Investing in the share market, also known as the stock market, is a common way for individuals and institutions to grow their wealth over time. The potential for high returns attracts many, but it's crucial to understand the mechanics and risks involved before diving in. Whether you can make money from it depends on a multitude of factors, and there's no guarantee of profit. This exploration will delve into the how-to of share market investing and examine the viability of generating income.

The foundation of successful share market investing lies in understanding its basic concepts. The share market is essentially a marketplace where shares of publicly traded companies are bought and sold. When you buy a share, you are purchasing a small piece of ownership in that company. The value of that share fluctuates based on factors such as the company's performance, industry trends, and overall economic conditions. The goal is to buy shares at a lower price and sell them at a higher price, thereby making a profit. Dividends, which are portions of a company's profits distributed to shareholders, can also be a source of income, although not all companies pay them.

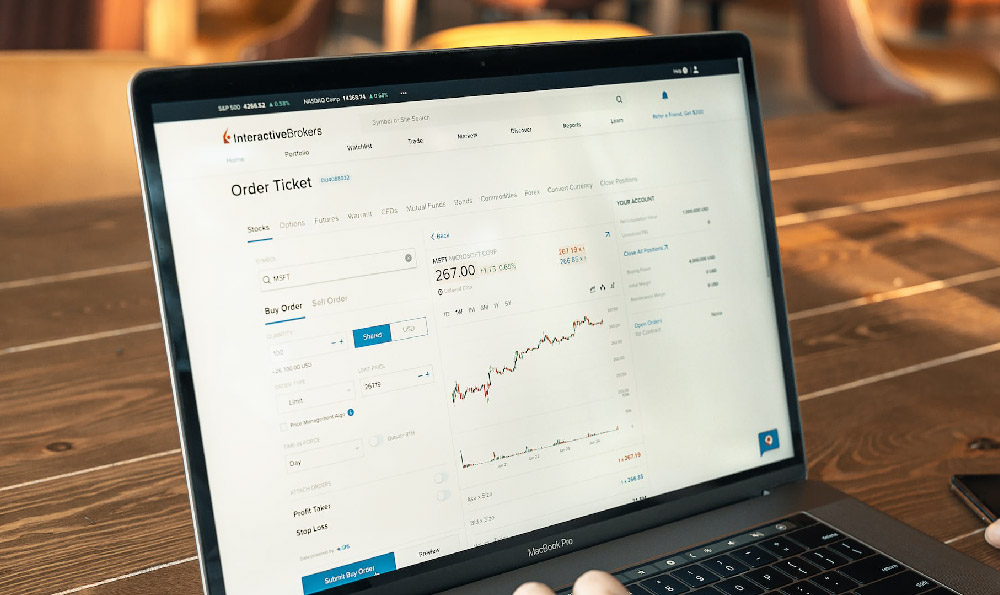

The first step in investing is opening a brokerage account. This is an account held with a financial institution that allows you to buy and sell shares on the stock market. There are many different types of brokerage accounts to choose from, so it's essential to research and find one that fits your needs and investment style. Considerations include the fees charged, the tools and research provided, and the level of customer support offered. Some brokers cater to active traders and offer sophisticated trading platforms, while others are geared towards long-term investors and provide automated investment services.

Once your account is set up, you need to decide what to invest in. There are several avenues to consider. Individual stocks involve researching and selecting specific companies to invest in. This requires a significant amount of time and effort to analyze company financials, industry trends, and competitive landscapes. It also carries the risk that a company you invest in may perform poorly, leading to losses. Another option is investing in mutual funds or Exchange-Traded Funds (ETFs). These are baskets of stocks (or other assets) that are managed by professionals. Mutual funds are actively managed, meaning the fund manager makes decisions on which stocks to buy and sell. ETFs, on the other hand, are typically passively managed and track a specific index, such as the S&P 500. Investing in mutual funds or ETFs offers diversification, which can reduce risk, as your investment is spread across many different companies.

Another crucial element of successful share market investing is understanding risk management. No investment is risk-free, and the share market can be volatile. It is important to only invest money that you can afford to lose, and to diversify your portfolio to reduce your overall risk. Diversification means spreading your investments across different asset classes, industries, and geographic regions. This helps to mitigate the impact of any single investment performing poorly. Furthermore, understanding your own risk tolerance is paramount. Are you comfortable with the possibility of losing a significant portion of your investment in exchange for the potential of higher returns, or do you prefer a more conservative approach with lower potential gains but also lower risk? Your risk tolerance should guide your investment decisions.

Developing a sound investment strategy is also crucial. This strategy should be based on your financial goals, time horizon, and risk tolerance. For example, if you are investing for retirement, you may have a longer time horizon and be able to tolerate more risk than if you are investing for a shorter-term goal, such as buying a house. Your investment strategy should also include a plan for rebalancing your portfolio periodically. Rebalancing involves adjusting your asset allocation to maintain your desired level of risk. Over time, some investments will likely outperform others, causing your portfolio to drift away from your target allocation. Rebalancing helps to keep your portfolio aligned with your investment goals and risk tolerance.

The possibility of making money in the share market is real, but it's essential to manage expectations. Historically, the stock market has provided strong returns over the long term, but there are periods of downturns and volatility. Building wealth through share market investing is typically a long-term game, requiring patience and discipline. Trying to get rich quick through speculative trading is often a recipe for disaster. Instead, focus on investing in quality companies or diversified funds and holding them for the long term.

There are numerous factors that can impact your ability to make money in the share market. These include market conditions, economic trends, and company-specific performance. It's important to stay informed about these factors and adjust your investment strategy accordingly. However, avoid making emotional decisions based on short-term market fluctuations. Stick to your long-term plan and resist the temptation to buy high and sell low.

Furthermore, consider seeking professional advice from a financial advisor. A financial advisor can help you develop a personalized investment strategy based on your individual circumstances. They can also provide guidance on asset allocation, risk management, and portfolio rebalancing. While there are costs associated with financial advice, the benefits can often outweigh the costs, particularly for those who are new to investing or who lack the time or expertise to manage their own investments.

In conclusion, investing in the share market can be a worthwhile way to grow your wealth, but it requires a solid understanding of the market, a well-defined investment strategy, and a commitment to managing risk. The possibility of making money is there, but it's not guaranteed and requires a long-term perspective. By doing your research, diversifying your portfolio, and seeking professional advice when needed, you can increase your chances of success in the share market. Remember to approach investing with caution and discipline, and to always prioritize your financial well-being.