In the digital age, the internet has become a powerful tool for generating income, offering opportunities that range from passive investments to active skill utilization. However, the allure of quick money often leads individuals to overlook the foundational principles of financial planning and risk management. While some methods may yield substantial returns in a short period, it’s crucial to approach them with a clear understanding of their mechanics, potential pitfalls, and alignment with personal financial goals. Let’s explore several avenues that can contribute to online earnings, while emphasizing the importance of patience, strategy, and caution.

One of the most straightforward paths to online income is leveraging your existing skills. Platforms like Upwork or Fiverr enable professionals to offer services in fields such as writing, graphic design, programming, or marketing. Success here hinges on building a credible profile, showcasing past work, and maintaining consistent communication with clients. For instance, a content creator with a strong following might monetize through brand partnerships or affiliate marketing, though this requires a blend of creativity and business acumen. The key to sustainability is not just earning quickly but cultivating a loyal audience or client base that appreciates your value consistently.

The gig economy has also paved the way for remote work opportunities that can generate income rapidly. From freelance writing to virtual assistance, the demand for specialized skills is ever-growing. Yet, the critical aspect lies in identifying the right niche where you can offer unique value. For example, a skilled translator may find a niche in catering to a specific industry, such as legal or medical documentation, thereby commanding higher rates. However, it’s essential to understand that while gig work can provide flexible income, it often demands significant time and effort upfront. Building a reputation and securing steady projects may take months, and the income can fluctuate based on market dynamics and competition.

Another avenue is the rise of online marketplaces that facilitate the purchase and sale of goods or services. Dropshipping, for instance, allows entrepreneurs to sell products without holding inventory, relying on third-party suppliers to fulfill orders. This model reduces upfront costs but requires careful selection of products with high demand and low competition. Similarly, affiliate marketing leverages online platforms to promote products and earn commissions for each sale made through your referral links. Success here depends on understanding your audience’s preferences, crafting compelling content, and maintaining transparency about the products you endorse. However, these methods often require a consistent marketing strategy and may not generate substantial income in the short term.

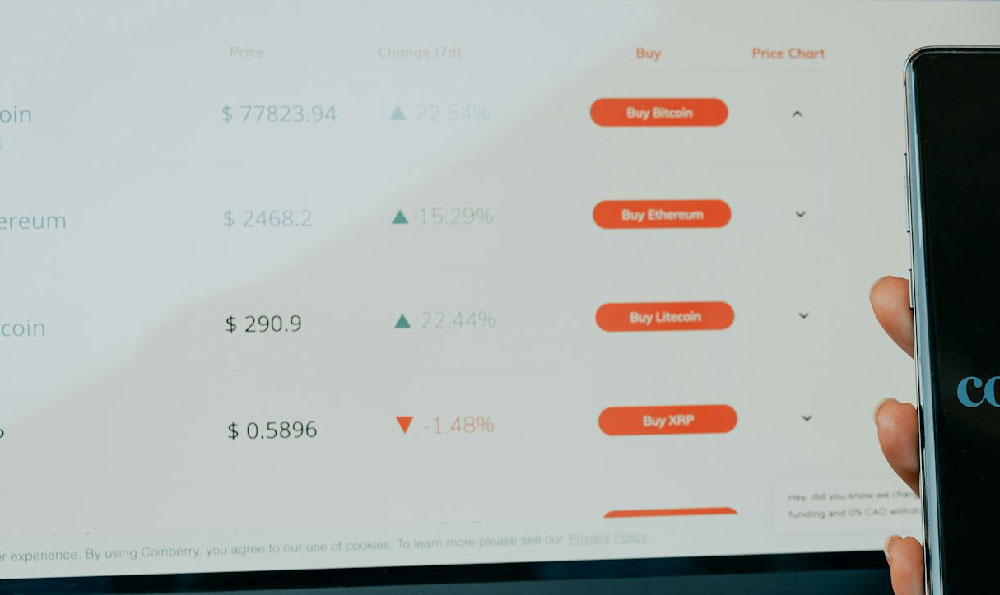

The world of cryptocurrency and digital assets also presents opportunities for fast returns, but it comes with inherent risks. Engaging in trading or investing in volatile assets such as Bitcoin or Ethereum can lead to rapid gains, yet the market is unpredictable and prone to sudden losses. Some individuals may opt for strategies like arbitrage or short-term trading, exploiting price differences across exchanges or capitalizing on market trends. Others may explore staking or investing in decentralized finance (DeFi) platforms to earn passive income. However, it’s vital to conduct thorough research, diversify investments, and avoid excessive leverage. The potential for high returns is often accompanied by the risk of significant loss, particularly for those unfamiliar with the intricacies of digital markets.

