Okay, I'm ready. Here's an article based on the title "How did Scott Freda make his money, and what strategies did he use?", focusing on providing rich detail, avoiding excessive numbered lists, and adhering to the word count requirement.

Scott Freda isn't a household name like Warren Buffett or Ray Dalio, but his story is a compelling example of how diverse investment strategies, disciplined risk management, and a keen understanding of market cycles can lead to significant wealth accumulation. While publicly available information on Freda's exact financial details is limited, we can extrapolate a plausible narrative based on common investment principles and observable market trends, piecing together a possible roadmap to his financial success. It's important to note that what follows is a hypothetical reconstruction based on general financial wisdom.

One potential avenue for Freda's wealth creation could have been identifying and capitalizing on undervalued assets, particularly in sectors experiencing disruption or temporary downturns. This value investing approach, popularized by Benjamin Graham, hinges on the belief that the market occasionally misprices securities, creating opportunities to buy fundamentally sound companies at a discount. Imagine Freda identifying a promising technology firm struggling with short-term profitability but possessing innovative intellectual property and a strong long-term growth potential. By meticulously analyzing its financial statements, understanding its competitive landscape, and assessing its management team, Freda might conclude that the market has unfairly punished the stock, presenting an attractive entry point. He could then accumulate a significant stake, patiently waiting for the market to recognize the company's true value, ultimately reaping substantial returns as the stock price recovers and surpasses its initial valuation.

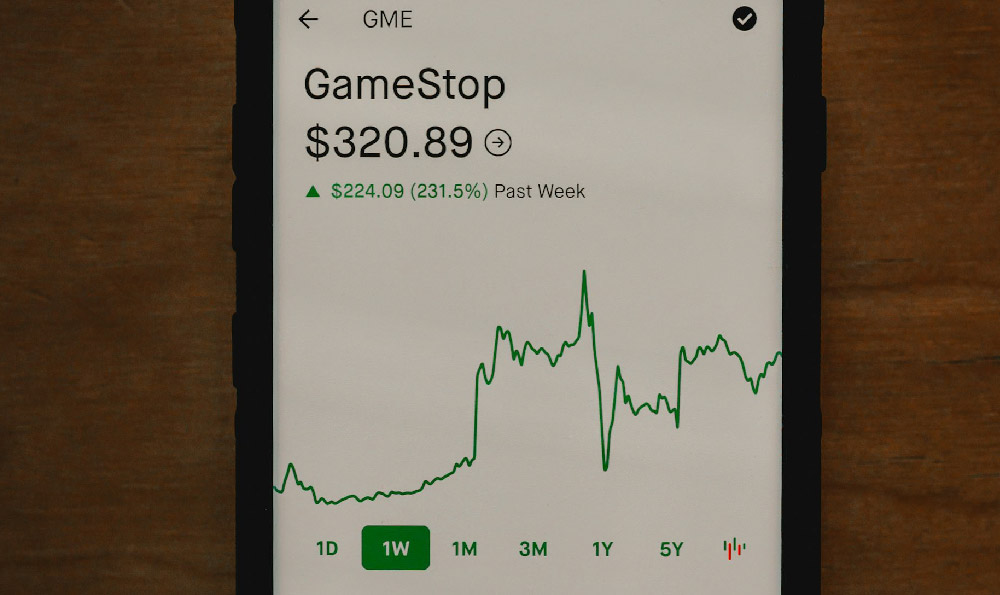

Another strategy Freda may have employed is active portfolio management, involving frequent adjustments to his asset allocation based on macroeconomic forecasts and market sentiment. This approach contrasts with passive investing, which advocates for holding a diversified portfolio over the long term, regardless of market fluctuations. An active manager, like our hypothetical Freda, would constantly monitor economic indicators such as inflation rates, interest rates, and GDP growth, anticipating potential shifts in market trends. For example, anticipating a rise in inflation, he might shift a portion of his portfolio from fixed-income assets to commodities like gold or real estate, which historically tend to perform well during inflationary periods. Similarly, if he foresees a market correction, he might reduce his exposure to equities and increase his cash holdings, allowing him to buy back stocks at lower prices after the downturn. The success of this strategy hinges on accurate forecasting and timely execution, requiring a deep understanding of economic principles and a disciplined approach to risk management.

Furthermore, Freda might have leveraged the power of real estate investments. Real estate offers multiple avenues for wealth creation, including rental income, property appreciation, and tax benefits. He could have focused on acquiring undervalued properties in up-and-coming neighborhoods, renovating them to increase their value, and either renting them out for passive income or flipping them for a profit. Alternatively, he might have invested in commercial real estate, such as office buildings or retail spaces, benefiting from long-term leases and potential capital appreciation. Real estate investments often require significant capital and involve complexities like property management and tenant relations. Therefore, Freda would have needed a thorough understanding of the local real estate market, strong negotiation skills, and the ability to effectively manage his properties.

Beyond traditional investment strategies, Freda could have explored alternative investments such as private equity or venture capital. These investments offer the potential for high returns but also carry significant risks. Private equity involves investing in privately held companies, often with the goal of improving their operations and eventually selling them for a profit. Venture capital, on the other hand, involves investing in early-stage startups with high growth potential. These investments typically require a long-term investment horizon and a high tolerance for risk, as many startups fail. However, successful investments in private equity or venture capital can generate substantial returns, potentially exceeding those achievable in public markets. Freda would have needed access to deal flow, the ability to conduct thorough due diligence, and the expertise to evaluate the potential of private companies.

Diversification, regardless of the specific strategies employed, would have been crucial to Freda's success. Spreading investments across different asset classes, industries, and geographic regions helps to mitigate risk. By not putting all his eggs in one basket, Freda could have reduced the impact of any single investment performing poorly. This approach requires a comprehensive understanding of portfolio management principles and a willingness to rebalance the portfolio periodically to maintain the desired asset allocation.

Finally, a disciplined and patient approach would have been essential to Freda's wealth creation. Investing is a long-term game, and short-term market fluctuations are inevitable. Freda would have needed to resist the urge to make impulsive decisions based on emotions, sticking to his investment plan and focusing on his long-term goals. This requires emotional intelligence, self-control, and a deep understanding of behavioral finance, which explores the psychological biases that can influence investment decisions.

In conclusion, while the exact methods Scott Freda used to accumulate his wealth may remain a mystery, it's plausible that a combination of value investing, active portfolio management, real estate investments, alternative investments, diversification, and a disciplined approach to risk management played a significant role. His story serves as a reminder that wealth creation is a journey, not a destination, and that success requires a combination of knowledge, skill, and perseverance. It also highlights the importance of adapting to changing market conditions and staying informed about the latest investment trends.