Joe Manchin, a prominent political figure in the United States, has built his financial foundation through a combination of public service, strategic investments, and his unique position in the political landscape. As a U.S. Senator representing West Virginia since 2004, his primary source of income is the senatorial salary, which is set by the Senate and includes a base annual compensation, additional allowances for travel and staff, and benefits such as healthcare and retirement plans. While these earnings form a stable but relatively modest portion of his overall wealth, they are augmented by a diverse array of financial assets and private ventures that have shaped his net worth over the years. Understanding the interplay between his political role and financial strategies provides insight into how he manages to achieve both public influence and personal economic stability.

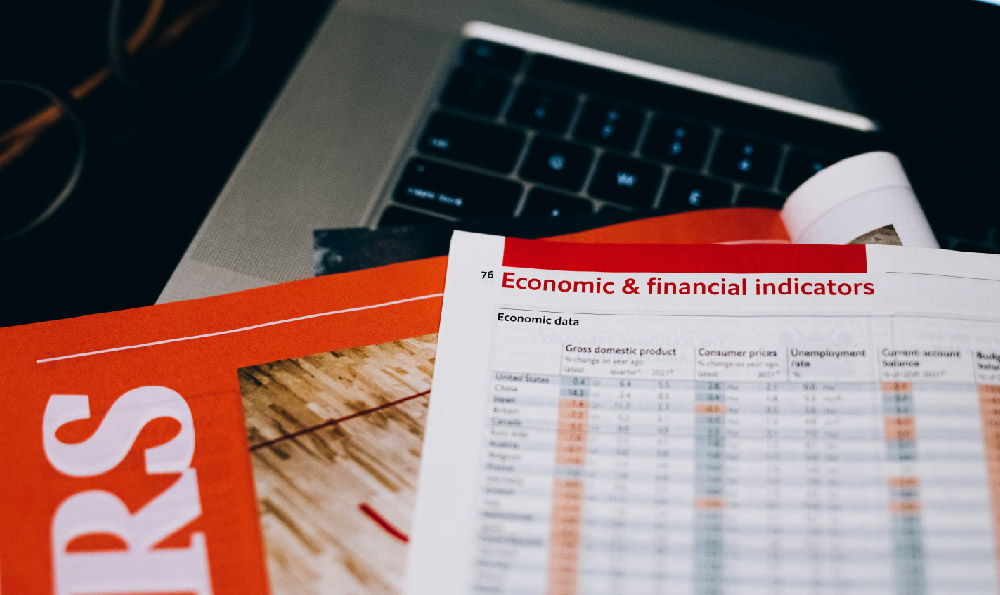

Manchin's financial portfolio is notable for its breadth and the fact that he has been cautious about fully leveraging his political platform for personal gain, a stance that distinguishes him from many of his peers. His wealth primarily comes from long-term investments in stocks, real estate, and private businesses. For instance, he has been known to hold shares in major corporations, including those in the energy sector, which aligns with the economic interests of his home state. This strategic alignment is crucial, as West Virginia's economy is heavily reliant on industries such as coal, natural gas, and manufacturing, and Manchin has often expressed support for policies that benefit these sectors. By investing in related industries, he not only diversifies his financial portfolio but also secures a level of economic resilience tied to regional development. However, this approach also poses risks, particularly in the context of shifting government policies and environmental regulations that could impact his investments. Manchin's ability to navigate these risks has been a key aspect of his financial strategy.

Real estate investments further contribute to his wealth, with properties in various locations ranging from high-value commercial assets to residential properties. This segment of his holdings allows him to generate passive income through rental yields and potential capital appreciation. The selection of real estate investments likely considers geographic stability, market demand, and long-term growth potential. For example, properties in politically stable regions or those with rising populations could offer better returns. However, real estate is not without its challenges, including market volatility and the costs associated with property management and maintenance. Manchin's approach to these challenges suggests a balance between meticulous planning and adaptability.

In addition to his public and investment income, Manchin has also explored other avenues for earnings, such as consulting, speaking engagements, and his involvement in political organizations. These activities provide supplementary income, allowing him to diversify his revenue streams beyond the traditional confines of political office. However, the extent to which these sources contribute to his overall wealth is relatively limited compared to his investment holdings. This reflects a deliberate choice to prioritize long-term asset appreciation over short-term financial gains, which is a common strategy among policymakers seeking to maintain financial independence while engaging in public service.

The intersection of his political role and financial interests is a unique dynamic. As a senator, he has the opportunity to influence legislation that may directly impact the industries in which he has invested. This dual role presents both opportunities and ethical considerations, as his financial interests could conflict with his legislative responsibilities. Manchin has, however, maintained a relatively low profile in terms of publicly disclosed financial interests, which might suggest a preference for discretion in managing his wealth. At the same time, this discretion does not imply a lack of strategic engagement with financial markets, but rather a methodical approach to balancing public obligations with private financial goals.

Manchin's financial strategy also involves careful consideration of risk management. By diversifying his portfolio across different sectors and asset classes, he minimizes the impact of economic downturns or industry-specific disruptions. For example, his investments in energy and manufacturing, which are vital to West Virginia's economy, are complemented by holdings in sectors that are more resilient to market fluctuations. This diversification approach is designed to ensure a steady income stream and to protect against potential losses in any single investment. Moreover, his real estate investments serve as a hedge against inflation, as property values and rental incomes tend to rise in tandem with inflationary pressures.

In terms of income generation, Manchin's focus on long-term capital appreciation over short-term transactions indicates a conservative financial philosophy. This approach is particularly important for someone in a high-visibility political role, where sudden changes in financial status could be scrutinized. By emphasizing steady growth and minimizing speculative investments, Manchin aligns his financial strategies with the principles of prudent wealth management. This not only ensures his personal financial security but also allows him to advocate for policies that support long-term economic stability for his constituents.

The broader implications of Manchin's financial approach extend beyond his personal wealth. His investments in industries that are central to his state's economy highlight the role of policymakers in shaping local financial landscapes. By aligning his private interests with public policy, he contributes to the economic development of West Virginia while maintaining a diversified and resilient financial portfolio. This balance between personal and public wealth is a complex but essential aspect of modern political economics, and Manchin's strategy offers a model for how politicians can navigate this duality. His experience underscores the importance of financial literacy and strategic planning in the political arena, where decisions can have far-reaching economic consequences. In this way, Manchin's financial sources and income methods not only reflect his personal choices but also demonstrate the intricate relationship between political influence and economic stability in contemporary society.