The allure of rapid wealth, especially in the volatile and often hyped world of cryptocurrencies, is undeniably strong. The question of whether one can "make money fast illegally" in this context, and more importantly, whether one should, necessitates a careful and ethically grounded response. While the promise of quick riches might seem tempting, engaging in illegal activities within the cryptocurrency sphere carries severe risks, both legal and financial.

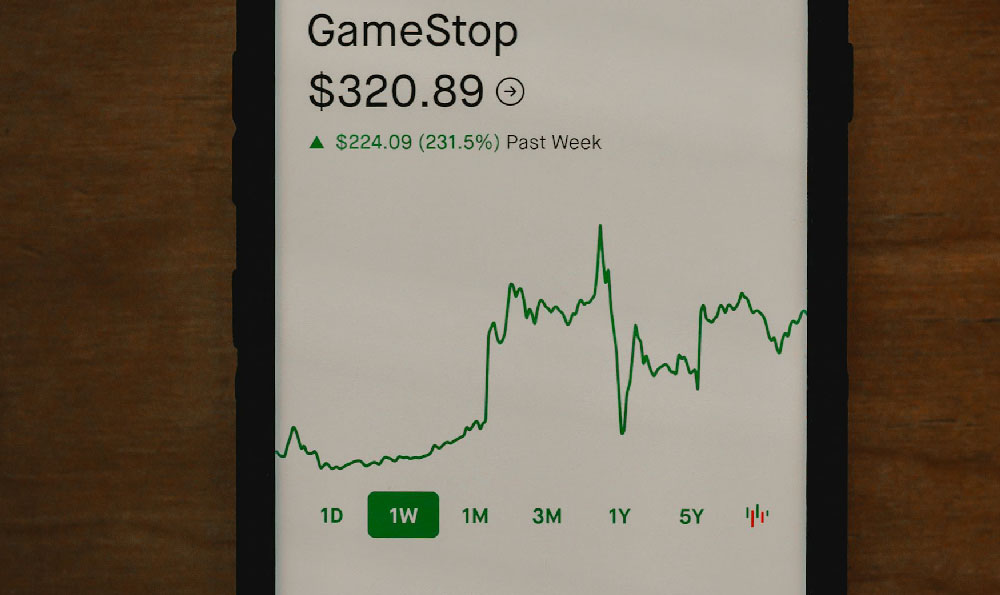

Let's first address the "possible" part of the equation. Technically, yes, illegal methods exist to potentially generate rapid profits in the crypto market. These often involve activities like pump-and-dump schemes, insider trading, market manipulation, or outright scams. Pump-and-dump schemes involve artificially inflating the price of a cryptocurrency through coordinated buying and misleading information, only to sell off holdings at a high price before the bubble bursts, leaving other investors with significant losses. Insider trading, using confidential information not available to the public to make investment decisions, is equally illegal and unethical. Market manipulation techniques, such as wash trading (simultaneously buying and selling an asset to create artificial volume and price movement) are also illegal and designed to deceive other traders. And then, of course, there are outright scams, such as Ponzi schemes disguised as crypto investments or fake ICOs (Initial Coin Offerings) designed to steal investors' money.

These illegal activities might, in the short term, enrich the perpetrators. However, the potential consequences far outweigh any perceived benefits. Law enforcement agencies globally are increasingly focused on regulating the cryptocurrency market and prosecuting those involved in illegal activities. Penalties can include hefty fines, asset forfeiture, and imprisonment. Even if one manages to evade immediate detection, the long-term psychological impact of knowing that one's wealth was obtained through illegal means can be significant, leading to guilt, anxiety, and a constant fear of being caught.

Moreover, the very nature of these illegal activities makes them inherently unstable and unsustainable. Pump-and-dump schemes, for instance, inevitably collapse, leaving the perpetrators exposed to legal action and the risk of losing their ill-gotten gains. Scams are ultimately discovered, and those involved are often pursued by law enforcement and angry investors. The "fast money" generated through illegal means is often fleeting and comes at a significant cost.

Now, let's consider the "should" aspect. From an ethical perspective, the answer is a resounding no. Engaging in illegal activities within the cryptocurrency market not only harms other investors but also undermines the integrity of the entire ecosystem. It erodes trust, scares away legitimate investors, and hinders the development of innovative and beneficial blockchain technologies. The cryptocurrency market, while still relatively nascent, has the potential to revolutionize finance and other industries. Its success depends on fostering a culture of transparency, fairness, and ethical conduct. Illegal activities directly contradict these principles and threaten the long-term viability of the market.

Furthermore, the pursuit of "fast money" often leads to irrational decision-making and a disregard for risk management. Legitimate investing, even in the volatile crypto market, requires careful research, due diligence, and a long-term perspective. It involves understanding the underlying technology, assessing the potential risks and rewards, and diversifying one's portfolio. Seeking shortcuts or relying on illegal methods often results in impulsive decisions based on greed and fear, leading to significant financial losses.

Instead of chasing unrealistic and unethical get-rich-quick schemes, individuals interested in cryptocurrency investment should focus on building a solid foundation of knowledge, developing a well-defined investment strategy, and managing risk effectively. This includes:

- Thorough Research: Before investing in any cryptocurrency, it's crucial to understand its underlying technology, its intended use case, and the team behind it. Read the whitepaper, research the project's roadmap, and analyze its market capitalization and trading volume.

- Due Diligence: Don't rely solely on hype or social media endorsements. Independently verify the information you encounter and be wary of projects that promise unrealistic returns or lack transparency.

- Risk Management: Only invest what you can afford to lose. Cryptocurrencies are highly volatile assets, and their value can fluctuate significantly. Diversify your portfolio to reduce your overall risk.

- Long-Term Perspective: Avoid making impulsive decisions based on short-term price movements. Focus on the long-term potential of the technology and the project you are investing in.

- Secure Storage: Protect your cryptocurrency holdings by using secure wallets and enabling two-factor authentication. Be wary of phishing scams and other attempts to steal your private keys.

- Stay Informed: The cryptocurrency market is constantly evolving. Stay up-to-date on the latest news, regulations, and technological developments.

In conclusion, while the allure of "making money fast illegally" in the cryptocurrency market might be tempting, it is ultimately a dangerous and unethical path. The potential legal and financial consequences, coupled with the erosion of trust and integrity within the ecosystem, far outweigh any perceived benefits. A more prudent and responsible approach involves focusing on education, due diligence, risk management, and ethical conduct. By building a solid foundation of knowledge and adopting a long-term perspective, individuals can participate in the cryptocurrency market in a safe and sustainable manner, contributing to its growth and benefiting from its potential rewards without resorting to illegal or unethical practices. Remember, sustainable wealth is built on a foundation of integrity and responsible decision-making, not on the fleeting gains of illegal activities.