In the ever-evolving landscape of digital finance, the concept of earning money through online platforms has become increasingly intertwined with the rise of cryptocurrencies and blockchain technologies. While the allure of quick returns can be tempting, the path to sustainable financial growth in this space requires a blend of strategic thinking, technical analysis, and disciplined risk management. Whether one is exploring the volatile world of crypto trading, the potential of decentralized finance (DeFi), or the emerging opportunities in non-fungible tokens (NFTs), a comprehensive approach is essential. Here’s a detailed exploration of seven well-documented strategies that can help individuals navigate this complex terrain, leveraging both traditional and innovative financial instruments while safeguarding their capital against common pitfalls.

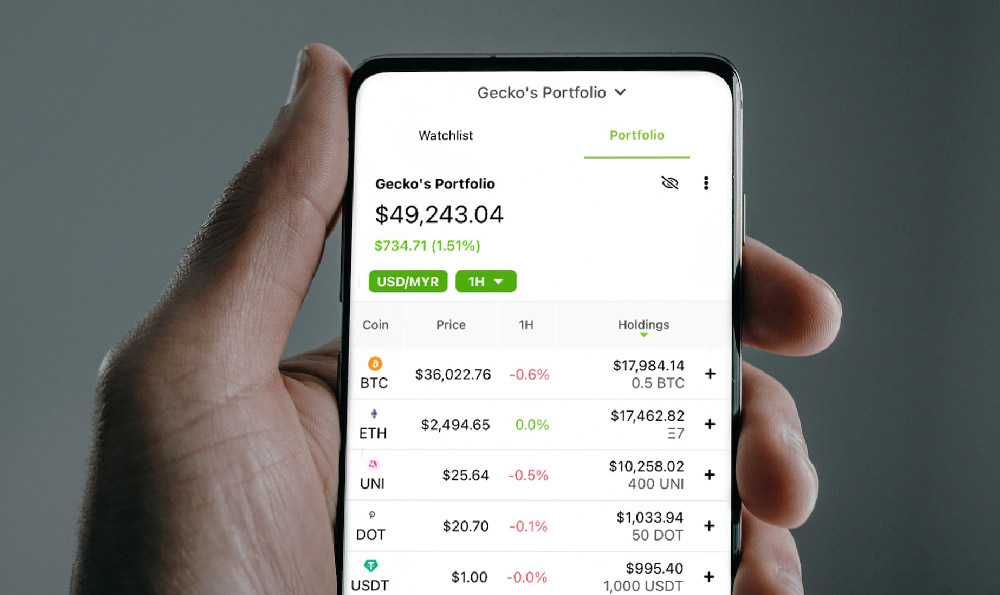

One of the most promising avenues for online earnings lies in the realm of crypto investing, where the selection of high-potential assets can yield substantial returns over time. However, the market is inherently unpredictable, driven by factors such as macroeconomic trends, regulatory developments, and technological advancements. To capitalize effectively, investors must adopt a long-term perspective, focusing on projects with strong fundamentals, innovative use cases, and experienced leadership. This approach, often termed as value investing in crypto, emphasizes the importance of thorough research, including examining a project’s whitepaper, market adoption, and community engagement. Unlike short-term speculative trading, which can lead to significant losses during market crashes, value investing aims to capture growth through patient accumulation and strategic timing. Additionally, diversifying one’s portfolio across multiple cryptocurrencies can help mitigate risks associated with the inherent volatility of the market.

Another strategy involves participating in the decentralized finance ecosystem, where users can earn passive income through activities such as liquidity provision, staking, or yield farming. These mechanisms allow individuals to leverage their crypto holdings without the need for traditional financial intermediaries. For instance, liquidity provision on decentralized exchanges (DEXs) enables users to earn fees from trades facilitated through their pooled assets. Similarly, staking crypto assets involves locking up coins to support network operations, earning rewards in return. While these opportunities can be lucrative, they are not without risks. The emergence of mechanical farming has raised concerns about rug pulls and project failures, where developers may abandon initiatives after extracting funds. To avoid such pitfalls, investors should carefully evaluate the security and transparency of DeFi platforms, monitor their risk exposure, and consider the broader implications of smart contract vulnerabilities.

The rise of non-fungible tokens has also created new channels for online earnings, particularly in the digital art and collectibles markets. However, the success of NFT investments hinges on identifying projects with genuine value, sustainable use cases, and strong community support. Unlike traditional cryptocurrencies, NFTs are unique digital assets, making their valuation more subjective. To navigate this space effectively, investors should focus on market trends such as the adoption of interoperable platforms or the integration of real-world assets. For example, NFTs that represent virtual land in gaming environments or provide access to exclusive content can attract long-term demand. This approach, often referred to as strategic NFT acquisition, requires a deep understanding of the market dynamics, including the interplay between scarcity, utility, and community-driven development.

In the context of cloud-based investments, cryptocurrency arbitrage has emerged as a popular strategy, capitalizing on price discrepancies across different trading platforms. This practice involves buying low on one exchange and selling high on another, profiting from the difference. However, the execution of arbitrage strategies requires access to multiple platforms, fast transaction speeds, and a clear understanding of market volatility. While it can provide consistent returns, the risks of slippage and transaction fees must be carefully managed. Additionally, interest rate-driven investing in stablecoins and other digital assets has gained traction, especially in response to traditional financial market conditions. Investors should monitor macroeconomic indicators such as inflation rates and central bank policies, as they can significantly impact the value of stablecoins.

The growing interest in financial literacy and education has also introduced new avenues for online earning, particularly through platforms offering investment advice or financial planning services. These services, often presented as online consulting platforms, can provide valuable insights into market trends, risk management, and long-term financial planning. However, the effectiveness of these services depends on the credibility and expertise of the providers. To ensure the best results, individuals should verify educational credentials, assess past performance, and evaluate the professional reputation of the practitioners. Additionally, ethical investing has gained prominence, with many investors prioritizing socially responsible projects that align with their values. This approach, known as impact investing, can be both financially rewarding and socially meaningful.

Lastly, the concept of seasoned online earning suggests that consistent profitability often emerges from a combination of skill, knowledge, and careful risk management. For example, technical analysis of cryptocurrency markets involves studying price patterns, trading volumes, and market sentiment to make informed decisions. This practice, often referred to as strategical technical analysis, requires the ability to identify trends through tools such as moving averages and RSI indicators. Additionally, advocating for online earning through social media or content creation can provide alternative revenue streams, particularly in the realm of cryptocurrency information sharing. Creators who provide educational content on blockchain technologies, investment strategies, or market trends can generate income through sponsorships, affiliate marketing, and platform monetization.

In conclusion, the pursuit of online earnings in the financial sector demands a meticulous approach that balances innovation with caution. By adopting strategies such as value investing, DeFi participation, NFT acquisition, arbitrage, interest rate-driven investments, educational consulting, and technical analysis, individuals can position themselves to capture opportunities while minimizing risks. However, the success of these strategies ultimately depends on the investor’s ability to adapt to market fluctuations, remain informed about emerging trends, and prioritize long-term growth over short-term gains. With proper research, disciplined execution, and a clear understanding of the risks involved, the path to financial growth in this dynamic space can be both rewarding and sustainable.