Investing your money wisely is a crucial step towards building long-term wealth and achieving financial security. The path to generating the biggest returns isn't a one-size-fits-all solution; it depends heavily on your individual circumstances, risk tolerance, time horizon, and financial goals. A young professional with decades to invest can afford to take on more risk than someone nearing retirement. Similarly, someone with a high savings rate can recover from losses more easily than someone who struggles to save. To effectively guide you, let's break down the key considerations and strategies to explore.

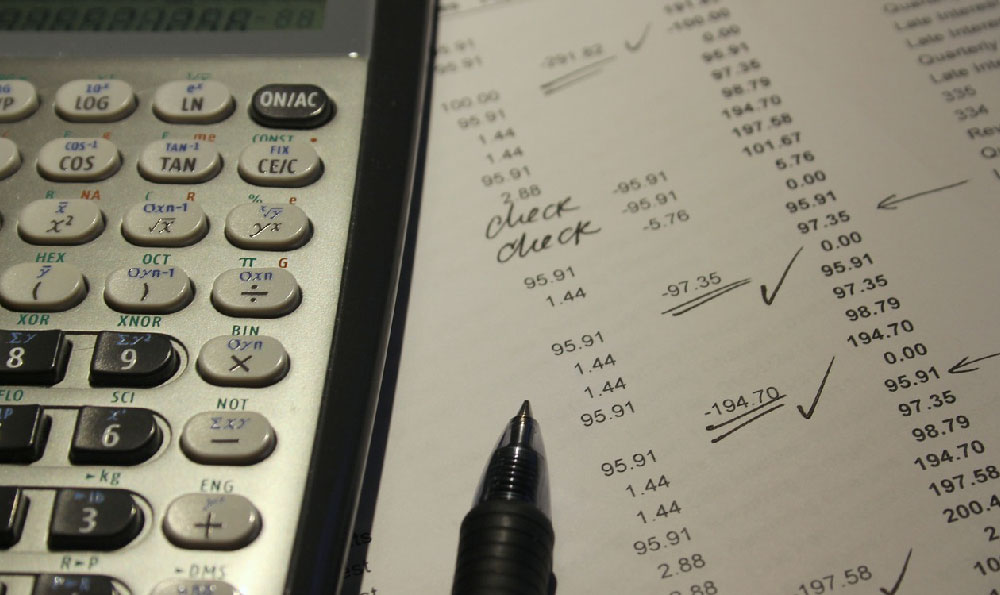

Before diving into specific investment options, it's essential to establish a solid financial foundation. This involves assessing your current financial situation, including your income, expenses, debts, and assets. Creating a budget helps you understand where your money is going and identify areas where you can save more. Paying down high-interest debt, such as credit card balances, should be a priority, as the interest paid on debt can significantly erode your investment returns. Building an emergency fund that covers 3-6 months of living expenses is also critical. This provides a safety net in case of unexpected events like job loss or medical emergencies, preventing you from having to dip into your investments prematurely.

Once your financial house is in order, you can start exploring different investment options. Let's start with the foundations. Stocks, representing ownership in companies, have historically provided the highest returns over the long term. However, they also come with higher volatility, meaning their value can fluctuate significantly in the short term. Bonds, on the other hand, are debt instruments issued by governments or corporations. They typically offer lower returns than stocks but are considered less risky. Real estate can provide both rental income and capital appreciation, but it also requires significant upfront investment and ongoing maintenance.

Diversification is a cornerstone of successful investing. Spreading your investments across different asset classes, industries, and geographic regions can help reduce risk. This means not putting all your eggs in one basket. If one investment performs poorly, the others can help offset the losses. A well-diversified portfolio might include a mix of stocks, bonds, real estate, and potentially alternative investments like commodities or private equity.

Within the stock market, you can choose to invest in individual stocks or through mutual funds and exchange-traded funds (ETFs). Investing in individual stocks requires significant research and analysis to identify companies with strong growth potential. Mutual funds and ETFs offer instant diversification by holding a basket of stocks or bonds. Mutual funds are actively managed by professional fund managers who aim to outperform the market, while ETFs are typically passively managed and track a specific index, such as the S&P 500. ETFs generally have lower expense ratios than mutual funds, making them a cost-effective option for building a diversified portfolio.

Consider the power of dollar-cost averaging. This involves investing a fixed amount of money at regular intervals, regardless of the market price. When prices are low, you buy more shares, and when prices are high, you buy fewer shares. This strategy helps to smooth out the impact of market volatility and can potentially lead to higher returns over time. It also removes the emotional element of trying to time the market, which is notoriously difficult to do consistently.

Retirement accounts, such as 401(k)s and IRAs, offer tax advantages that can significantly boost your investment returns. Contributions to traditional 401(k)s and IRAs are tax-deductible, meaning you don't pay taxes on the money until you withdraw it in retirement. Roth 401(k)s and Roth IRAs offer tax-free withdrawals in retirement, but contributions are not tax-deductible. Take advantage of employer matching contributions in your 401(k), as this is essentially free money that can accelerate your wealth accumulation. Understanding the contribution limits and withdrawal rules for these accounts is essential for maximizing their benefits.

Beyond the basic asset classes, you might consider exploring alternative investments like real estate investment trusts (REITs), commodities, or even peer-to-peer lending. REITs allow you to invest in real estate without directly owning property. Commodities can provide a hedge against inflation, while peer-to-peer lending offers the potential for higher returns than traditional fixed-income investments. However, alternative investments typically come with higher risks and may be less liquid than traditional investments. Thoroughly research any alternative investment before committing your money.

It is impossible to guarantee the "biggest returns" without understanding your personal risk tolerance and investment goals. Seeking professional advice from a financial advisor can be invaluable. A qualified advisor can assess your individual circumstances, help you develop a personalized financial plan, and provide ongoing guidance to ensure you stay on track. They can also help you navigate complex investment strategies and avoid common pitfalls.

Stay informed about market trends and economic conditions. Read financial news, attend investment seminars, and consult with experts to stay abreast of the latest developments. The more you understand about the investment landscape, the better equipped you will be to make informed decisions. However, be wary of get-rich-quick schemes and promises of unrealistic returns. Investing is a long-term game, and patience and discipline are key to success. Remember that past performance is not necessarily indicative of future results, and all investments carry some degree of risk.

Continually review and rebalance your portfolio. As your investment goals and risk tolerance change over time, you may need to adjust your asset allocation. Rebalancing involves selling some assets that have performed well and buying others that have underperformed to maintain your desired asset allocation. This helps to ensure that your portfolio remains aligned with your goals and risk tolerance. Aim to rebalance your portfolio at least annually or whenever your asset allocation deviates significantly from your target.

Ultimately, the journey to financial success is a marathon, not a sprint. By establishing a solid financial foundation, diversifying your investments, taking advantage of tax-advantaged accounts, and seeking professional advice, you can increase your chances of achieving your financial goals and maximizing your long-term returns. Remember to stay disciplined, patient, and informed, and you will be well on your way to building a secure and prosperous future.