The allure of "pot stocks," or cannabis-related stocks, is undeniable. Fueled by the increasing legalization and acceptance of cannabis for both medicinal and recreational purposes, the industry presents a tempting opportunity for investors seeking potentially high growth. However, navigating this burgeoning market requires a nuanced understanding of its complexities, inherent risks, and evolving regulatory landscape. Simply jumping on the bandwagon without careful consideration can lead to significant financial losses. Therefore, a measured and informed approach is paramount.

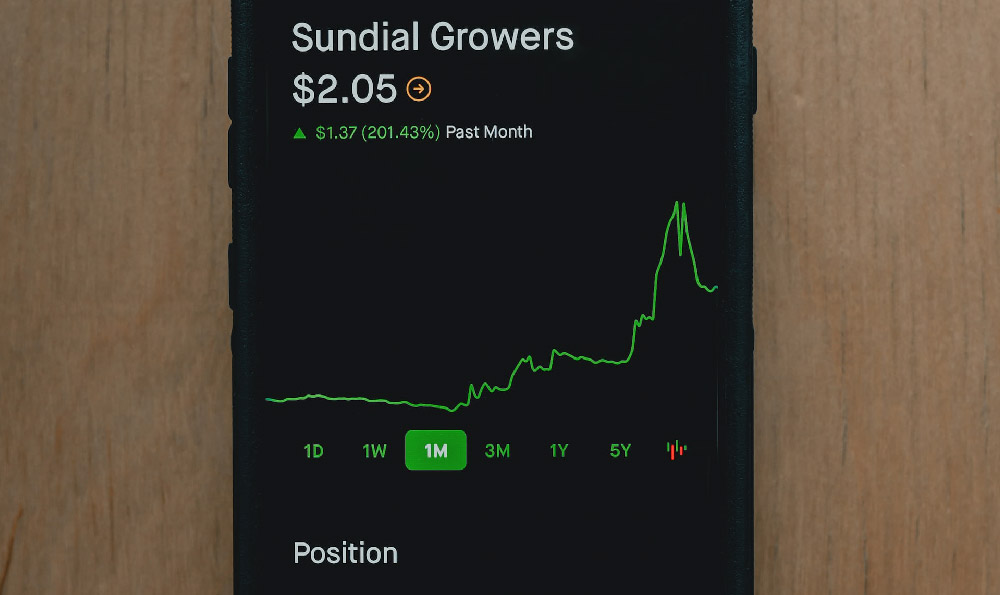

Before even contemplating investing in cannabis stocks, it’s crucial to address the fundamental question: are you prepared for the volatility? The cannabis industry is not yet mature. It’s still in its infancy, characterized by regulatory uncertainties, fierce competition, and fluctuating consumer demand. This translates into heightened price swings in cannabis stocks, making them significantly more volatile than traditional investments. If you're risk-averse or have a short investment horizon, pot stocks may not be suitable for your portfolio. You need to possess a tolerance for significant fluctuations in value and be prepared to hold your investments for the long term to weather the inevitable storms.

If you’ve determined that you possess the appropriate risk tolerance and investment timeline, the next step is to conduct thorough due diligence. This involves more than just reading news headlines or following popular opinions on social media. It requires a deep dive into the specific companies you're considering. Start by examining their financial statements, including revenue, profit margins, debt levels, and cash flow. Are they consistently profitable, or are they burning through cash? Are they burdened by excessive debt, which could hinder their growth potential? These fundamental financial metrics provide a crucial baseline for evaluating a company's long-term viability.

Beyond the numbers, you must also analyze the company's business model. What is their specific niche within the cannabis industry? Are they focused on cultivation, processing, distribution, retail, or a combination thereof? What are their competitive advantages? Do they have proprietary technologies, strong branding, or established distribution networks? Understanding their unique position in the market is essential for assessing their potential for future success. Furthermore, consider the regulatory environment in which they operate. Cannabis regulations vary significantly from country to country, state to state, and even municipality to municipality. These regulations can impact a company's ability to operate, expand, and generate profits. A company operating in a heavily regulated market may face higher compliance costs and limited market access, which could negatively impact its growth prospects.

Another critical aspect of due diligence is understanding the management team. Who are the individuals leading the company, and what is their track record? Do they have experience in the cannabis industry, or are they newcomers? A strong and experienced management team can be a significant asset, guiding the company through the challenges of a rapidly evolving market. Conversely, a weak or inexperienced management team could lead to poor decision-making and ultimately undermine the company's performance.

Once you've completed your due diligence and identified potential investment opportunities, it's time to consider different investment strategies. One option is to invest directly in individual cannabis stocks. This allows you to target specific companies that you believe have the greatest potential for growth. However, it also exposes you to the risks associated with those individual companies. A more diversified approach is to invest in exchange-traded funds (ETFs) that focus on the cannabis industry. These ETFs hold a basket of cannabis stocks, providing you with broader exposure to the sector and reducing your risk. However, ETFs also come with their own set of fees and may not perfectly align with your specific investment goals.

Regardless of which investment strategy you choose, it's important to manage your risk effectively. One way to do this is to diversify your portfolio. Don't put all your eggs in one basket. Allocate only a small portion of your overall investment portfolio to cannabis stocks. This will limit your potential losses if the cannabis industry underperforms. Another risk management strategy is to use stop-loss orders. A stop-loss order automatically sells your shares if the price falls below a certain level, helping to protect you from significant losses. However, be aware that stop-loss orders can also be triggered by temporary price fluctuations, potentially causing you to sell your shares prematurely.

Finally, it's essential to stay informed and adapt to the evolving landscape of the cannabis industry. Keep up-to-date on the latest news and developments, including regulatory changes, scientific advancements, and market trends. Be prepared to adjust your investment strategy as needed to reflect the changing environment. The cannabis industry is dynamic and unpredictable, so flexibility and adaptability are crucial for long-term success. Remember, investing in pot stocks is not a get-rich-quick scheme. It requires careful planning, diligent research, and a long-term perspective. By following these guidelines, you can increase your chances of navigating this exciting but challenging market successfully and potentially reap the rewards of the cannabis revolution. Ignoring these warnings and proceeding with reckless abandon is a recipe for financial disaster. The key is to approach the cannabis market with the same level of due diligence and prudence that you would apply to any other investment, tempering enthusiasm with a healthy dose of skepticism and careful analysis.