Okay, I understand. Here's an article addressing the topic of Capital Markets Investment Banking, designed to be informative, comprehensive, and engaging, avoiding excessive bullet points and formulaic introductions:

Capital Markets Investment Banking: A Deep Dive into Value Creation

The world of finance is a vast and complex landscape, and at its heart lies investment banking. Within investment banking, a particularly crucial and dynamic area is Capital Markets Investment Banking (CMIB). Understanding what CMIB encompasses, and why it matters to businesses, investors, and the overall economy, is paramount to navigating the financial world effectively.

Capital Markets Investment Banking is a specialized branch of investment banking that focuses on connecting companies with investors to raise capital through the issuance of securities. This is a core function for businesses looking to expand, fund acquisitions, restructure debt, or simply finance their operations. Instead of relying solely on traditional bank loans, CMIB provides access to a wider pool of capital available in the public and private markets. This access can be a transformative catalyst for growth and innovation.

The primary role of CMIB professionals is to advise and assist companies in accessing capital markets through the issuance of debt or equity. This involves a multifaceted process, beginning with a thorough assessment of the company’s financial standing, strategic goals, and market conditions. Based on this assessment, the CMIB team will formulate a tailored capital markets strategy. This strategy will outline the optimal type of security to issue (e.g., common stock, preferred stock, bonds, convertibles), the proposed offering size, pricing, and timing.

For companies considering an initial public offering (IPO), the CMIB team plays a pivotal role in guiding them through the complex and highly regulated process. This includes assisting with the preparation of the registration statement (a comprehensive document filed with regulatory bodies), conducting due diligence, and roadshowing the company to potential investors. The roadshow is a crucial part of the IPO process, allowing management to pitch the company's story and future prospects to institutional investors. The CMIB team also provides critical guidance on pricing the offering, balancing the company's desire to maximize capital raised with the need to attract sufficient investor demand.

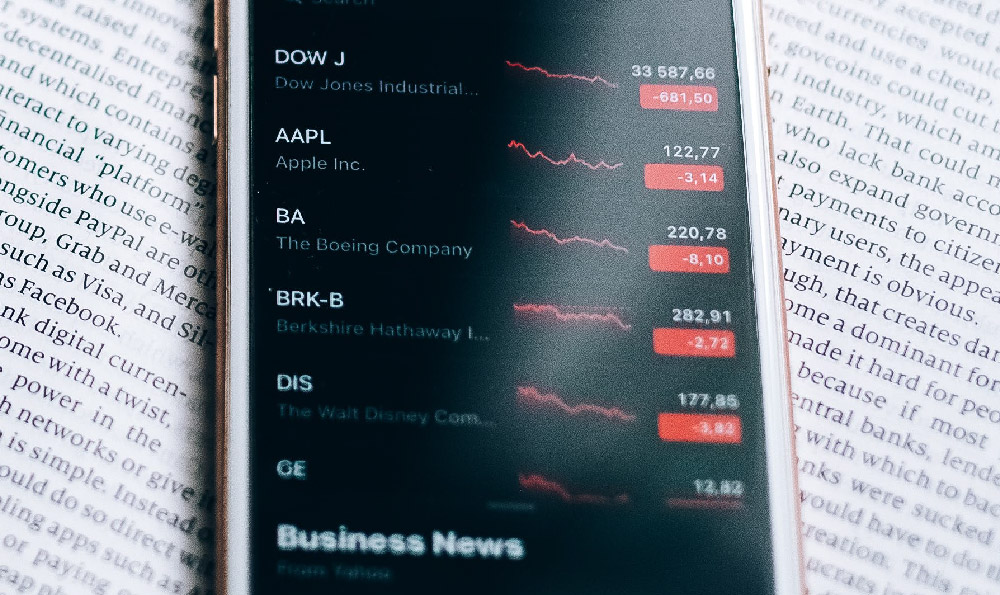

Beyond IPOs, CMIB professionals also advise on and execute secondary offerings, where companies issue additional shares of stock to the public market after their initial listing. They also assist companies in raising debt capital through the issuance of bonds, either in the public markets or through private placements to institutional investors. The type of debt issued can vary greatly, ranging from investment-grade bonds issued by large, established companies to high-yield (or "junk") bonds issued by companies with lower credit ratings.

The process of bringing a security to market involves several key steps. First, the CMIB team conducts thorough due diligence on the company, assessing its financial performance, business model, and competitive landscape. They also work closely with legal counsel to ensure compliance with all relevant securities laws and regulations. Once the due diligence is complete, the CMIB team works with the company to prepare the offering documents, which include a prospectus (for public offerings) or a private placement memorandum (for private placements).

Next, the CMIB team markets the offering to potential investors. This typically involves distributing the offering documents and holding meetings with institutional investors to discuss the company and its prospects. The CMIB team also plays a key role in managing the book-building process, which involves collecting indications of interest from investors and allocating shares based on demand. Finally, the CMIB team works with the company to price the offering and execute the transaction.

Why does CMIB matter? The answer lies in its fundamental role in facilitating economic growth and innovation. By connecting companies with capital, CMIB enables businesses to invest in new projects, expand their operations, and create jobs. It also allows investors to participate in the growth of promising companies and earn returns on their investments.

Furthermore, CMIB plays a crucial role in maintaining the efficiency and stability of the financial markets. By providing a mechanism for companies to raise capital in a transparent and regulated manner, CMIB helps to ensure that capital is allocated to its most productive uses. This promotes economic growth and prosperity. The capital markets also provide valuable price signals, reflecting investors' expectations for the future performance of companies and the overall economy.

The impact extends beyond individual companies and investors. A healthy capital market, fostered by CMIB activities, is essential for a vibrant economy. It supports job creation, technological advancement, and overall economic prosperity. CMIB's role in allocating capital efficiently contributes to a more robust and resilient financial system.

However, it’s also important to acknowledge the potential risks associated with CMIB. The process of raising capital can be complex and costly, and there is always the risk that an offering may not be successful. Market volatility, regulatory changes, and unforeseen events can all impact the success of a capital markets transaction. Therefore, it is essential for companies to work with experienced and reputable CMIB professionals who can provide sound advice and navigate the complexities of the capital markets.

In conclusion, Capital Markets Investment Banking is a vital component of the financial ecosystem. It acts as a critical bridge between companies seeking capital and investors seeking returns. By facilitating the efficient allocation of capital, CMIB fuels economic growth, supports innovation, and contributes to a more prosperous society. While challenges and risks exist, the fundamental role of CMIB in connecting capital with opportunity remains indispensable. Therefore, understanding CMIB is not just for finance professionals, but for anyone seeking to understand the dynamics of the modern economy.