As the sun set over the city, the world watched with anticipation as Mike Tyson, the legendary former heavyweight champion, stepped into the spotlight once more. While his ring days may be behind him, the financial influence of this iconic figure still resonates across industries, particularly in the realm of investments and asset management. Tyson's journey from a prodigious athlete to a multifaceted businessman offers a compelling case study for understanding how to leverage legacy and diversification in modern investing.

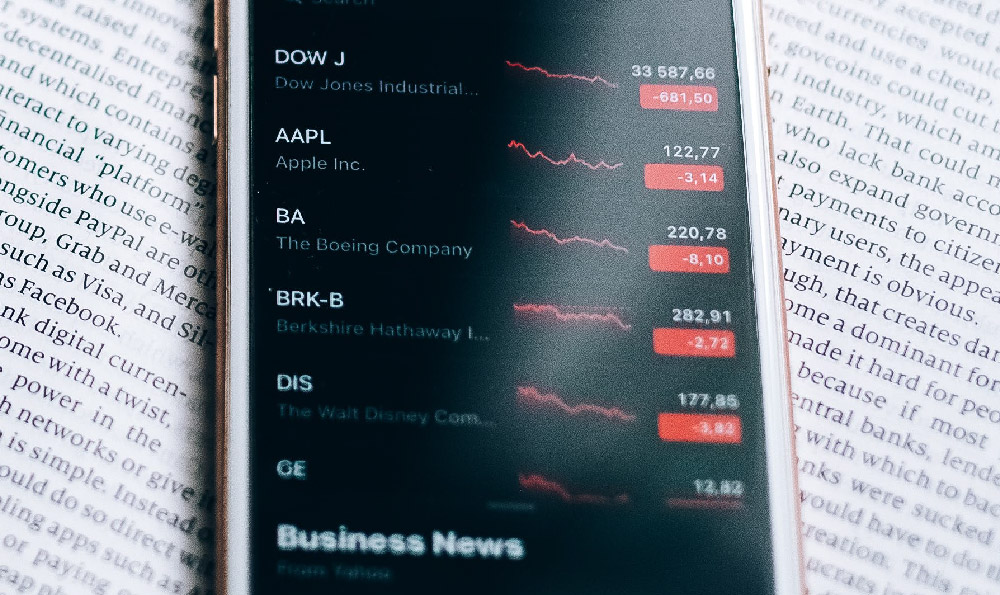

Tyson's career was marked by an ability to capitalize on his name and reputation, a strategy that echoes the principles of investing in high-visibility assets. In the early days, his earnings were primarily tied to boxing, where he earned millions through ring fees, bonuses, and sponsorships. However, as his career evolved, Tyson recognized the importance of diversifying income streams, a lesson applicable to any investor seeking to mitigate risk. By expanding into ventures such as media, brand deals, and even ventures into the world of cryptocurrency, Tyson demonstrated an understanding of how to harness his influence for financial gain.

The transition from traditional income sources to alternative investments highlights a key insight for modern investors: the value of a brand or reputation can be monetized in multiple ways. Tyson's foray into the world of cryptocurrency, while not widely publicized, serves as a metaphor for how investors can explore emerging markets with strategic foresight. Just as Tyson's legacy allowed him to negotiate lucrative deals beyond boxing, savvy investors can position themselves to benefit from the growth of digital assets by understanding their underlying value and potential for appreciation.

