When it comes to part-time shifts, the duration can vary significantly depending on the type of work, industry, employer, and the individual’s personal circumstances. Unlike full-time employment, which generally involves a consistent schedule of 40 hours per week, part-time roles often offer more flexibility, allowing workers to adjust their hours to fit around other commitments. This flexibility can be both a blessing and a challenge, as it requires careful consideration of how much time should be dedicated to such work to maximize productivity without compromising other aspects of life, including savings and investments.

The average daily hours for part-time shifts typically range from 3 to 6 hours, though this can fluctuate based on specific factors. In many cases, part-time roles are structured to accommodate students, caregivers, or individuals seeking supplemental income. For example, a retail store might require employees to work 8 hours per day, 2 to 3 days a week, translating to about 16 to 24 hours weekly. Conversely, a freelance writer might focus on 3 to 4 hours per day, 5 days a week, giving them more control over their schedule while still meeting professional demands. The variability in work patterns highlights the importance of understanding the nature of the job before committing to a part-time arrangement.

In certain industries, part-time shifts may align with operational cycles or seasonal demand. For instance, hospitality and event staffing often experience peaks during holidays, festivals, or weekends, requiring workers to sign up for longer hours during these periods. In contrast, roles in education, such as tutoring or teaching assistant positions, might involve more consistent schedules, with shifts lasting 3 to 4 hours per day, 5 days a week. Similarly, technology and remote work sectors may offer part-time opportunities with more flexible timeframes, allowing individuals to work from home or during off-peak hours. These differences underscore the idea that part-time work is not a one-size-fits-all solution but rather a customizable option that depends on the specific demands of the job market.

The flexibility of part-time shifts also extends to how they are compensated. Some employers offer hourly wages, while others might provide piece-rate pay or commission-based structures. This can influence the number of hours an individual chooses to work, as they may prioritize jobs with higher pay rates even if the hours are longer. For example, a part-time sales role at a retail store might pay more per hour than a customer service position, prompting workers to dedicate more time to the former despite its greater intensity. However, it is crucial to strike a balance between earning potential and personal well-being, as overworking can lead to burnout and negatively impact long-term financial goals.

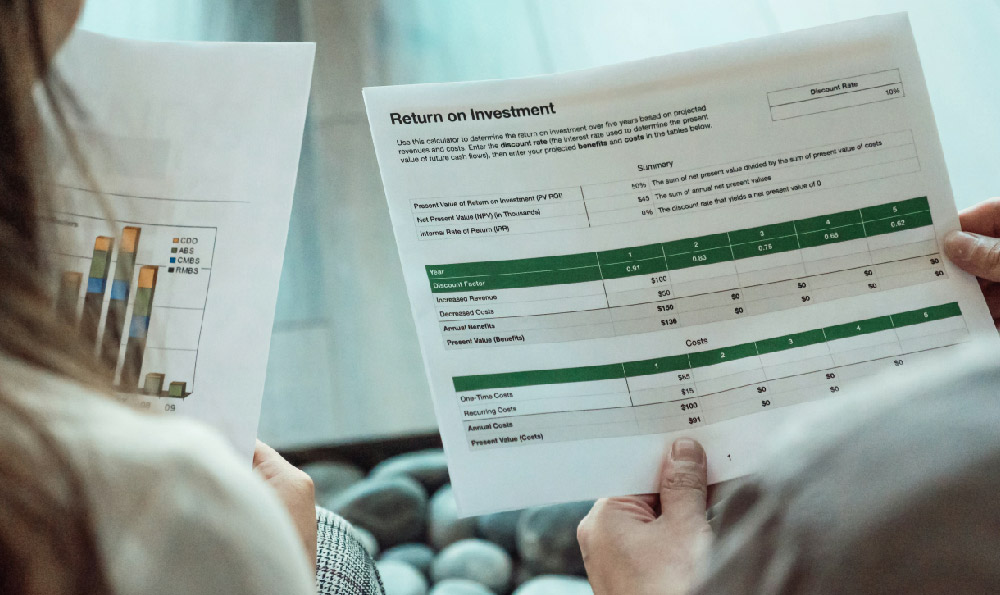

In terms of financial planning, part-time shifts can play a pivotal role in shaping an individual’s capacity to save and invest. If a part-time job requires only 3 to 4 hours per day, the additional time available can be leveraged to explore investment opportunities, whether through compound interest, asset diversification, or passive income streams. On the other hand, if the hours are more demanding, such as 6 to 8 hours per day, the individual must ensure that their savings plans remain aligned with their newfound income. For example, a person working 30 hours per week as a part-time teacher might allocate 10% of their monthly earnings to a retirement account, while someone with a 20-hour weekly role could direct more funds toward emergency savings or high-yield savings accounts.

The key to optimizing part-time work lies in evaluating the trade-offs between income, time, and financial priorities. In some cases, part-time jobs may be temporary, such as during academic breaks or while searching for a full-time role, requiring careful budgeting to ensure that expenses do not outpace the income earned. For instance, a student working part-time during summer might focus on maximizing their savings by minimizing spending on non-essentials, while someone transitioning between careers might prioritize investing in skills development to enhance their long-term earning potential.

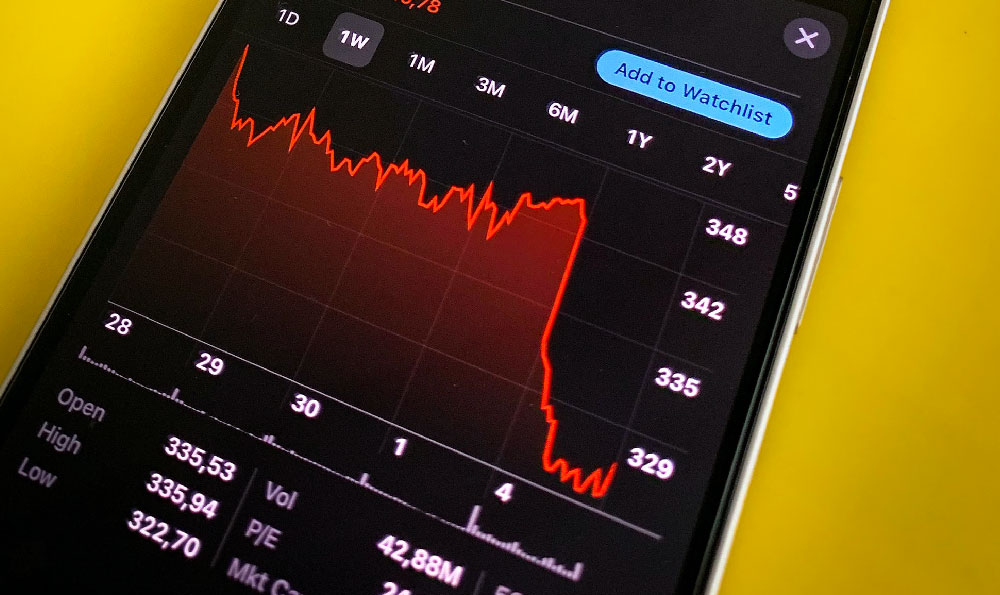

Ultimately, the decision about how long part-time shifts should last depends on the individual’s unique goals and circumstances. For those aiming to build a foundation for wealth, it is advisable to allocate consistent hours without overextending themselves, ensuring that there is enough time to review and adjust their investment strategies. This could mean setting aside 15 minutes daily to check financial news, 30 minutes weekly to review portfolio performance, or dedicating weekends to researching new investment opportunities. By aligning their part-time work schedule with their financial aspirations, individuals can create a balanced approach that supports both immediate needs and long-term financial stability.