Online education has also become a lucrative option for generating income. Platforms like Udemy or Coursera allow individuals to create and sell courses on various subjects, from coding to personal development. For those with expertise in a particular field, this can be a way to monetize knowledge while reaching a global audience. However, creating a successful course requires a deep understanding of pedagogy, marketing, and audience engagement. It’s not uncommon for creators to invest considerable time and resources into developing content, with income streams emerging gradually rather than instantaneously. Additionally, the demand for courses may vary depending on market trends and the quality of the content provided.

While these opportunities may offer the prospect of quick earnings, they all require a foundational understanding of financial principles. The concept of quick money is often a misnomer, as most ventures that deliver immediate returns are either high-risk or lack long-term viability. For instance, investing in high-yield savings accounts or peer-to-peer lending platforms may yield modest but steady returns, but these are not considered “fast” in the traditional sense. The critical element is to evaluate the time, effort, and financial commitment required for each opportunity, ensuring they align with your overall financial strategy.

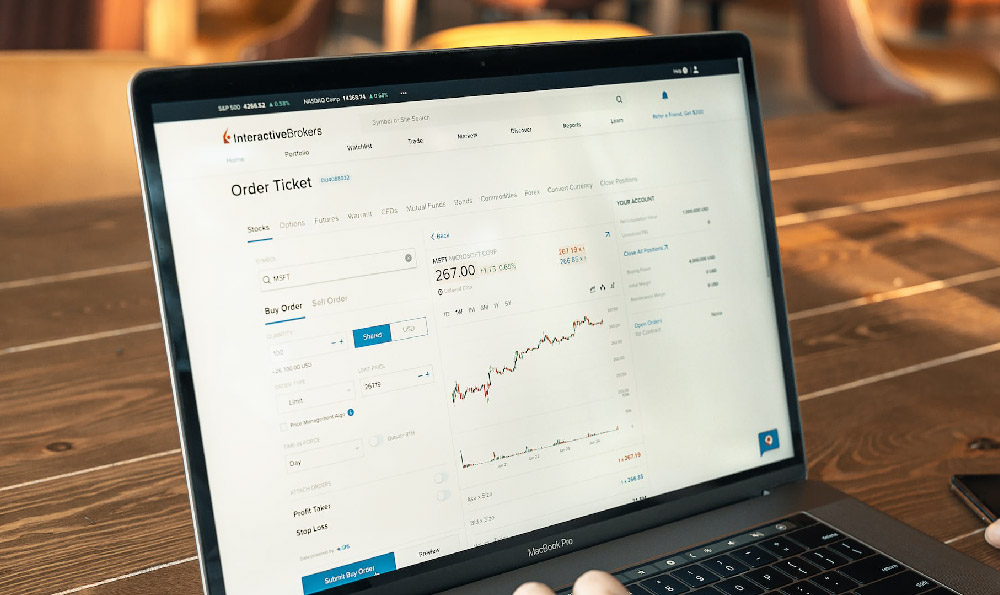

Moreover, the importance of risk management cannot be overstated. Whether you’re trading cryptocurrencies, investing in online businesses, or participating in gig economy work, diversification, thorough research, and emotional discipline are essential. A balanced approach to risk and reward can help mitigate potential losses and build a more stable income stream. For example, allocating a portion of your funds to low-risk ventures while exploring higher-risk opportunities can create a diversified portfolio. This strategy allows you to benefit from growth potential while safeguarding against unexpected downturns.

Ultimately, achieving financial success online requires a combination of skill, strategy, and patience. While some methods may generate income quickly, they often come with caveats that demand careful consideration. The most sustainable approach is to focus on long-term value creation, whether through building expertise, investing in personal development, or creating assets that generate passive income. By understanding the interconnectedness of these factors and approaching them with a disciplined mindset, individuals can navigate the online income landscape more effectively. The key is to avoid the trap of seeking instant gratification and instead prioritize informed decisions that align with your financial objectives.

In conclusion, while the internet offers a myriad of opportunities for generating online income, it’s essential to approach them with a clear understanding of their risks and rewards. Quick money is often a myth, and lasting financial success is built on a foundation of knowledge, discipline, and strategic planning. By focusing on sustainable methods that align with personal strengths and market opportunities, individuals can create a more resilient path to financial growth. Remember, the most valuable investments are those that provide long-term benefits, and the key to unlocking them lies in patience, education, and a balanced approach to risk and reward.