Okay, I understand. Here's an article based on the title "Investing in the Share Market Online: How and Where?", keeping in mind the requested guidelines.

Investing in the stock market online has become increasingly accessible, transforming the landscape of personal finance. No longer confined to professional traders or the wealthy elite, the opportunity to own a piece of publicly traded companies is now readily available to almost anyone with an internet connection and a small amount of capital. But with this ease of access comes the critical need for knowledge and careful planning. Diving into the world of online stock trading without understanding the basics can be a recipe for financial disappointment, or even disaster.

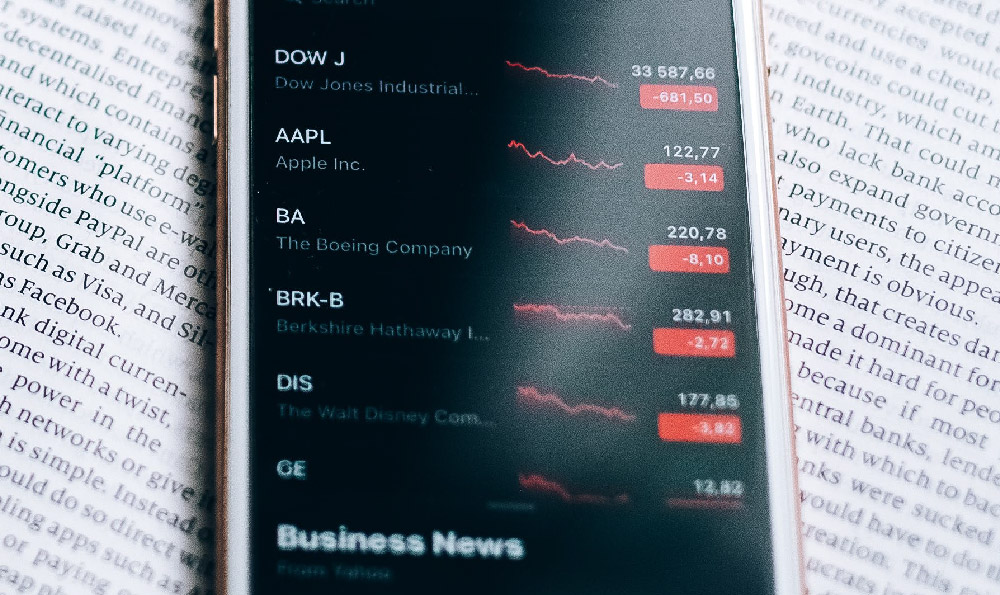

Before even considering which brokerage to choose or which stock to buy, it's essential to understand the fundamentals of the stock market itself. At its core, the stock market is a platform where investors buy and sell shares of publicly held companies. These shares represent ownership in the company, and their value fluctuates based on a multitude of factors, including company performance, industry trends, economic conditions, and even investor sentiment. When you purchase a share, you're essentially betting that the company will perform well in the future, leading to an increase in the share price. Conversely, if the company falters, the share price can decline.

Understanding the different types of stocks is also important. Common stock typically gives you voting rights within the company, while preferred stock usually comes with fixed dividend payments. Growth stocks are shares of companies expected to grow at a rate significantly above the market average, while value stocks are shares that are trading below their intrinsic value. Knowing the difference helps align your investments with your risk tolerance and financial goals.

Once you have a grasp of the basics, the next step is to choose an online brokerage. This is where the "where" part of the equation comes in. There are numerous online brokers competing for your business, each offering different features, pricing structures, and levels of support. Some brokers cater to beginners with user-friendly platforms and extensive educational resources, while others are geared towards more experienced traders with advanced charting tools and sophisticated order types.

When evaluating online brokers, consider the following factors:

- Fees and Commissions: This is perhaps the most obvious consideration. Some brokers offer commission-free trading on stocks, while others charge a small fee per trade. However, even commission-free brokers may have other fees, such as account maintenance fees or inactivity fees, so be sure to read the fine print.

- Platform and User Interface: The brokerage's platform should be intuitive and easy to navigate. Look for features like real-time quotes, charting tools, and research reports. Many brokers offer mobile apps, which can be convenient for trading on the go.

- Account Minimums: Some brokers require a minimum deposit to open an account, while others do not. This can be an important factor for beginners who may not have a lot of capital to invest.

- Investment Options: Make sure the broker offers the types of investments you're interested in. In addition to stocks, many brokers offer options, mutual funds, exchange-traded funds (ETFs), and other investment products.

- Educational Resources: For beginners, access to educational resources is crucial. Look for brokers that offer tutorials, webinars, and articles on investing.

- Customer Support: Choose a broker that offers responsive and helpful customer support. You may need assistance with technical issues or account inquiries.

Popular brokerage options range from well-established names like Fidelity, Charles Schwab, and Vanguard, which offer a wide range of services and research tools, to newer, app-based platforms like Robinhood and Webull, which are known for their commission-free trading and user-friendly interfaces. Choosing the right broker is a personal decision that depends on your individual needs and preferences.

After selecting a brokerage, the "how" part comes into play: how do you actually start investing?

First, you'll need to open an account and fund it. This typically involves providing personal information, such as your Social Security number and bank account details. Once your account is approved, you can transfer funds into it via electronic transfer, check, or wire transfer.

Next, you'll need to research and select the stocks you want to buy. Don't just pick stocks based on tips from friends or social media. Do your own due diligence. Read company reports, analyze financial statements, and understand the company's business model. Consider using a variety of resources, such as Morningstar, Value Line, and Yahoo Finance, to gather information.

When you're ready to buy a stock, you'll need to place an order through your brokerage's platform. There are several types of orders you can place, including market orders, limit orders, and stop-loss orders. A market order is an order to buy or sell a stock at the current market price. A limit order is an order to buy or sell a stock at a specific price or better. A stop-loss order is an order to sell a stock if it falls below a certain price.

Once your order is executed, the stock will be added to your portfolio. You can then monitor your portfolio's performance and make adjustments as needed. It's important to remember that investing in the stock market involves risk, and you could lose money. Never invest more than you can afford to lose.

Furthermore, consider diversifying your portfolio. Don't put all your eggs in one basket. Spreading your investments across different stocks, industries, and asset classes can help reduce your overall risk. A well-diversified portfolio is less likely to be significantly impacted by the performance of any single investment.

Finally, be patient and stay disciplined. The stock market can be volatile, and there will be times when your portfolio declines in value. Don't panic and sell your investments at the first sign of trouble. Instead, stick to your long-term investment plan and focus on your financial goals. Investing in the stock market is a marathon, not a sprint. Remember to regularly review your portfolio and make adjustments as needed, but avoid making impulsive decisions based on short-term market fluctuations. Understanding the market, choosing the right tools, and sticking to a well-defined strategy are essential for navigating the online stock market successfully. With knowledge, patience, and discipline, anyone can potentially benefit from the opportunities it offers.