Real estate passive income with no money appears to be a dream that many people chase, yet is often dismissed as unattainable. The truth is, the real estate market offers several innovative avenues for individuals to generate stable cash flow without direct capital outlay. These strategies rely on creative financing, leveraging opportunities, and understanding the nuances of real estate investment ecosystems. By exploring these unconventional paths, even those with limited capital can tap into the lucrative potential of real estate without being tethered to traditional homeownership models.

One of the most viable strategies for creating real estate passive income with no upfront money is to leverage the structures of rental platforms and short-term leasing agreements. For instance, platforms like Airbnb enable individuals to rent out their existing properties for short-term stays, effectively transforming their housing equity into a revenue stream. This approach can be applied to primary residences, vacation homes, or even undeveloped land that is rented out as storage space or for seasonal use. The key is to identify niche markets where demand is consistent, such as in cities with high tourism activity or regions with favorable climate conditions. By optimizing online listings, managing guest interactions, and implementing smart cleaning and maintenance schedules, homeowners can automate the rental process to a significant extent. The scalability of this method is remarkable, as it allows individuals to expand their portfolio by renting out multiple properties simultaneously, regardless of location. However, the unpredictability of short-term rentals and the need for active management can pose challenges, making it essential to seek professional assistance in areas like marketing and property upkeep. This balance between automation and involvement can be critical in maintaining high occupancy rates while minimizing the time burden on investors.

