Okay, I'm ready. Here's an article, in English, based on the prompt you provided:

The intense scrutiny surrounding Nancy Pelosi's investment portfolio has transformed it from a private matter into a subject of public fascination. While directly mimicking any individual's investment strategy is rarely, if ever, advisable without understanding their specific circumstances and risk tolerance, analyzing the patterns and reports surrounding her holdings can offer valuable insights into potential investment themes and strategic approaches. It's crucial to remember that successful investing requires independent research, due diligence, and a deep understanding of one's own financial goals and risk appetite. Let's delve into potential strategies and considerations based on observations of reports surrounding Pelosi's investments.

One frequently cited characteristic of her portfolio is its apparent concentration in the technology sector. Publicly available information, though often delayed and subject to reporting requirements, suggests significant holdings in companies like Nvidia, Apple, and other prominent tech giants. This inclination towards technology highlights the potential for growth in the sector, particularly given the ongoing digital transformation across various industries. However, it's crucial to recognize that the technology sector can be volatile and sensitive to factors like interest rate hikes, regulatory changes, and evolving consumer preferences. Before allocating a significant portion of one's portfolio to technology stocks, a thorough assessment of market conditions, company fundamentals, and potential disruptive forces is paramount. Diversification within the technology sector, spreading investments across different sub-sectors like cloud computing, artificial intelligence, and cybersecurity, can help mitigate risk. Furthermore, understanding the specific competitive advantages and long-term growth prospects of individual companies within the sector is crucial for making informed investment decisions.

Beyond specific sectors, the reported frequency of options trading within Pelosi's portfolio has also drawn considerable attention. Options contracts offer the potential for leveraged gains, allowing investors to control a large number of shares with a relatively small initial investment. However, they also carry a significant risk of loss, as the value of an option can decline rapidly if the underlying asset does not move in the anticipated direction within a specified timeframe. Options trading requires a sophisticated understanding of market dynamics, risk management principles, and the mechanics of option pricing. Novice investors should avoid options trading altogether or, at the very least, start with small, well-researched positions and a clear understanding of the potential downside. Simulating option trades using paper trading platforms can be a valuable way to gain experience and refine strategies without risking real capital. It's also essential to establish clear profit targets and stop-loss orders to manage risk effectively. The use of more complex options strategies, such as spreads and straddles, requires an even deeper understanding of market volatility and correlation.

Another element to consider is the timing of reported transactions. While legal reporting requirements mandate the disclosure of trades, there is often a delay between the transaction date and the public disclosure, which renders mirroring a specific trade at the exact same price practically impossible. However, analyzing the general investment themes and sectors favored in these reports may still be useful. For example, if several reports indicate an increase in investments in renewable energy companies, this could be a signal to research the sector more thoroughly and identify promising investment opportunities. Furthermore, paying attention to the rationale behind investment decisions, as reported by news outlets and financial analysts, can provide valuable context. Understanding the factors that influence investment decisions, such as government policies, technological advancements, or macroeconomic trends, is crucial for making informed investment choices.

Furthermore, it's important to consider the potential influence of insider information, even if it is not explicitly illegal. Members of Congress and their spouses may have access to non-public information that could inform their investment decisions. While strict laws prohibit trading on material non-public information, the ethical implications of investing in sectors that are directly impacted by legislative decisions are complex. Retail investors lack this access to information, making direct mirroring an inherently unequal game. Focus instead on broader trends and fundamentals.

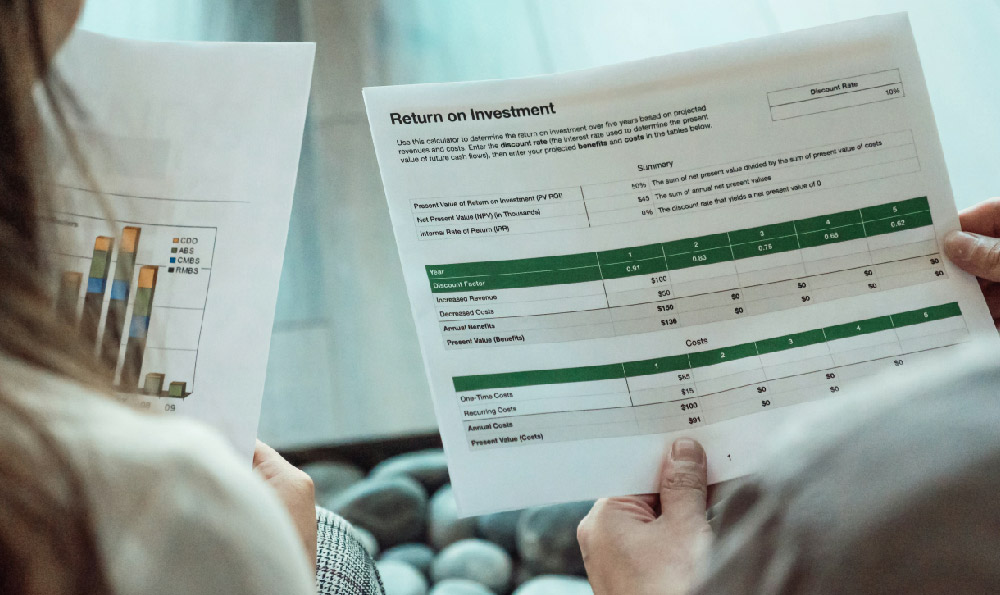

Finally, and perhaps most importantly, remember that investment strategies should be tailored to individual circumstances. Factors like age, income, risk tolerance, and investment goals should all play a crucial role in shaping investment decisions. A young investor with a long time horizon may be able to tolerate more risk than a retiree seeking to preserve capital. Before making any investment decisions, it's advisable to consult with a qualified financial advisor who can help assess your individual needs and develop a personalized investment plan. A financial advisor can also provide guidance on asset allocation, diversification, and risk management.

In conclusion, while the intense interest in Pelosi's investments offers potential clues to investment themes, direct mirroring is unrealistic and potentially risky. A more prudent approach involves analyzing the underlying trends, conducting thorough research, understanding one's own risk tolerance, and seeking professional financial advice. Focusing on fundamental analysis, diversification, and long-term investing principles is far more likely to lead to sustainable investment success than attempting to replicate the reported trades of any individual, regardless of their public profile. Remember that the key to successful investing is not imitation, but informed decision-making based on a sound understanding of financial principles and market dynamics.