Investment in the cryptocurrency market has become a focal point for many seeking financial growth and diversification. For those who are new to this field or considering it as a component of their overall financial strategy, understanding how to navigate potential returns is essential. This process involves more than just following trends or hasty decisions—it demands a methodical approach, an awareness of various calculators that can aid in decision-making, and a deep insight into the interplay between risk and reward. Focusing on the use of an investment calculator for cryptocurrencies, this exploration considers how forecasting expected earnings can be both a practical and strategic endeavor, especially when done with a long-term perspective and informed by data-driven analysis.

The cryptocurrency market is inherently volatile, which makes precise forecasting complex. However, an investment calculator can serve as a valuable tool in this context, allowing investors to estimate returns based on factors such as initial investment amount, projected growth rates, and holding periods. By inputting these variables, users can gain a clearer understanding of the potential profitability of their investments, while also highlighting the risks involved. It is crucial to remember that while these calculators can provide estimates, they should not be seen as definitive predictions, but rather as a guide to help structure informed strategies.

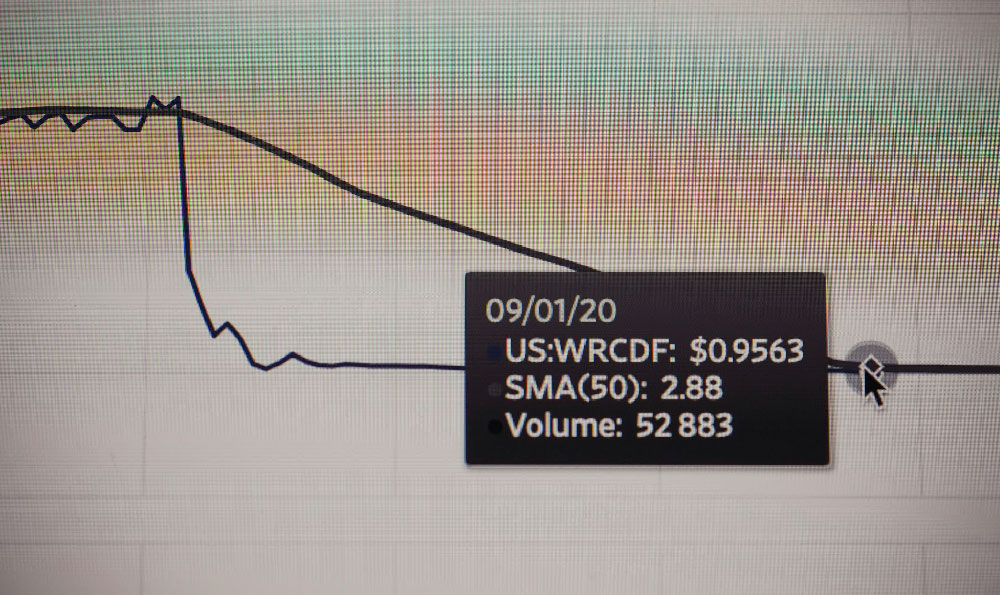

One key consideration in utilizing an investment calculator for cryptocurrency is the volatility of the market itself. Unlike traditional investments such as stocks or bonds, cryptocurrencies often experience significant price fluctuations within short timeframes. For example, a single day's trading can result in a substantial gain or loss, making it difficult to predict returns based on a simple formula. However, by incorporating historical performance data and considering market trends, investors can gain a more nuanced view of what to expect. A well-designed calculator may include parameters for annualized returns, risk tolerance levels, and market conditions, providing a more accurate projection that reflects the reality of the investment environment.

Understanding how to interpret the results of an investment calculator is equally important. A healthy perspective involves recognizing that these tools can assist in evaluating scenarios but are also limited by their assumptions. For instance, if an investor sets a target of achieving a 20% return within a year, the calculator can simulate potential outcomes based on the current market situation and projected growth. However, it may not account for unexpected events such as regulatory changes, technological failures, or market corrections that could impact the investment. This means that the calculator serves to identify opportunities, but it is the investor's responsibility to devise a comprehensive strategy that includes contingency plans and diversification.

In the context of cryptocurrency investment, financial growth is often tied to strategic opportunities. By leveraging an investment calculator, investors can explore various strategies, such as dollar-cost averaging, long-term holding, or short-term trading. Each approach carries its own risk and reward profile, and the calculator can help visualize the potential impact of these strategies. For example, a long-term holding strategy may yield higher overall returns, but it also involves subjecting the investment to greater fluctuations. In contrast, a short-term trading approach may offer quicker gains, but it requires more active management and a higher risk tolerance. The calculator can thus aid in evaluating which strategy aligns best with an investor’s goals and risk appetite.

Risk management is another critical factor in cryptocurrency investment, and an investment calculator can play a role in identifying potential risks. By simulating different scenarios, investors can evaluate the possible impact of market downturns or price volatility. This helps in preparing for the worst-case situations while staying focused on the best-case outcomes. For example, if an investor has a set target of earnings, the calculator can help determine the level of risk involved in reaching that target and whether the strategy is aligned with their financial goals and risk tolerance.

In conclusion, while an investment calculator for cryptocurrency can provide a useful framework for forecasting potential earnings, it is important to approach this tool with a clear understanding of its limitations. Cryptocurrency investments are complex, and relying solely on calculated estimates may not be sufficient to navigate the dynamic market landscape. By combining the insights from the calculator with broader market analysis and strategic planning, investors can make more informed decisions that contribute to financial growth while managing risks effectively. Ultimately, the ability to balance these elements is what separates successful investors from those who struggle in this volatile market.