Making Money Fast for Kids in One Hour: A Strategic Approach to Financial Education and Safe Earnings

In the modern digital age, the idea of generating income through unconventional methods has become increasingly appealing, especially for those seeking rapid financial growth. For children, this pursuit presents a unique opportunity to learn about money management and entrepreneurial thinking while avoiding the pitfalls of high-risk investments. However, the concept of "fast money" for minors is often misunderstood, and it’s crucial to approach it with both caution and creativity. Virtual currencies, or cryptocurrencies, have been at the forefront of discussions about quick returns, but their volatility and complexity make them unsuitable for young audiences. Instead, a more sustainable and educational path involves understanding basic financial principles, leveraging time management, and identifying low-risk opportunities that align with a child's developmental stage.

The foundation of any successful financial strategy lies in education. Children are inquisitive by nature, and their ability to absorb knowledge is unparalleled at a young age. Encouraging them to learn about budgeting, saving, and the value of money is the first step toward cultivating a healthy relationship with finances. For instance, creating a budget for a small stash of allowance or understanding the basics of compound interest can instill long-term financial discipline. These exercises not only teach them the mechanics of money but also help them appreciate the effort required to generate income. A one-hour session can be dedicated to explaining concepts like opportunity cost, the difference between needs and wants, and how even small savings can grow over time with consistent effort.

When it comes to generating income quickly, there are several low-risk avenues that children can explore. One of the most straightforward methods is to engage in monetary small tasks, such as completing household chores, helping neighbors, or selling handmade crafts. These activities require minimal resources and are entirely within the child's capacity. For example, a child with a talent for art could create simple drawings or keychains and sell them online via platforms like Etsy. Similarly, organizing a small yard sale or offering to water a neighbor’s plants for a fee can provide immediate cash flow. The key is to match the child’s skills and interests with opportunities that are both time-efficient and financially rewarding.

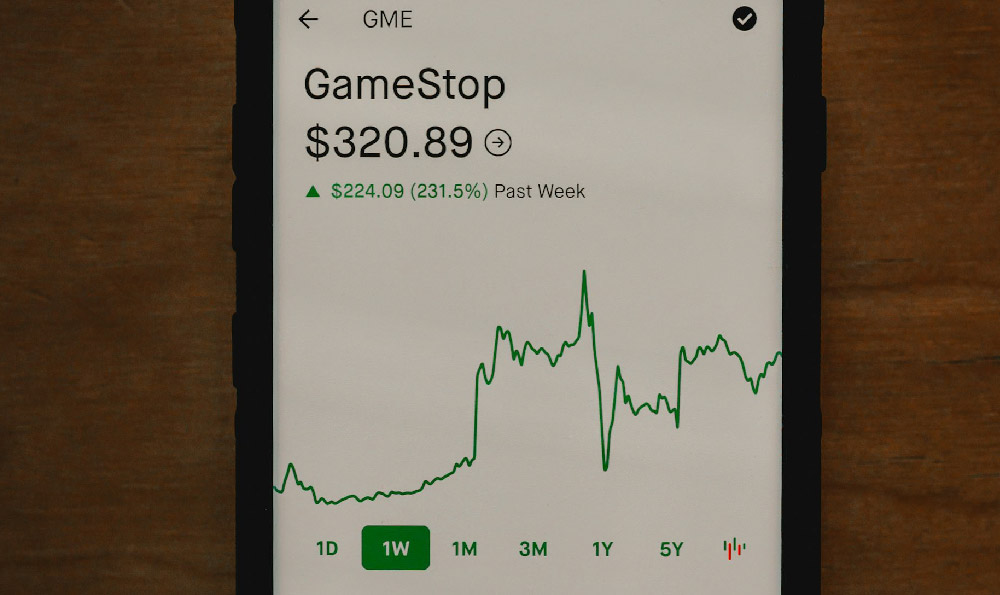

Another effective strategy involves leveraging technology to create value in the short term. While virtual currency investments are not recommended for minors, there are safer digital tools that can help children earn money. For instance, they can begin with a micro-investment account that allows them to invest in stocks or mutual funds with small amounts of money. These platforms, such as Acorns or Robinhood, offer educational resources and simplified interfaces that make it easier for young investors to understand the market. By starting with low-risk vehicles, children can develop a foundational understanding of financial markets while avoiding the extreme volatility associated with cryptocurrencies.

Parents and guardians should also emphasize the importance of time management in earning money. A one-hour window can be broken down into smaller, actionable steps. For example, setting up a micro-business project, such as selling baked goods or creating digital content, requires careful planning. A child could spend the first 10 minutes brainstorming an idea, the next 25 minutes preparing materials or launching an online presence, and the final 25 minutes handling customer interactions or promoting their offering. This structured approach teaches them how to allocate time effectively, a skill that will benefit them in all areas of life.

The role of parental involvement cannot be overstated. While children may have the enthusiasm to work quickly, adults should guide them to avoid impulsive decisions. Teaching them to assess risks, research opportunities, and prioritize long-term goals is essential. For instance, if a child is interested in virtual currency, it’s important to explain that while the market offers potential, it also comes with significant risks. Instead, they could be introduced to educational platforms that simulate market behaviors, allowing them to practice without real financial exposure.

Moreover, fostering a mindset of financial responsibility is crucial. Children should understand that money earned through shortcuts often comes with hidden costs. A one-hour session can include a discussion on the importance of delayed gratification, such as saving for a larger goal rather than spending all earnings immediately. This principle not only helps them appreciate the value of money but also prepares them for more complex financial decisions as they grow older.

In the end, the goal of helping children make money quickly is not just about the amount earned but about the lessons learned. By combining financial education, practical skills, and mindful decision-making, parents can equip their children with the tools to navigate the world of money. Whether through family projects, online marketplaces, or time-bound activities, the emphasis should remain on teaching them how to create, manage, and grow wealth in a safe and sustainable manner. Remember, the rapid growth of virtual currencies has no place in a child’s financial strategy, but the principles of learning, patience, and strategic thinking can open doors to far greater opportunities.