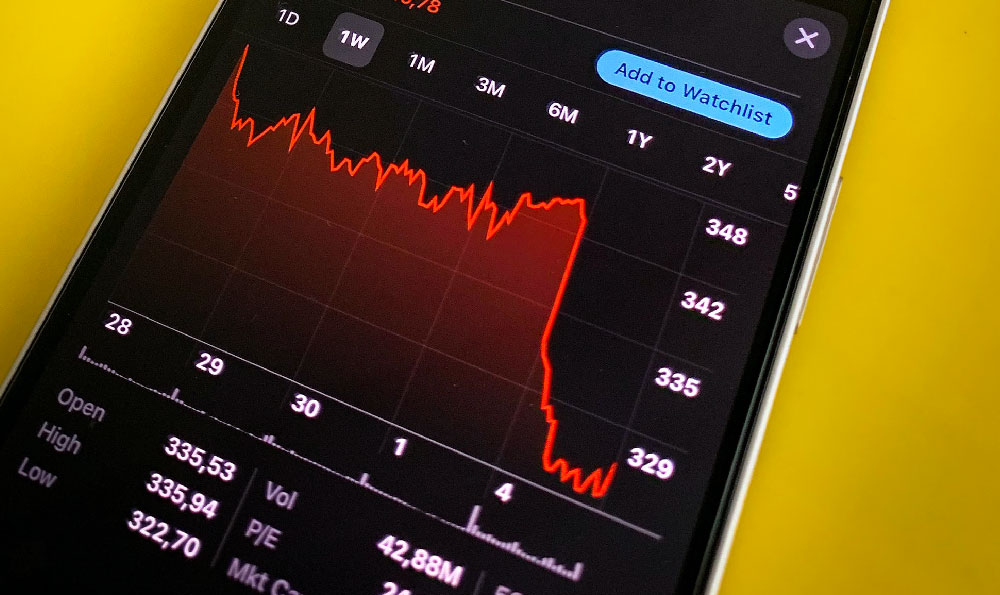

In the world of investments, as in sports, the ability to adapt is crucial. Tyson's career was not without its challenges—personal struggles, legal issues, and the inevitable decline of peak athletic performance. Yet, his resilience in navigating these obstacles mirrors the importance of having a diversified portfolio to protect against market fluctuations. By investing in various sectors, including stocks, real estate, and digital currencies, investors can create a more stable financial foundation, much like Tyson did by developing a multifaceted career.

The enduring relevance of Tyson's name also speaks to the power of long-term wealth management. Even as his boxing career waned, the value of his brand continued to grow through media appearances, book deals, and brand partnerships. This underscores the importance of investing in assets that have the potential for sustained value, such as blue-chip stocks, index funds, or cryptocurrencies with strong fundamentals and community support. The key to success lies in identifying assets that are not only profitable in the short term but also have the potential for long-term growth.

Furthermore, Tyson's public persona and the way he managed his wealth provide valuable lessons for investors about the importance of transparency and accountability. In an era where investing in digital assets often involves navigating complex ecosystems and regulatory landscapes, the ability to maintain clear financial records and communicate effectively with stakeholders is essential. Tyson’s experiences with public scrutiny and financial mismanagement can serve as cautionary tales, reminding investors to prioritize responsible investment practices and risk management strategies.

The connection between Tyson's financial trajectory and the world of investments is further strengthened by the concept of emotional intelligence. Just as Tyson learned to control his emotions during high-stakes matches, investors must cultivate the discipline to avoid making impulsive decisions based on market volatility or hype. This involves setting clear investment goals, maintaining a long-term perspective, and resisting the urge to chase quick profits, all of which are critical in the unpredictable world of cryptocurrency and other high-risk investments.

In addition, Tyson’s ability to stay relevant beyond his athletic prime illustrates the importance of continuous learning and adaptation in investment strategies. The world of finance, much like the world of sports, is constantly evolving, and staying ahead requires a commitment to education and innovation. Whether it's mastering new technologies in the digital asset space or understanding the nuances of market cycles, investors who embrace lifelong learning are better positioned to make informed decisions and capitalize on opportunities.

Ultimately, Tyson’s financial journey serves as a testament to the value of strategic thinking, diversification, and long-term planning in any investment endeavor. While his story is rooted in sports, the principles he applied to managing his wealth are universally applicable to investors seeking to grow their assets and navigate financial risks. By studying the successes and challenges of individuals like Tyson, investors can gain valuable insights into how to build a resilient financial future, whether through traditional markets or the dynamic world of cryptocurrency.

In conclusion, the lessons drawn from Mike Tyson’s financial experiences extend far beyond the boxing ring, offering a roadmap for navigating the complexities of modern investing. By focusing on diversification, long-term planning, and responsible financial management, investors can replicate the kind of success that Tyson achieved, ensuring their wealth grows sustainably in an ever-changing economic landscape.