Okay, I understand. Here's an article addressing the topic of making good money and exploring various potential avenues, written in English and avoiding numbered lists or direct repetition of the title, while aiming for comprehensive coverage:

Making substantial income is a goal shared by many, yet the path to achieving it varies wildly depending on individual circumstances, risk tolerance, and long-term aspirations. There's no magic formula, no guaranteed shortcut, but rather a spectrum of strategies that can be tailored to fit different profiles. A crucial initial step involves honestly assessing your current financial situation, including income, expenses, debts, and assets. Understanding your baseline is paramount for informed decision-making.

One of the most fundamental approaches to increasing income is, naturally, optimizing your existing employment. This encompasses several tactics. First, actively pursue opportunities for professional development and skill enhancement. Investing in certifications, workshops, or advanced degrees can significantly boost your market value and qualify you for higher-paying positions within your current company or elsewhere. Demonstrate your value to your employer by consistently exceeding expectations, taking on challenging projects, and proactively seeking solutions to problems. Don't be afraid to negotiate for a raise or promotion when you've demonstrably contributed to the company's success. Regularly research industry standards for your role and experience level to ensure your compensation is competitive. Networking within your industry can also open doors to better opportunities. Building relationships with colleagues, attending conferences, and engaging in online forums can provide valuable insights and connect you with potential employers.

Beyond traditional employment, exploring entrepreneurial ventures can offer a path to significantly higher income, though it also comes with greater risk. Starting a business requires careful planning, market research, and a solid understanding of finances. Identifying a need or gap in the market is essential. This could involve developing a new product or service, improving an existing one, or catering to a specific niche audience. A comprehensive business plan is crucial, outlining your business goals, target market, marketing strategy, and financial projections. Securing funding can be a challenge, and options include bootstrapping (using your own savings), seeking loans from banks or credit unions, or attracting investors through venture capital or angel investment. The legal and regulatory aspects of starting a business must also be considered, including registering your business, obtaining necessary licenses and permits, and complying with relevant laws. E-commerce presents a particularly accessible entry point for many aspiring entrepreneurs. Platforms like Shopify, Etsy, and Amazon Marketplace provide tools and resources to create and manage online stores with relative ease. Identifying in-demand products or services and building a strong online presence are key to success in the e-commerce space.

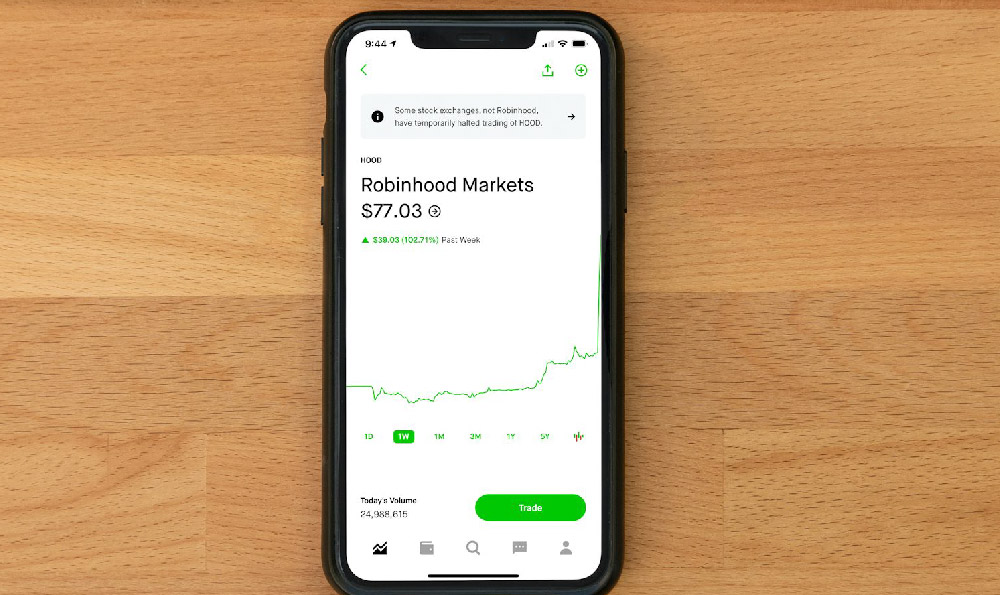

Investing is another critical component of long-term wealth accumulation. However, it's vital to understand the inherent risks involved and to diversify your portfolio accordingly. Investing in the stock market can offer significant returns over time, but it also carries the risk of losing money. Investing in established companies with a proven track record can mitigate some of this risk, but it's still important to do your research and understand the company's financials. Index funds and ETFs (Exchange Traded Funds) provide a diversified way to invest in the stock market without having to pick individual stocks. Bonds are generally considered to be less risky than stocks, but they also offer lower returns. Bonds are essentially loans to governments or corporations, and they pay a fixed interest rate over a set period of time. Real estate can be a lucrative investment, but it requires significant capital and ongoing maintenance. Rental properties can generate passive income, but they also come with the responsibilities of managing tenants and dealing with repairs. Investing in REITs (Real Estate Investment Trusts) can provide exposure to the real estate market without having to directly own property. Cryptocurrency has emerged as a potential investment opportunity, but it's highly volatile and speculative. Investing in cryptocurrency should only be done with money you can afford to lose, and it's important to do your research and understand the risks involved. Before making any investment decisions, consult with a qualified financial advisor to discuss your individual circumstances and risk tolerance.

Beyond these core strategies, various side hustles and passive income streams can supplement your income. Freelancing offers opportunities to leverage your skills and expertise on a project-by-project basis. Online platforms connect freelancers with clients seeking services in areas such as writing, graphic design, web development, and virtual assistance. Creating and selling online courses or ebooks can generate passive income if you have expertise to share. Affiliate marketing involves promoting other companies' products or services and earning a commission on sales. Starting a blog or YouTube channel can also generate income through advertising, sponsorships, and affiliate marketing.

No matter which path you choose, consistency and discipline are essential. Building wealth takes time and effort, and there will inevitably be setbacks along the way. Sticking to your financial plan, avoiding impulsive spending, and continuously learning about personal finance are key to achieving long-term financial success. Moreover, consider consulting with a financial advisor to develop a personalized strategy aligned with your specific goals and risk tolerance. Financial advisors can provide valuable guidance on investment management, retirement planning, and tax optimization. The pursuit of financial well-being is a marathon, not a sprint, demanding patience, resilience, and a commitment to continuous improvement.