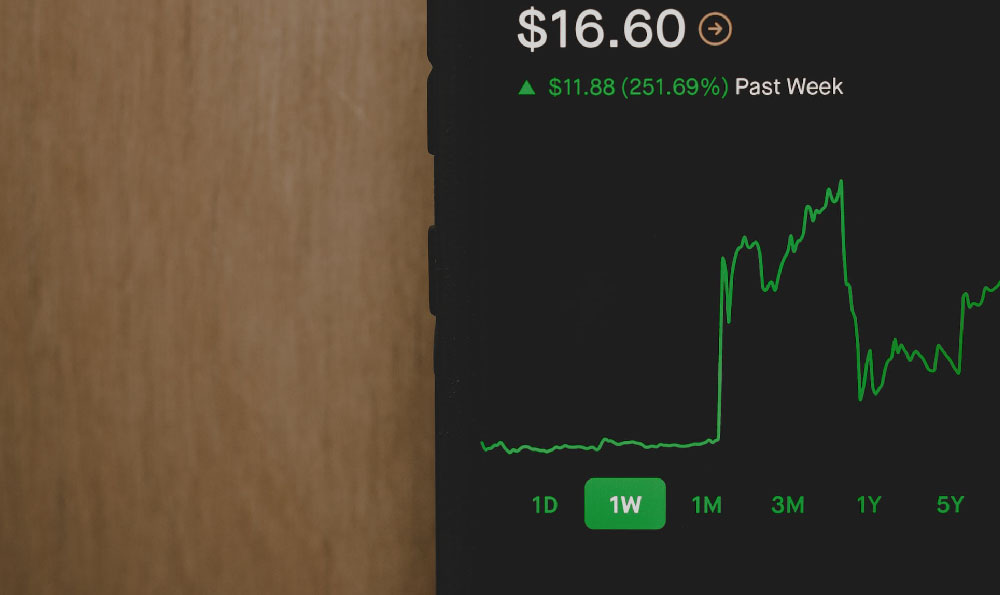

The financial markets themselves have always been a playground for both innovation and deception. Cryptocurrencies, for instance, have captured the imagination of many with their potential for exponential growth, yet their volatile nature and regulatory uncertainties make them a high-stakes gamble. Similarly, online trading platforms enable individuals to speculate on stocks, commodities, or forex with just a smartphone, but the same tools can also lead to significant losses if used without proper education or risk management. The key distinction lies in recognizing that while these methods may offer the possibility of rapid wealth accumulation, they demand a deep understanding of market dynamics, emotional discipline, and a tolerance for uncertainty.

For those with technical expertise or a willingness to learn, online freelancing and digital product creation provide alternative pathways to financial independence. Platforms like Upwork, Fiverr, or Toptal allow professionals to monetize their skills globally, yet competition is fierce, and success often hinges on building a credible reputation and consistently delivering value. Similarly, creating and selling digital products through Etsy, Gumroad, or even social media can generate passive income, but this requires not only creative vision but also an understanding of marketing, customer acquisition, and platform algorithms. The speed of returns in these domains is contingent upon the individual's ability to adapt, innovate, and maintain a long-term perspective.

The rise of influencer culture and online entrepreneurship has blurred the lines between traditional investing and modern wealth creation. Building a following on platforms like Instagram, TikTok, or YouTube can yield substantial earnings through brand partnerships, sponsored content, or affiliate marketing, but the path to monetization is fraught with challenges. Content saturation, algorithmic changes, and the need for constant engagement can make scalability difficult, while the initial phase often requires significant time and effort to establish credibility. Success in these realms is not guaranteed and frequently depends on the individual's ability to maintain consistency, deliver authentic value, and navigate the complexities of digital branding.

Another avenue gaining traction is the automation of investment processes through robo-advisors and algorithmic trading. These technologies promise to optimize returns by leveraging data-driven strategies, yet their effectiveness is highly dependent on the accuracy of the algorithms and the alignment of the investor's goals with the platform's approach. The convenience of automated systems comes with a trade-off: while they reduce the need for active management, they can also lead to losses if the underlying models are flawed or if they fail to account for unforeseen market conditions. The value of these methods lies in their ability to streamline wealth-building processes, but they are not a substitute for human judgment and strategic foresight.

Ultimately, the pursuit of rapid wealth in the digital realm is a multifaceted endeavor that requires careful consideration of risk, time, and effort. While some methods may offer quicker returns than traditional investing, they often come with higher volatility, greater uncertainty, or steeper learning curves. The most effective strategies tend to combine elements of patience, education, and proactive management. For instance, diversifying investments across low-risk assets, such as index funds or dividend-paying stocks, can provide steady growth over time, while exploring high-potential opportunities, like emerging technologies or niche markets, requires a thorough assessment of risks and a willingness to adapt. The path to financial success in the online world is not a shortcut but a complex journey that demands a blend of knowledge, discipline, and strategic planning.

In conclusion, while the internet provides a wealth of opportunities for those seeking financial growth, the idea of "getting rich quick" is often a mirage. Sustainable wealth creation requires a balance between innovation and caution, leveraging the tools available while remaining vigilant against the pitfalls of over-optimism and mismanagement. By adopting a data-driven approach, refining their skills, and maintaining a long-term perspective, individuals can navigate the digital landscape with greater confidence and achieve meaningful financial milestones without falling into the traps of unrealistic expectations.