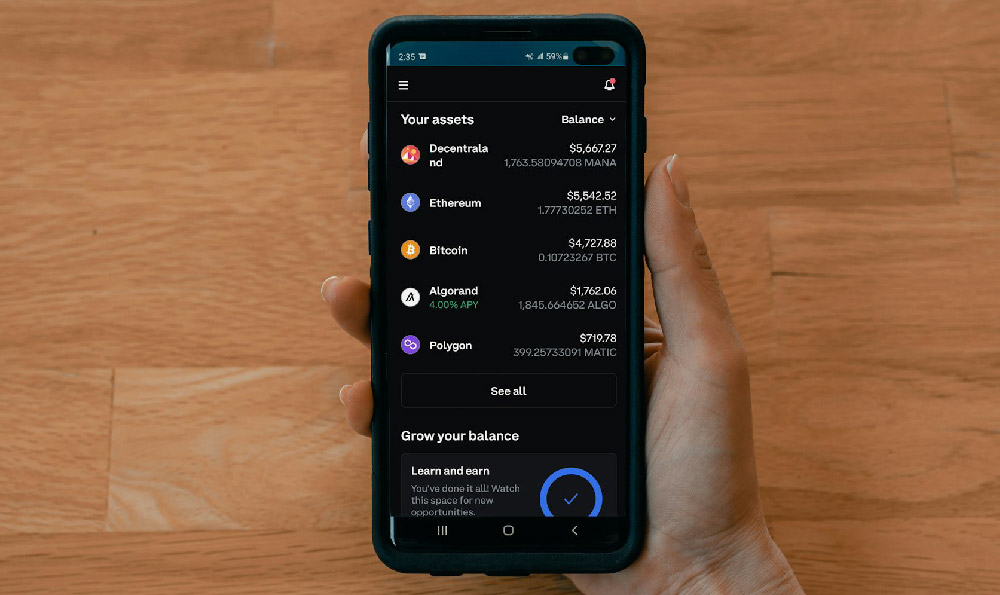

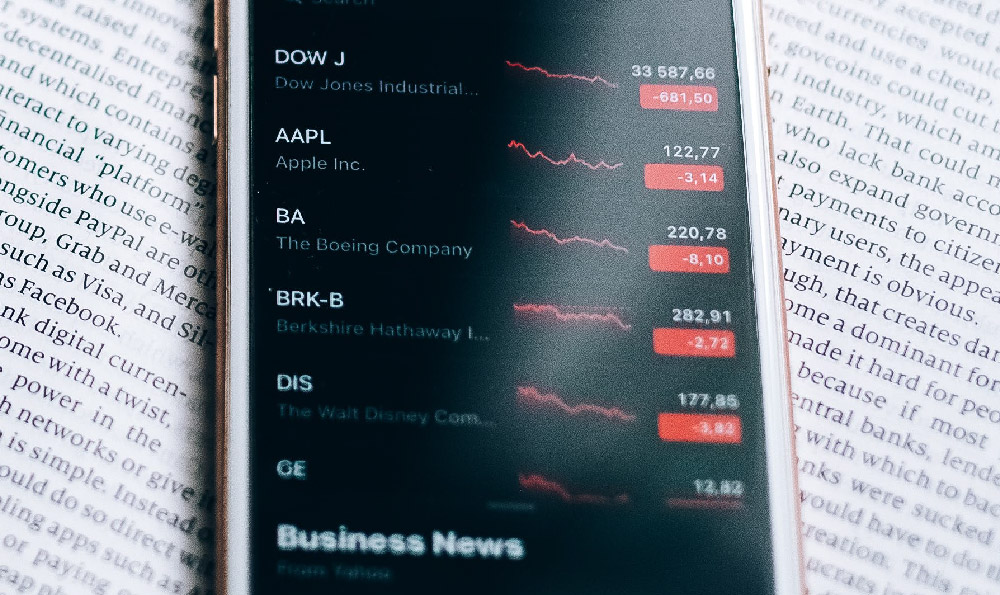

Another profitable avenue lies in the realm of real estate investment trusts (REITs), which democratize access to the real estate market. REITs are companies that own or finance income-generating real estate, and they operate as closed-end funds, allowing investors to buy shares in these entities without directly purchasing property. This method is particularly appealing for those who lack the initial capital required for property acquisition, as REITs enable investment in diversified portfolios spanning various sectors like commercial buildings, apartments, and industrial properties. The advantages of this strategy are manifold; it requires minimal upfront investment, provides passive income through regular dividends, and offers liquidity as shares can be traded on the stock exchange. Additionally, REITs are subject to strict regulations that ensure transparency and consistency, making them a relatively safer option compared to other real estate ventures. However, the lack of direct control over the properties and the reliance on the management team's expertise mean that investors must conduct thorough research on the REITs they consider. The market's dynamic nature means that selecting the right REITs requires an understanding of factors such as interest rates, economic cycles, and property sector performance. A combination of diversification and careful monitoring can help mitigate risks while maximizing long-term returns.

For investors looking to minimize their financial risk, partnering with others or investing in real estate crowdfunding platforms presents an effective solution. Collaborative property investments allow individuals to pool their resources with friends, family, or other investors, reducing the capital required and spreading financial responsibilities. This strategy often involves dividing the property costs, such as taxes and maintenance, among partners and establishing a clear profit-sharing agreement. The flexibility of this method is striking, as it enables participation in high-value projects without the need for a large initial investment. Additionally, crowdfunding platforms like Fundrise or RealtyMogul have emerged as a powerful tool, enabling small-scale investors to contribute to large development projects or buy shares in real estate ventures. These platforms operate by aggregating small investments from multiple individuals, enabling the purchase of properties that would otherwise be beyond their reach. The benefits include access to professional management, diversified portfolios, and the ability to scale investment without significant capital outlay. However, the success of these strategies depends on due diligence, as the performance of the underlying assets is influenced by factors such as market trends, property location, and the credibility of the managing entities. Investors must ensure they select platforms with a proven track record and transparent management practices to minimize financial exposure.

For those seeking a more hands-off approach, offsetting the initial costs by renting out spaces for rental income without direct ownership is another strategic option. This method involves leasing out a property for rental purposes, thereby covering the costs of maintenance and property taxes through rental income. The versatility of this strategy is evident as it can be applied to a wide range of properties, from single-family homes to commercial spaces, depending on the target market and the investor's capacity for managing such operations. The advantages include financial independence from depreciation risk and the ability to maintain a consistent cash flow. However, the maintenance of such properties requires focused attention, as the need for regular upkeep directly affects the quality of the rental experience. Engaging professional management services can help alleviate this concern, allowing investors to focus on other aspects of their financial strategy while ensuring the property remains profitable.

The allure of real estate passive income with no money is rooted in the ability to amplify returns through innovative approaches. These strategies empower individuals to manipulate the dynamics of the market, combining creativity with financial discipline to achieve their investment goals. By exploring various methods such as leveraging rental platforms, investing in REITs, partnering for collaborative projects, and utilizing crowdfunding opportunities, individuals can navigate the real estate landscape with minimal capital. This path demands a balance of careful planning, implementation of smart management practices, and a commitment to continuous learning. The result is a diverse set of opportunities that cater to different risk tolerance levels, investment capacities, and personal preferences, making real estate a viable tool for generating passive income even in the absence of significant upfront capital.