Investing can be a powerful tool for building wealth and achieving financial security, but it's crucial to approach it with careful consideration and a well-defined strategy. Before diving into the world of investments, particularly volatile assets like cryptocurrencies, it's essential to assess your financial situation, risk tolerance, and investment goals. Asking yourself "Is Investing Right for You?" is the first step toward responsible and potentially rewarding financial planning.

Evaluating Your Financial Foundation

Before even contemplating any investment, take a hard look at your financial health. Do you have a solid financial foundation in place? This means having an emergency fund that can cover at least three to six months of living expenses. This safety net is critical because it prevents you from having to sell investments at a loss if unexpected expenses arise.

Next, evaluate your debt situation. High-interest debt, such as credit card debt, can significantly hinder your ability to grow wealth. Prioritize paying down high-interest debt before investing. The interest you save by eliminating debt often outweighs the potential returns from most investments, especially when considering the associated risks.

Finally, consider your cash flow. Are you consistently saving money each month? Investing requires capital, so having a surplus of income after covering essential expenses is crucial. If you're struggling to save, focus on budgeting and expense management before venturing into investments.

Defining Your Investment Goals and Risk Tolerance

Once you've established a solid financial foundation, the next step is to define your investment goals. What are you hoping to achieve through investing? Are you saving for retirement, a down payment on a house, your children's education, or simply to grow your wealth over time? Your investment goals will heavily influence your investment timeline and the level of risk you're willing to take.

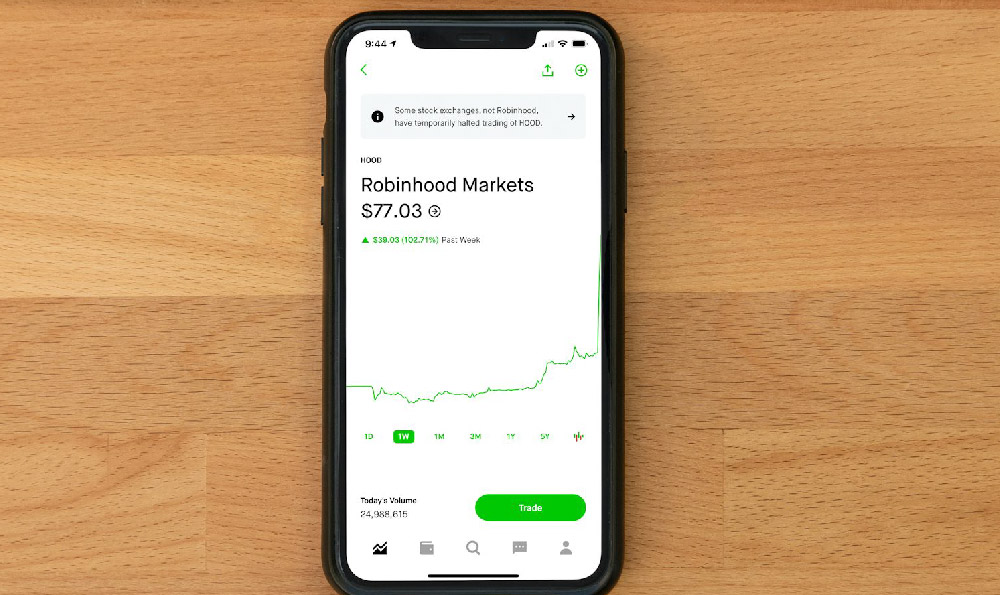

Your risk tolerance is another critical factor to consider. How comfortable are you with the possibility of losing money? Investments inherently involve risk, and some investments are riskier than others. Cryptocurrencies, for example, are known for their high volatility, meaning their prices can fluctuate dramatically in short periods. If you're risk-averse, you may prefer less volatile investments like bonds or dividend-paying stocks. If you're comfortable with more risk, you might consider allocating a portion of your portfolio to cryptocurrencies or other growth-oriented assets.

Choosing the Right Investment Strategies

Now, let's delve into how to "grow your money safely." While no investment is entirely risk-free, there are strategies you can employ to mitigate risk and increase your chances of success.

-

Diversification: Don't put all your eggs in one basket. Diversifying your investments across different asset classes, industries, and geographic regions can help reduce your overall risk. If one investment performs poorly, the others may offset the losses. For example, you might invest in a mix of stocks, bonds, real estate, and even a small allocation to cryptocurrencies.

-

Dollar-Cost Averaging: This involves investing a fixed amount of money at regular intervals, regardless of the asset's price. This strategy helps you avoid trying to time the market, which is notoriously difficult, even for experienced investors. When prices are low, you buy more shares; when prices are high, you buy fewer shares. Over time, this can average out your cost basis and potentially improve your returns.

-

Long-Term Investing: Avoid the temptation to chase short-term gains. Investing is a long-term game. Focus on holding investments for the long haul, allowing them to grow over time. This is particularly important with volatile assets like cryptocurrencies, as short-term price fluctuations are common.

-

Research and Due Diligence: Before investing in any asset, do your research. Understand the underlying fundamentals, the risks involved, and the potential rewards. This is especially important with cryptocurrencies, which are still relatively new and evolving. Read whitepapers, follow industry news, and consult with financial professionals if needed.

Navigating the Cryptocurrency Landscape: A Cautious Approach

Given the increasing popularity of cryptocurrencies, it's essential to address them specifically. While cryptocurrencies offer the potential for high returns, they also come with significant risks. Here are some tips for navigating the cryptocurrency landscape safely:

-

Start Small: Don't invest more than you can afford to lose. Given the volatility of cryptocurrencies, it's wise to start with a small allocation and gradually increase your investment as you gain more experience and confidence.

-

Choose Reputable Exchanges: Use reputable cryptocurrency exchanges that have strong security measures in place. Research the exchange's history, security protocols, and user reviews before depositing any funds.

-

Secure Your Wallet: Use a secure cryptocurrency wallet to store your digital assets. Consider using a hardware wallet, which is a physical device that stores your private keys offline, making it less vulnerable to hacking.

-

Be Wary of Scams: The cryptocurrency space is rife with scams and fraudulent schemes. Be wary of promises of guaranteed returns, high-pressure sales tactics, and unsolicited investment offers.

Seeking Professional Advice

Investing can be complex, especially in the ever-evolving world of cryptocurrencies. Don't hesitate to seek professional advice from a qualified financial advisor. A financial advisor can help you assess your financial situation, define your investment goals, and develop a personalized investment strategy that aligns with your risk tolerance. They can also provide guidance on which investments are appropriate for your specific needs and help you avoid common investment pitfalls.

Investing is a journey, not a destination. By carefully evaluating your financial situation, defining your investment goals, employing sound investment strategies, and seeking professional advice when needed, you can increase your chances of growing your money safely and achieving your financial aspirations. Remember that patience, discipline, and a long-term perspective are key to successful investing.