Okay, I'm ready. Here's an article on the profitability of Bitcoin mining, aiming for depth, readability, and avoiding excessive bullet points or numbered lists.

How Much Can You Make Mining Bitcoins? Is It Still Profitable?

The allure of Bitcoin mining – the digital-era equivalent of striking gold – continues to capture the imagination of many. The idea of using powerful computers to solve complex cryptographic puzzles and being rewarded with freshly minted Bitcoin is undeniably attractive. But beneath the surface of this seemingly simple proposition lies a complex web of factors that determine whether Bitcoin mining is still a viable and, more importantly, a profitable endeavor.

The fundamental principle behind Bitcoin mining is to secure the Bitcoin network and verify transactions. Miners essentially compete to solve a mathematical problem, and the first to find the solution adds the next block to the blockchain. As a reward for this work, the successful miner receives a certain amount of Bitcoin, along with transaction fees included in the block. This "block reward" is what incentivizes miners to dedicate resources to the network.

However, the block reward isn't static. Bitcoin is designed to undergo "halving" events approximately every four years. These halvings reduce the block reward by 50%, effectively cutting the amount of new Bitcoin entering circulation. Initially, the block reward was 50 BTC per block. After subsequent halvings, it's currently 6.25 BTC. The next halving, projected for 2024, will further reduce this to 3.125 BTC. This built-in scarcity mechanism is a key driver of Bitcoin's long-term value proposition, but it also directly impacts mining profitability.

Beyond the block reward, transaction fees also contribute to a miner's earnings. These fees are paid by users to prioritize their transactions in the next block. During periods of high network activity, transaction fees can surge significantly, providing a substantial boost to miner revenue. Conversely, during periods of low activity, transaction fees might be relatively insignificant.

Calculating the potential profit from Bitcoin mining requires a careful consideration of several key variables. The first, and arguably most crucial, is the cost of electricity. Mining requires significant computational power, which translates to substantial electricity consumption. The cost of electricity varies widely depending on location, ranging from very cheap renewable energy sources to expensive grid power. A miner with access to cheap electricity has a significant advantage over someone paying higher rates.

Next is the cost of mining hardware. Specialized computers called ASICs (Application-Specific Integrated Circuits) are specifically designed for Bitcoin mining. These machines are incredibly powerful but also relatively expensive, and their efficiency constantly improves with new generations. A miner needs to invest in the latest, most efficient hardware to remain competitive. The initial investment in hardware can be substantial, and the lifespan of these machines is limited as newer models become more efficient.

The hash rate, a measure of the computational power dedicated to the network, also plays a critical role. As more miners join the network, the difficulty of solving the cryptographic puzzles increases. This means that a miner needs more powerful hardware and consumes more electricity to maintain their chances of successfully mining a block. The higher the network hash rate, the lower the probability of an individual miner finding a block.

Another important factor is the pool fees. Individual miners rarely mine solo. Instead, they join mining pools, which combine their computational power to increase their chances of finding a block. When the pool finds a block, the reward is shared proportionally among the pool members, minus a small fee charged by the pool operator. While joining a pool reduces variance in earnings, it also comes with a cost.

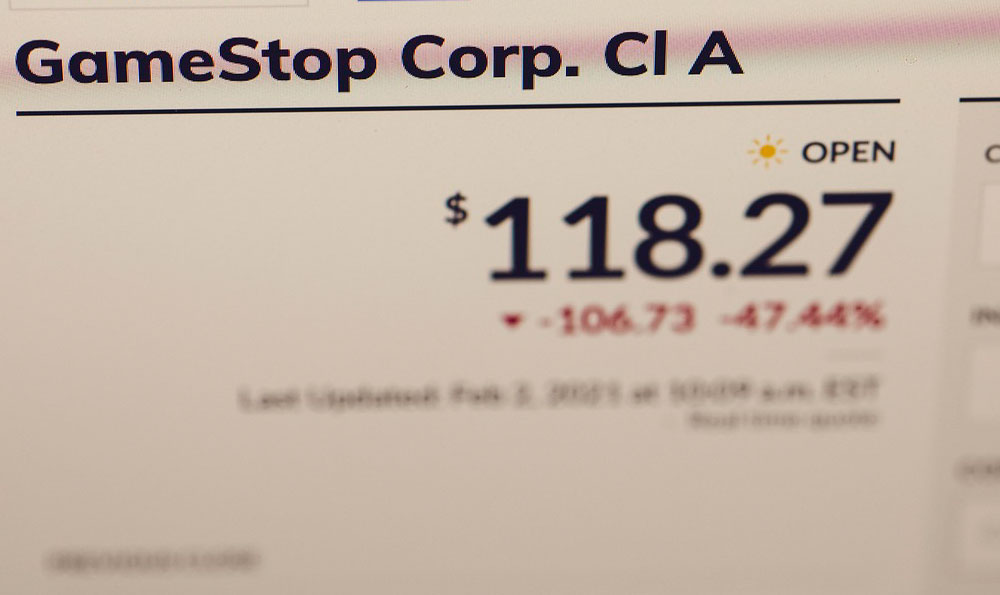

Finally, the price of Bitcoin itself is the ultimate determinant of profitability. Even if a miner has low electricity costs and efficient hardware, if the price of Bitcoin is too low, the revenue generated from mining may not cover the expenses. Bitcoin's price volatility adds another layer of complexity to the equation. A miner might be profitable at one price level but unprofitable at another.

So, is Bitcoin mining still profitable? The answer is a resounding "it depends." It depends on electricity costs, hardware costs, the network hash rate, pool fees, and, most importantly, the price of Bitcoin. It also depends on a miner's operational efficiency and their ability to adapt to changing market conditions.

For individuals or small businesses with limited capital and access to expensive electricity, Bitcoin mining is unlikely to be a profitable endeavor. The high upfront costs of hardware, the intense competition, and the volatility of Bitcoin's price make it a risky proposition.

However, for large-scale mining operations with access to cheap electricity and significant capital, Bitcoin mining can still be profitable. These operations often locate their facilities in areas with abundant renewable energy sources, such as hydroelectric or geothermal power. They also invest in the latest, most efficient hardware and employ sophisticated strategies to optimize their operations.

Looking to the future, the profitability of Bitcoin mining will likely become increasingly challenging as the block reward continues to decrease with each halving. Miners will need to become even more efficient and innovative to remain competitive. The increasing reliance on renewable energy sources and the development of more energy-efficient mining hardware will be crucial for the long-term sustainability of the Bitcoin network. Furthermore, the reliance on transaction fees will likely increase significantly, making the ability to prioritize transactions a more valuable aspect of mining.

In conclusion, while the dream of easy profits from Bitcoin mining may be alluring, the reality is far more complex. The industry is becoming increasingly competitive and requires significant capital, technical expertise, and a deep understanding of the Bitcoin ecosystem. For those who are willing to do their research, understand the risks, and invest in the necessary infrastructure, Bitcoin mining can still be a profitable endeavor. But for most individuals, it's a venture best left to the professionals.